As central banks continue to grapple with the increasing risk of deteriorating global growth, some are turning towards negative rates which are likely to widen the current interest rate divide between the currencies. However, as these policies start to bite and the USD strengthens, so too does the pressure upon the US economy.

Friday’s poor US unemployment figures had a surprising impact upon world currency markets buoying the USD by around 0.5%. The unemployment report was largely expected to be a weak number given the fall in a range of metrics in the lead up to the release. However, despite the NFP result of 151k falling well below the 190k consensus, the market largely focussed upon the decline in the US Unemployment rate to 4.9%. In addition, average hourly earnings rose around 0.5% m/m, suggesting that the fall in jobs growth may just be transitional or a statistical outlier. Subsequently, the market was not convinced of any growing risk to the Fed’s lift off schedule.

However, there is increasing tightening in the global financial conditions which could impact US economic activity in the coming quarter as well as labour conditions. Subsequently, any such slow down would likely place the forecasted rate hikes to the US Federal Funds Rate at risk of being delayed, or in fact reversed. Although the market consensus is still largely in line with the Fed’s expectations setting, the risk sentiment is starting to falter and the global front end rates have subsequently fallen, as both the ECB and BoJ return to a policy of easing. What this potentially means for the US is the short term, higher repricing of rates, subsequently benefiting both the USD and GBP.

In the medium term, expect the USD to bounce back from its recent routs and continue to rise whilst the diverging monetary policies between the ECB and the Fed continue. In addition, as Japan also moves to undertake a negative interest rate policy, capital will seek yield and the outflows are partially expected to head state side. This further complicates the US Federal Reserve’s policy of interest rate normalisation as the US trade deficit grows in line with the strengthening currency, further impacting shrinking US exports.

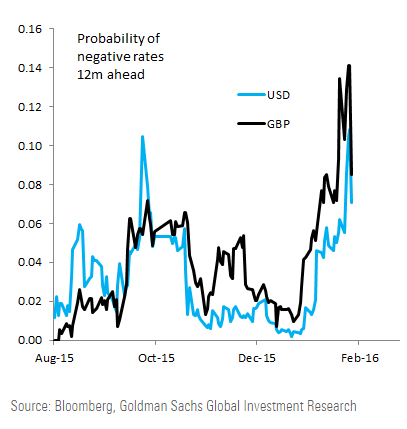

Subsequently, both the possibility of further rate hikes as well as continued strength within the US labour markets is now in question. In addition, assuming a 3-month constant OIS spread the probability of future negative rates in the US and UK has recently touched new highs. Despite this concerning indicator, market expectations still largely point towards a range of expected rate hikes throughout 2016. However given both the recent downturn in world growth, as well as upward pressure on currency valuations, this scenario seems unlikely.

Ultimately, when the market realises that rate normalisation may no longer be on the table, expect a sharp depreciation in the US Dollar, which could lead to an additional round of the currency depreciation war throughout Asia.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.