I love the silver market. If you read my articles you can understand why, because when it comes to the technical side of things it loves to play along and has done so for some time.

In the current period silver has been going through a strong technical pattern of consolidation. This has been after a steep down trend over the previous months, where a lot of metal traders took full advantage of the situation. The reason for this down trend was the appreciation of the USD and the outlook remaining positive for the US economy – nothing keeps the speculators further away than a booming economy for a change.

With a ceiling at 17.55 and a floor at 17.07, the markets will be eyeing up the possibility of a fall below the 17.07 level, a solid bearish candle below this level could bring the bears back into the market to swipe down silver once more. This is not something that is unreasonable either when you think about it, despite some recent US woes the labour market and consumer sentiment is still very strong. The prospect of rates is ever more increasing as a result.

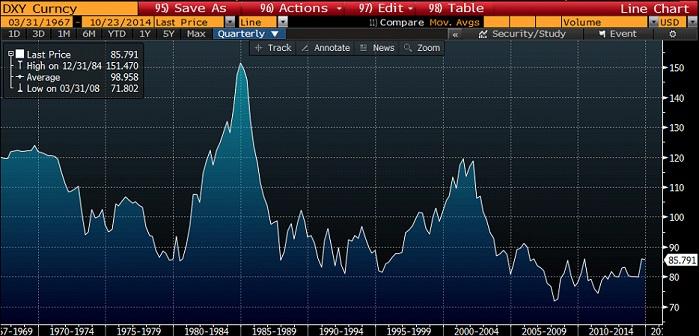

To put it in an even better perspective long term; we have seen the dollar index well below its average against other trade weighted indexes. This is unlikely to remain the same in the long term as other currencies look to devalue themselves in an effort to stimulate their economies. In the long term metals will likely fall against the US dollar as a result.

Overall, silver in the long term looks likely it will drop further and it is just a matter of time. In regards to justification, I look fundamentally to the US dollar strengthening and demand for precious metals tapering off further. From a technical point of view we have seen silver consolidate a few times before a large drop, and this looks no different.

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.