Market Brief

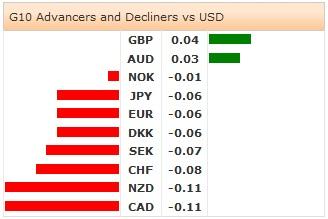

Friday’s jobs report showed that the US economy added 209’000 new jobs in July (vs. 230K exp. & 288K last), the unemployment rate deteriorated from 6.1% to 6.2%, while the participation rate slightly improved to 62.9% (62.8% prev). The US personal income remained unchanged (0.4%), while the spending increased from 0.2% to 0.4% over the past month. USD aggressively sold-off before the weekly closing bell, the sentiment is mixed this Monday. Despite disappointment, we still note that this is the sixth consecutive month that the NFP print is above 200K. The CFTC data shows extended USD longs and the recovery should continue given that the Fed expectations remain unchanged.

EUR/USD rallied to 1.3445 post-NFP. The sentiment remains negative, while the negative momentum loses speed. The short-term support zone stands at 1.3367/80 (July 30-31st lows), option barriers abound at 1.3450/1.3500. EUR/GBP broke above its June-July downtrend top and rallied toward its 50-dma (0.79934). The upside move signals a short-term bullish reversal, large option barriers (to expire tomorrow) are yet to be cleared between 0.79750/0.80300.

Despite post-NFP sell-off, USD/JPY consolidates gains above its 200-dma (102.21). Trend and momentum indicators are marginally bullish, with some hesitation in upside bets. Offers trail above 103.00, while short-term support is seen solid at 101.80/102.21 (region including 21/50/100 and 200 dma & Fibonacci 61.8% on Oct’13- Jan’14 rally). EUR/JPY is well bid above its 21-dma (137.53), the broad based EUR recovery suggest deeper upside correction. We see the upside limited below the descending Ichimoku cloud cover (138.66/140.09).

In Australia, the retail sales grew 0.6% in month to June (vs. -0.5% a month ago), the securities inflation slowed to 2.6% on year to July (vs. 3.0% last). AUD/USD opened the week above 0.9300, yet remained capped at 0.9333 in Sydney. We expect ranged Aussie pre-RBA verdict due on Tuesday. The RBA is expected to keep its cash rate target unchanged at 2.50%, the accompanying statement will define the short-term direction. The bias is negative due to divergent RBA/Fed bets.

NZD/USD holds ground above 0.8500 despite the fifth month of consecutive fall in commodity prices. According to ANZ, the milk powder prices dropped 12% in month to June, 53% y/y (converted to NZD this equals to 3.5% m/m and 11.6% y/y). NZD/USD remains in the bearish consolidation zone, the focus is on Q2 employment report due on Wednesday.

This Monday, the light economic calendar consists of Spanish July Net Employment, Swiss July PMI Manufacturing, UK July PMI Construction, Euro-zone June PPI m/m & y/y and US July ISM New York.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Top 3 Price Prediction Bitcoin, Ethereum, Ripple: Relief wave on altcoins likely as BTC shows a $5,000 range

Bitcoin price has recorded lower highs over the past seven days, with a similar outlook witnessed among altcoins. Meanwhile, while altcoins display a rather disturbing outlook amid a broader market bleed, there could be some relief soon as fundamentals show.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.