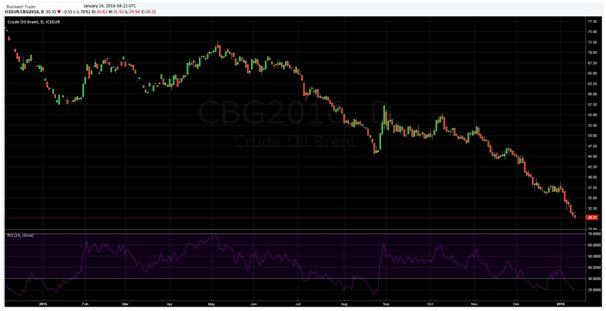

The looming spectre of Iranian oil shipments has spooked world oil markets as the price of Brent crude has declined below $30 a barrel for the first time since 2004. Speculation is mounting that world oil markets could be in for a rough year as global demand continues to sag.

Despite US domestic concerns over the viability of an Iranian nuclear deal, it appears that an agreement is close to being achieved. Such a monumental step would allow Iranian crude oil to flow freely following the lifting of sanctions. Subsequently a nuclear deal could have a significant impact on world crude markets as Iranian exports could further depress a sector already mired in over-supply.

Subsequently, as the parties appear close to reaching a resolution, the increasing risks of the additional supply are being priced into global oil prices. In fact, crude oil prices in London have slumped over 1.8 percent whilst WTI desperately clings to the $30.00 handle. The widening gulf between Brent and WTI prices continues largely due to the risk that the additional seaborne supply poses to Brent.

The return of Iran to the oil exporting fold has the potential to significantly impact global oil prices. The beleaguered state is likely to exacerbate the current global oversupply by an additional 500,000 barrels per day. This level of supply could potentially rise to 1 million barrels a day, within 6 months, following the lifting of sanctions.

Subsequently, Brent crude oil prices are likely to remain under pressure until some certainty is obtained regarding the lifting of sanctions. Currently, London crude oil is trading around the $29.92 a barrel mark but the additional Iranian supply could very well see prices around the $24.00 range. Subsequently, traders are keenly watching the outcome of the nuclear negotiations for a hint at Brent’s future trend direction.

In addition, poor US consumption and inventory data further complicates the markets view of future demand. As the world’s largest consumer of oil products markets typically look towards the US data for signs of strength. However, gasoline stockpiles continue to grow and are currently at over 240 million barrels, the highest since February of 2015. Subsequently, concerns continue to mount over a US led slowdown in demand that could have a long lasting impact in crude markets.

Given the current lack of demand, coupled with the continuing oversupply of crude, the coming quarter looks bleak for Brent and WTI prices. Crude oil markets are in a perilous position and as the essential rebalancing occurs we could very well see a significant change to the market structure and power of Middle Eastern participants in the coming year.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD trades with mild positive bias near 0.6700, RBA Meeting Minutes eyed

The AUD/USD trades with a mild positive bias near 0.6695 during the early Asian session on Monday. The weaker US Dollar provides some support to the pair. The markets remain unconvinced that the Fed will pivot earlier than previously expected.

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

Gold looks to extend uptrend once it confirms $2,400 as support

Gold price continued to push higher last week and rose above $2,400 on Friday, gaining nearly 2% for the week. Investors will continue to scrutinize comments from Fed officials this week and look for fresh hints on the timing of the policy pivot in the minutes of the April 30-May 1 meeting.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.