In a sign that the recent stimulatory policy has failed, the Central Bank of Nigeria (CBN) has cut their benchmark interest rates by over 200 basis points. However, the rate cut could just be the tip of the ice berg as the Nigerian economy faces a self-imposed, diminished growth environment.

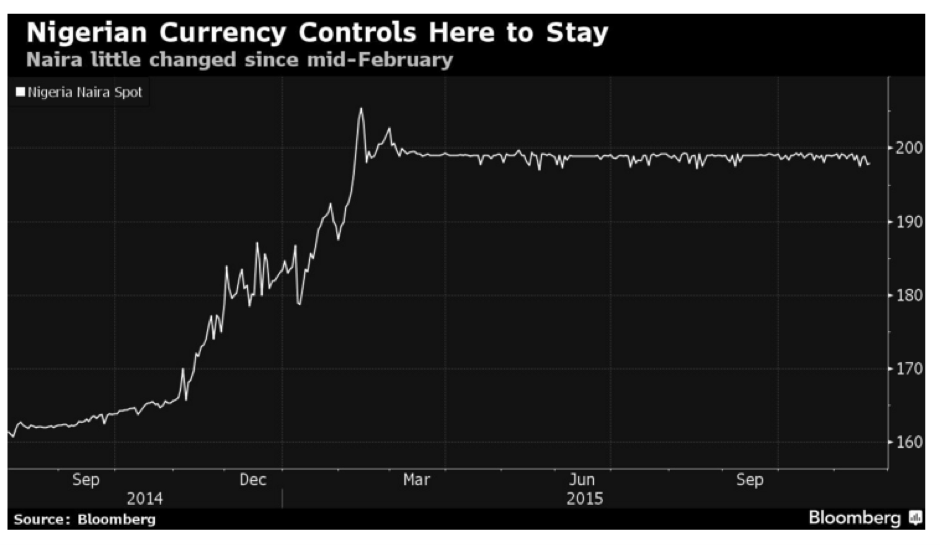

It is largely no surprise that the central bank has been forced into action given the recent schizophrenic fiscal policy, including capital controls, undertaken by the national government. February saw the scraping of the bi-weekly currency auction and a subsequent peg being applied at 198 between the Naira and Dollar. This action was followed closely by the CBN taking up arms to defend any devaluation of the Naira through the introduction of foreign exchange capital controls.

Subsequently, the reduction of interest rates by over 200 basis points to 11.00% demonstrates a central bank that has largely lost control over monetary policy. The concept of stimulating economic activity and growth through a decrease in rates typically only works if you allow capital to flow freely throughout the economy. Adding additional bottle necks, in the form of foreign exchange capital controls, acts only as a disincentive to foreign investment in the region, and is unsustainable in the long run.

In addition, the joint failure of both government and central banking policy hides a deeper underlying problem, a lack of fiscal discipline. The Nigerian government has a problem not only with their external debt load but also with internal expenditure. As their foreign currency reserves dwindle, so too does their ability to raise additional funds on international debt markets at reasonable yields. The simple truth is that the current state of the Nigerian economy is such that government expenditure cannot be maintained at the current level.

In the short run, lower interest rates may assist the government in borrowing to fund an expanding budget but it fails to address systemic failures in the Nigerian economy. Moving forward, Nigeria requires a stable economy based upon incentives for entrepreneurs who drive economic activity rather than central planning and continued government meddling in the economy. Without some radical changes, the debt load will continue to increase to unsustainable levels, whilst economic growth will remain elusive.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.