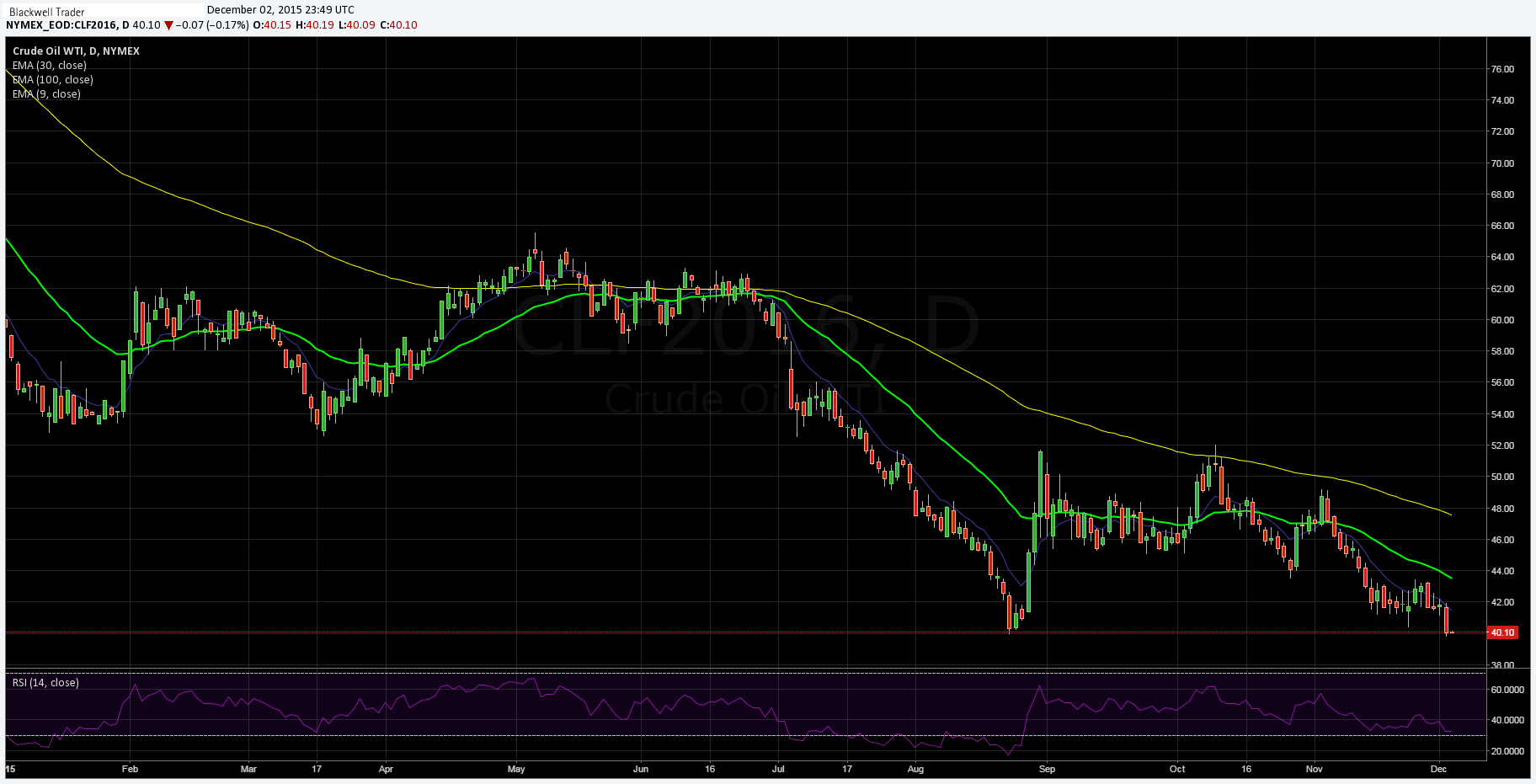

Crude oil prices continued to slide overnight, forming new lows not seen since early August, as concerns over a supply imbalance weighed upon the commodity. There continues to be mounting evidence that the oil glut is here for the long term as OPEC waivers on any consensus to cut production.

WTI Crude oil futures were hit relatively hard overnight as an EIA report demonstrated a further 1.18m barrel build in inventories. Despite significant declines m/m in the rig count, there seems to be no end in sight as oil analysts point to 2016 being a year of pain for the black gold. There is also mounting evidence that the oil industry will have to tolerate a savage over-supply that is likely to lead to a slump that exceeds anything seen during the GFC.

In addition, OPEC’s initial strategy of driving down production costs to damage the fledgling US shale industry has reached a critical point where a pivot is now required. In fact, it would appear that Middle Eastern producers are now facing the prospect of maintaining supply to defend their current market share against the innovative US sector.

However, the outcome of any such strategy is likely to end up further enlarging the current supply glut. Subsequently, 2016 is likely to be a year of severely depressed oil prices and continued production in an attempt to defend their respective market shares. The full effect of the lower prices is yet to be felt through much of the oil producing world but as supply continues to increase so will the impact further down the supply chain.

The next few months are going to be critical for oil prices and it is hard to see much in the way of upside for them. This is especially salient given the coming seasonal weakness as the US bids goodbye to the bullish summer months. This fact, coupled with the continuing global oversupply, provides plenty of fuel to the case for weaker crude prices.

Subsequently, I reiterate my medium term forecast for WTI futures to trade within the $35.00 - $39.00 a barrel range during the early part of 2016.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.