The Aussie dollar has felt the wrath of bearish traders over the last month, as it moved towards forming a new six year low. Currently, the embattled pair is hanging on for dear life right around the 0.73 handle, but further falls are almost assumed considering the overall bearish sentiment.

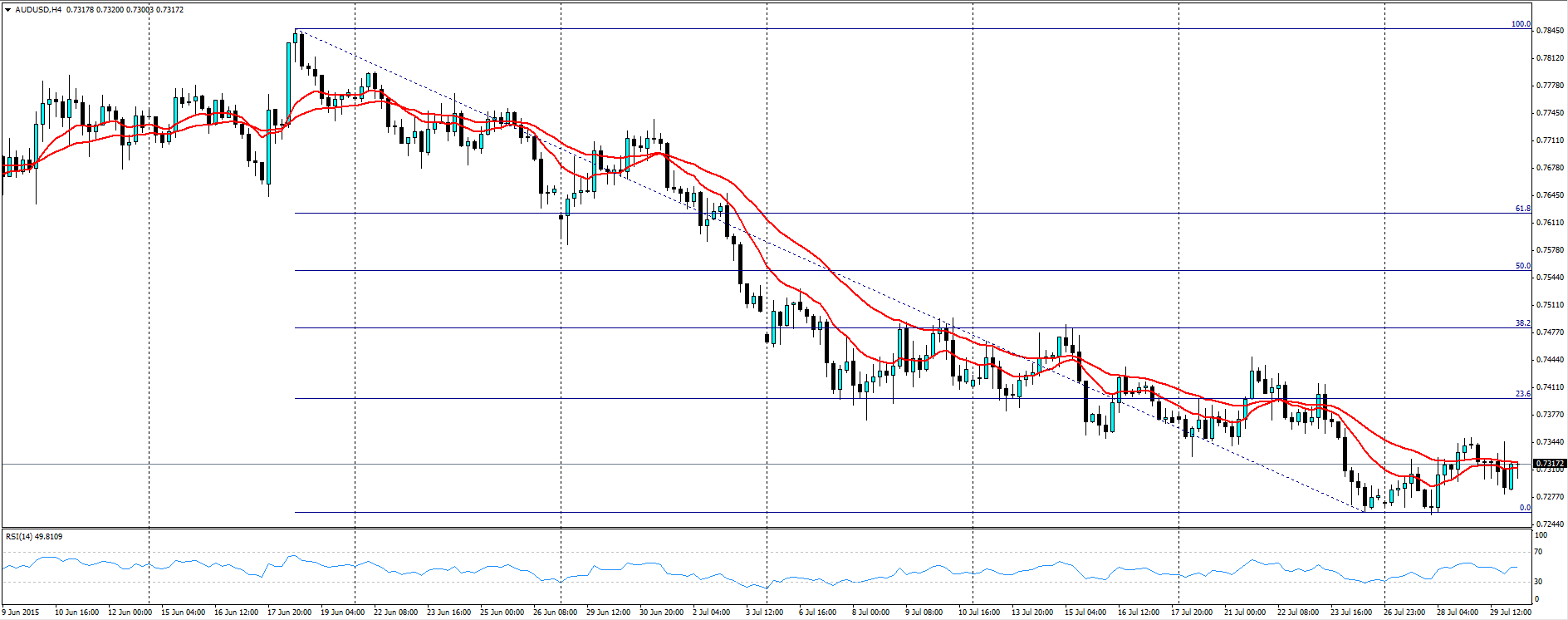

June really formed the key month for the pair as the currency surged higher to form new highs above the 0.77 level. However, the push ran out of steam and the AUD found strong resistance around the key 0.7850 level. Subsequently, the retracement was severe and the currency has continued to be dominated by bears all the way down to its current level at the 0.73 handle.

It is going to be difficult for the Aussie to hang on to the 0.73 handle considering the potential slowdown in Chinese demand for commodities. The currency is also likely facing further monetary easing from the RBA, despite continual jawboning from Governor Stevens to the contrary. The fact is, despite what the RBA may desire, the market will ultimately determine the overall valuation of the currency.

Frankly, the technicals are looking significantly bearish for the Aussie Dollar. The moving averages are declining, whilst RSI still remains within neutral territory which indicates there is still plenty of room on the downside. Also, any long side push is likely to meet significant resistance at 0.7393 which represents the 23.6% Fibonacci level.

The Australian Dollar is subsequently setting itself up to continue its bearish run and woe behold the trader who attempts to get in its way. The analogy of never trying to catch a falling knife certainly comes to mind and is more than appropriate in this situation.

So in the immortal words of Australia’s most successful citizen, Crocodile Dundee, that’s not a knife…this is a knife!

Risk Warning: Any form of trading or investment carries a high level of risk to your capital and you should only trade with money you can afford to lose. The information and strategies contained herein may not be suitable for all investors, so please ensure that you fully understand the risks involved and you are advised to seek independent advice from a registered financial advisor. The advice on this website is general in nature and does not take into account your objectives, financial situation or needs. You should consider whether the advice is suitable for you and your personal circumstances. The information in this article is not intended for residents of New Zealand and use by any person in any country or jurisdiction where such distribution or use would be contrary to local law or regulation. Knight Review is not a registered financial advisor and in no way intends to provide specific advice to you in any form whatsoever and provide no financial products or services for sale. As always, please take the time to consult with a registered financial advisor in your jurisdiction for a consideration of your specific circumstances.

Recommended Content

Editors’ Picks

AUD/USD regains the constructive outlook above the 200-day SMA

AUD/USD advanced strongly for the second session in a row, this time extending the recovery to the upper 0.6500s and shifting its focus to the weekly highs in the 0.6580-0.6585 band, an area coincident with the 100-day SMA.

EUR/USD keeps the bullish performance above 1.0700

The continuation of the sell-off in the Greenback in the wake of the FOMC gathering helped EUR/USD extend its bounce off Wednesday’s lows near 1.0650, advancing past the 1.0700 hurdle ahead of the crucial release of US NFP on Friday.

Gold stuck around $2,300 as market players lack directional conviction

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Bitcoin price rises 5% as BlackRock anticipates a new wave of capital inflows into BTC ETFs from investors

Bitcoin (BTC) price slid to the depths of $56,552 on Wednesday as the cryptocurrency market tried to front run the Federal Open Market Committee (FOMC) meeting. The flash crash saw millions in positions get liquidated.

FOMC in the rear-view mirror – NFP eyed

The update from May’s FOMC rate announcement proved more dovish than expected, which naturally weighed on the US dollar (sending the DXY to lows of 105.44) and US yields, as well as, initially at least, underpinning major US equity indices.