The Aussie dollar looks under a bit of pressure and comments from the RBA did the bulls no favours. We may see a pull back from the recent movement, however, a touch of the bearish trend line should see a strong movement downwards.

Data out today from China helped the Aussie dollar to maintain its bearish channel. The HSBC Manufacturing PMI showed a reading of 50.3, down from 51.7 a month ago and well below the 51.5 the market had anticipated. The impact comes as no surprise given the nature of Australia’s mining led economy and its reliance on exports to China.

Yesterday we saw the Reserve Bank of Australia Governor Glenn Stevens give a speech. He said he believed the Aussie dollar had further to fall and he was becoming concerned about the unemployment rate. He also told parliament that low interest rates were not enough, indicating they will stay low for some time.

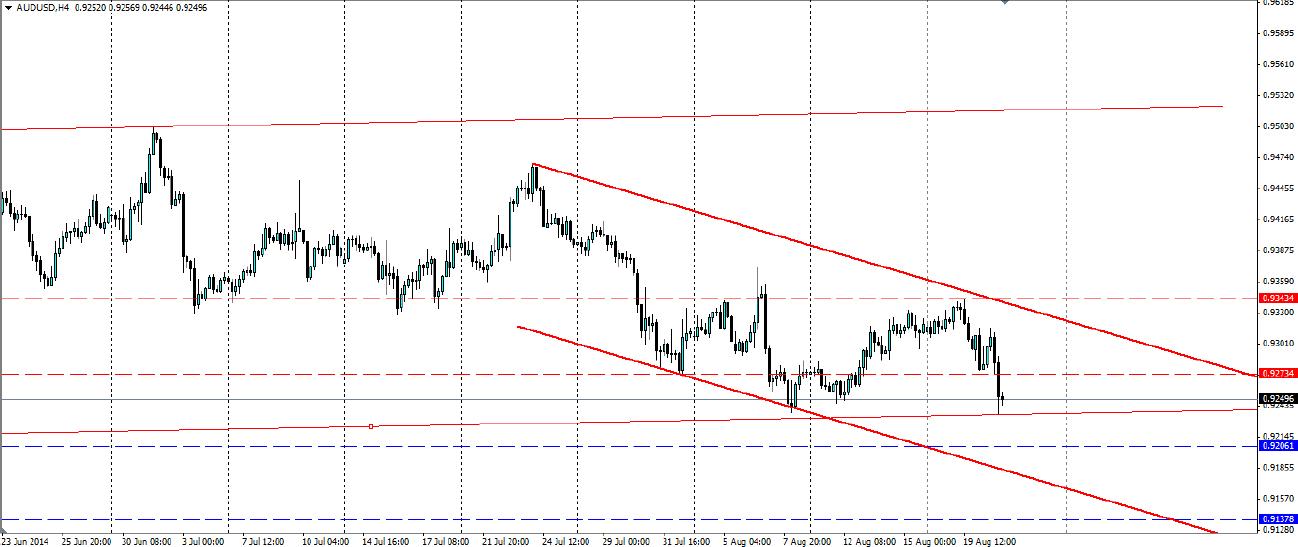

From a technical point of view the bearish channel is looking rather solid on the H4 chart. The price looks likely to break through the bottom of the ranging channel it has been following for the past three months. We could see the price use this as support, however, the bearish sentiment looks strong as we see on the below daily chart.

The MACD is certainly still looking bearish and it would pay to wait for the price to break through the larger channel before taking this pair short. Once confirmed, levels of support can be found at 0.9206, 0.9138 and 0.8995 and may act as possible exit points, with the bearish channel acting as dynamic support. If the price bounces higher it will find resistance at 0.9273 and 0.9343, with the upper level of the bearish channel acting as dynamic resistance.

The Aussie dollar is looking rather bearish at the moment and a bearish channel has confirmed this. Look for a breakout of the larger channel before a serious movement to the downside.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.