As the odds of a rate hike by the US Federal Reserve slips away, so does the hawkish rhetoric from the central bankers as the market starts to realise that the jig is up.

The past month has seen the Federal Reserve on a public relations blitz, like nothing I have ever witnessed in my time covering the capital markets. Despite the obvious attempt to impact market expectations, the recent rhetoric clearly took a more dovish tone, albeit one that still hinted at the chance of a rate rise for 2015. However, the shell game might finally be up as central banks around the world start to take decisive action ahead of any potential move by the Fed.

The reality is that central bankers around the world have been closely watching US developments for some time as they look for passive ways to depreciate their respective currencies. The commonly held view was that the US Federal Reserve would hike rates and alleviate any need for other central bankers to cut rates. However, the Fed’s hawkish rhetoric is in doubt, as China’s PBOC fires the first shot by cutting interest rates to 1.50%.

Subsequently, China’s decisive move is likely to forestall the current wait and see policy that most Asian nations are employing. It is highly probable that a range of central bankers will now take action to loosen their monetary policy and depreciate their currencies. In particular, Thailand and Malaysia will now be faced with the need to consider their monetary policy given the hit that any CNY depreciation would pose to their exports. So by relying upon the Fed to effect a depreciation much of Asia is now facing rate cuts prior to Christmas.

The closely held view by a vast majority of market pundits and economists for some time has been that the latter part of 2015 would see a rate hike by the Fed. This view has been largely formed by the hot air escaping from the raft of FOMC members prevaricating to the media. The Fed has clearly formed a bubble of expectations that a rate hike would be forthcoming. However, the probability now is miniscule given the global economic conditions (that were forecast some months ago).

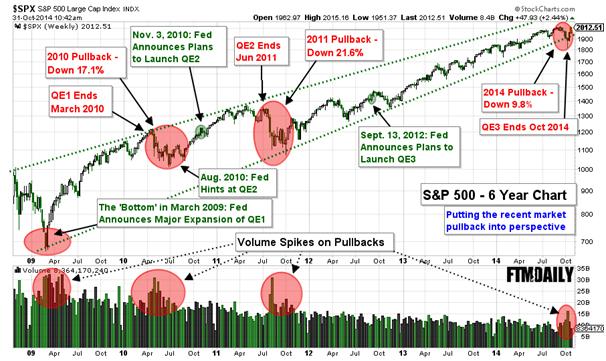

The Fed’s real reason for the continual drive to alter expectations is the fact that they have a problem on their hands in US equities. Successive rounds of Quantitative Easing have fuelled a speculative bubble in the markets, which have continued on an almost linear rise. Stock valuations are through the roof and the Fed is starting to become very concerned that a sharp correction could form a real risk to the US financial system. The reality is they are attempting to let some pressure out of the market in the hope that they need not normalise rates.

Ultimately, we are faced with a US central bank that has lost all credibility as the hot air evaporates from their “case” for a rate rise. Look for them to continue prevaricating in the coming months as they soften their rhetoric and then point to some market event as the reason why they were unable to raise rates.

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.