Market Brief

As expected, BoJ’s Kuroda and the Japanese PM Abe met to exchange views on the financial situation. According to Japanese news agency Jiji, Mr. Kuroda wouldn’t hesitate to add more stimulus if needed, while no particular pressure came from Abe’s government at this stage. USD/JPY and JPY crosses fluctuated in mixed fashion in Tokyo. USD/JPY remains capped by thick set of offers at 102.00. More resistance is eyed at the daily Ichimoku cloud cover (102.37/103.10). On the downside, key supports are placed at 101.50 (Feb-Apr up trending channel base), then 100.76 (year low). EUR/JPY remains well supported above its daily cloud (140.65/70). Trend and momentum indicators point downwards given the EUR risk.

EUR/USD remains bid above the 21-dma (1.3802). Comments from ECB did ease the EUR-bulls, yet failed to trigger the anticipated downside move. Traders are still reluctant to join the bear market given its fragility over the past year. The sentiment deteriorates; bids at 1.3800 are yet to be cleared. EUR/GBP consolidates below the 50-dma, the bias is downwards.

The UK will release the March inflation figures today, the expectations are soft. The headline CPI is expected lower at 1.6% (vs. 1.7% in Feb and well below BoE’s 2% target). Falling consumer prices are supportive of BoE’s forward guidance, as the inflation knock-out is now far from being a concern. GBP/USD trades slightly below the mid-range of Nov-Apr uptrend channel. Key short-term support is seen at 21 & 50 dma (1.6628/23).

AUD/USD advanced to 0.9426 yesterday, despite better-than-expected US retail sales data. The RBA minutes hided no surprise; the OCR is to remain steady for some time and the AUD is still at historical highs. AUD/USD wrote-off gains to 0.9381 in Sydney. Light option related offers trail below 0.9420 for today’s expiry. The first line of support is seen at 0.9339 (Fib 38.2% on Nov’13 – Jan’14 pullback). AUD/NZD 4 month forward points stand at highest since 2009, meaning that AUD/NZD demand develops despite RBA/RBNZ divergence. Option bids favor the upside for the week ahead.

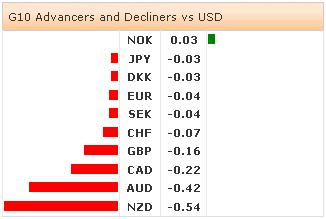

In the US, the headline retail sales expanded by 1.1% year-on-year in March (vs. 0.9% exp. & 0.3% last) and by 1.0% y/y excluding autos (vs. 0.4% exp. & 0.3% last). USD marginally gained against all G10 majors. In Canada, the market reaction to slower house prices remained capped below 1.1000 offers.

The economic calendar consists of Swiss March Producer and Import Prices m/m & y/y, UK March CPI, PPI and RPI m/m & y/y, April ZEW Survey on Current situation in Germany and Expectations in Germany and the Euro-Zone, Euro-Zone February Trade Balance, , Canadian February Manufacturing Sales m/m and March Existing Home Sales, US April Empire Manufacturing, US March CPI m/m & y/y, US February Net-long TIC Flows and Total Net TIC Flows and US April NAHB Housing Market Index.

This report has been prepared by Swissquote Bank Ltd and is solely been published for informational purposes and is not to be construed as a solicitation or an offer to buy or sell any currency or any other financial instrument. Views expressed in this report may be subject to change without prior notice and may differ or be contrary to opinions expressed by Swissquote Bank Ltd personnel at any given time. Swissquote Bank Ltd is under no obligation to update or keep current the information herein, the report should not be regarded by recipients as a substitute for the exercise of their own judgment.

Recommended Content

Editors’ Picks

EUR/USD eases to near 1.0700 ahead of German inflation data

EUR/USD is paring gains to near 1.0700 in the European session on Monday. The pair stays supported by a softer US Dollar, courtesy of the USD/JPY sell-off and a risk-friendly market environment. Germany's inflation data is next in focus.

USD/JPY recovers after testing 154.50 on likely Japanese intervention

USD/JPY is recovering ground after sliding to 154.50 on what seemed like a Japanese FX intervention. The Yen tumbled in early trades amid news that Japan's PM lost 3 key seats in the by-election. Focus shifts to the US employment data and the Fed decision later this week.

Gold price holds steady above $2,335, bulls seem reluctant amid reduced Fed rate cut bets

Gold price (XAU/USD) attracts some buyers near the $2,320 area and turns positive for the third successive day on Monday, albeit the intraday uptick lacks bullish conviction.

Ripple CTO shares take on ETHgate controversy, XRP holders await SEC opposition brief filing

Ripple loses all gains from the past seven days, trading at $0.50 early on Monday. XRP holders have their eyes peeled for the Securities and Exchange Commission filing of opposition brief to Ripple’s motion to strike expert testimony.

Week ahead: FOMC and jobs data in sight

May kicks off with the Federal Open Market Committee meeting and will be one to watch, scheduled to make the airwaves on Wednesday. It’s pretty much a sealed deal for a no-change decision at this week’s meeting.