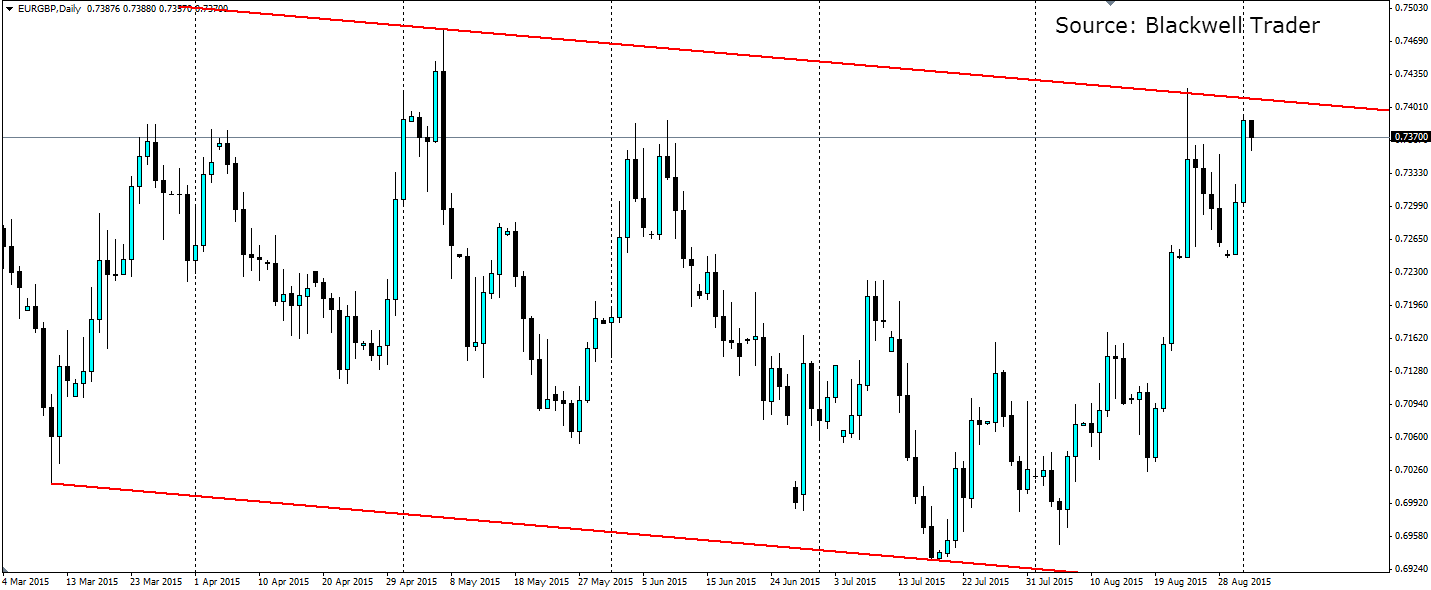

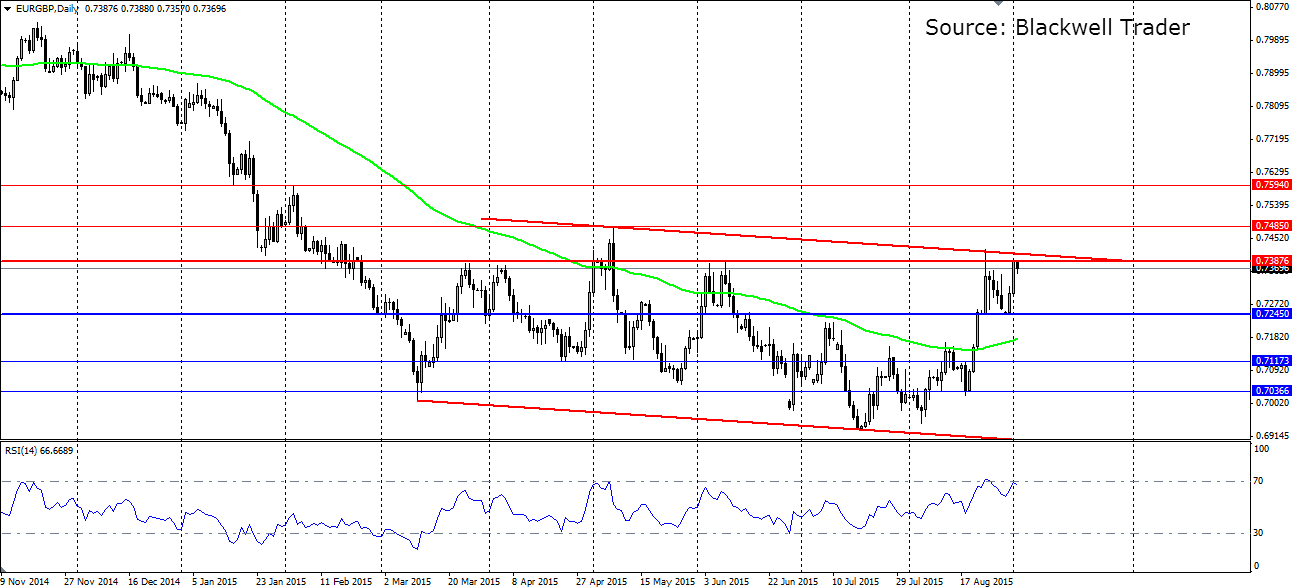

The Euro-Pound pair has found some bids over recent weeks, but all this has served to do is test the channel it has been stuck in for the past 6 months. Can it break the shackles, or will the Pound recover?

The slight bearish bias on the channel is a sign that the market has been favouring the Pound over the Euro in recent months, thanks to the expectation that the Bank of England would raise interest rates sometime this year. That expectation has all but evaporated with the turmoil on global markets and the Euro has taken full advantage.

The recent test of the channel led to a very strong rejection off it, in a sign that the market was willing to defend the short bias on the pair. The RSI pushed into oversold, giving an indication that the move had gone too far, before retreating. The pullback only lasted a week with another charge higher yesterday with a second pullback in the Asian session today.

Both pullbacks are interesting and were largely predictable. They have come in an area of resistance that price has played off several times before. The 0.7387 level acted as resistance in the channel and to support the pair before the channel formed. This level, coinciding with the dynamic resistance, was set up to rejected the pair. The question remains, will the channel hold?

The pattern that is forming currently is a rather classic looking double top. What favours the channel holding firm is the fact that the second ‘top’ is lower than the first, meaning the order flow is favouring the bulls defending the level. A confirmation will come if and when the neckline at 0.7245 is broken and price then uses it as resistance. This is the likely outcome, but not guaranteed.

If the channel holds, look for support to be found at the firm level (the neckline) mentioned above at 0.7245, with further support at 0.7117 and 0.7036. If the channel is breached, a meaningful break of the current resistance at 0.7387 will need to hold, as well as a break of the dynamic resistance along the channel. Further resistance will be found at 0.7485 and 0.7594.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD hovers near 1.0700 ahead of US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The US Dollar holds its ground following the Fed-inspired decline as market focus shifts to mid-tier US data releases.

GBP/USD holds steady above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside ahead of Unit Labor Costs and Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.