Market Brief

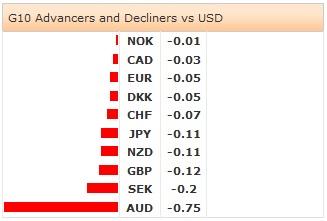

The US dollar came broadly in demand post-ADP release in New York yesterday. The ADP employment report surprised on the upside, the June report showed that the US economy added 281’000 new private jobs versus 205K expected & 179K a month ago. The June unemployment rate and nonfarm payrolls are due today (US closed on Friday). The consensus is 215’000 new nonfarm jobs in June versus 217’000 added through May.

EUR/USD broke the 200-dma (1.3676) on the downside, extended losses to 1.3643 pre-ECB. We do not expect any changes from the ECB today, yet remain attentive vis-à-vis any comment on a Fed-like QE eventuality. After adding extra stimulus on June 5th, is the ECB waiting to see what happens, or is it ready to act more? EUR/GBP consolidates losses in the tight range of 0.79500/700. The pair is no more in the bullish corrective zone, the bias is on the downside. The option related offers trail down from 0.80600 for today expiry.

The Cable advanced to fresh high of 1.7177 amid the Markit’s PMI reading showed faster expansion in UK’s construction business in June. GBP/USD is in the overbought territories (RSI at 71%, 30-day UBB at 0.7195), yet the US jobs data will say the last word today. The key resistance stand at a distant 1.7275 (year-to-date uptrend top), 1.7332 (50% Fibonacci retracement on 2008 decline).

In Japan, the MoF report showed significant reversal in investors’ interest through the week ended on June 27th. The Japanese investors sold -1,051.1bn yen worth of foreign bonds versus 1,486.5bn purchased the week before; foreigners exited only 117.7bn yen worth of Japanese bonds. USD/JPY remains timid on the upside. The US data pushed the pair above the 200-dma (101.77) in New York, however on the JPY-leg, the selling pressures remain subdued. For today expiry, decent JPY puts trail above 102.50, if triggered should help lifting the sentiment temporarily. USD/JPY opened the day in the daily Ichimoku cloud (101.70/102.47). A daily breakout on either side will define short-term direction.

AUD registered heavy losses in Sydney amid the retail sales unexpectedly contracted in May. AUD/USD sold-off aggressively from 0.9444 (session high) to 0.9371. A daily close below 0.9385 will send the MACD in the red zone. The first line of support stands at 0.9338/39 (50-dma & Fibo 61.8% on Oct’13 – Jan’14 drop).

The most important event/news of the day is the ECB policy verdict (11:45 GMT), the ECB President Draghi’s monthly press conference and the US labor data (12:30 GMT). The Riksbank will also give verdict at 07:30 GMT. The full calendar: June Final PMI Services and Composite readings in Sweden, Spanish, Italian, German, UK, Euro-zone and US, UK June Official Reserves Changes, Euro-Zone May Retail Sales m/m & y/y, US June Change in Manufacturing, Private and Nonfarm Payrolls, June Unemployment and Participation Rate, Average Hourly Earnings m/m & y/y, ISM June Non-Manufacturing Composite, June 28th Initial Jobless Claims and June 21st Continuing Claims.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.