The GBPCAD pair is a volatile one that broke out of a ranging pattern when the first poll showed the possibility of Scotland leaving the Union. The pair has pulled back and now finds the resistance at the old channel tough to break.

The movement in the GBPCAD pair has been mostly on the UK’s side of things. Scotland becoming independent will be detrimental for the GBP as the Bank of England has explicitly said Scotland cannot use the Pound Sterling. Scotland will be taking a vast amount of Oil and Gas tax revenue with it which will see London’s coffers take a sizeable hit. With the vote heating up, volatility is sure to stick with the pound through to the September 18 voting date.

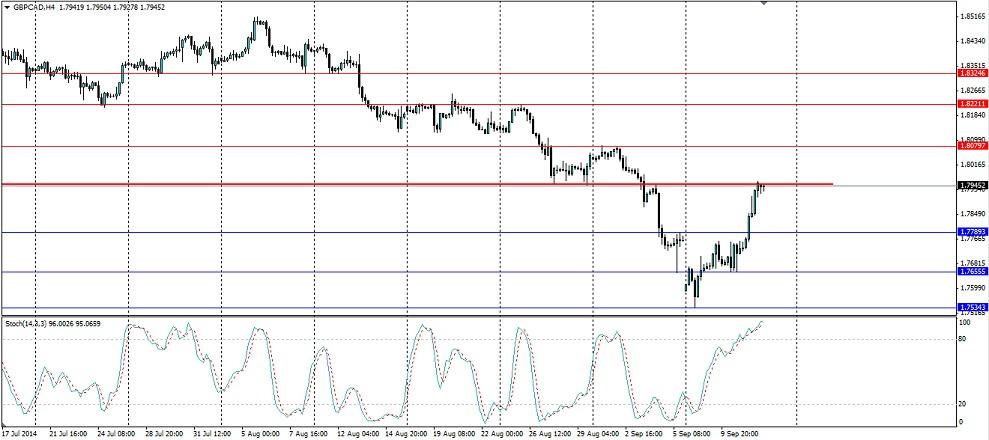

Last weekend we saw a poll by YouGov which put the ‘Yes’ vote ahead by 51%-49%. This caused the pound to take an enormous hit and it touched a nine month low at 1.7534 against the Canadian dollar as a result. The latest pullback is because that lead has now swung back in favour of the ‘No’s by 52% to the 48% of ‘Yes’ votes. This has left the pound sitting just under some fairly solid resistance in the form of the bottom of the old channel that previously acted a support.

There is little news out for both Canada and the UK (not including any polls on the independence vote) so with any luck this pair will look to play off technicals. The Stochastic Oscillator is looking extremely overbought at the moment so the likelihood of a rejection off the resistance is high.

A bounce off the resistance at 1.7959 will look to find support at 1.7789, 1.7655 and 1.7534, any of which will likely act as possible exit points for a short trade. Should the price break back into the channel (if another poll shows the ‘No’ vote well ahead) then look for resistance to be found at 1.8079, 1.8221 and 1.8325.

The GBPCAD pair has seen a nice pullback to the channel which the price broke out of last week. This is acting as heavy resistance and the price could see a solid rejection off it.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.