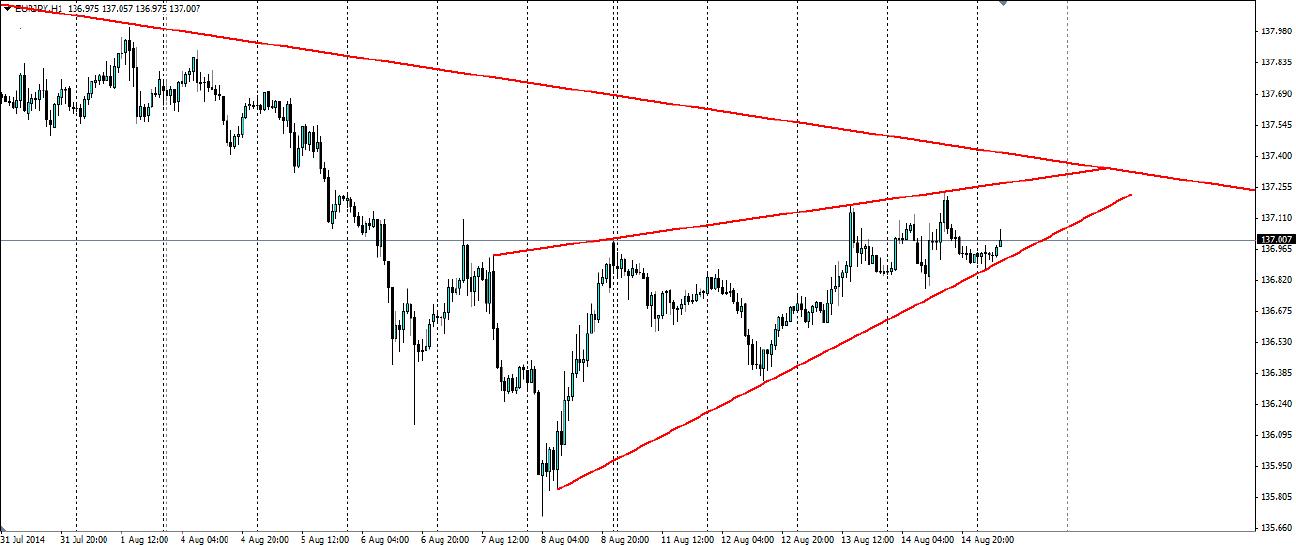

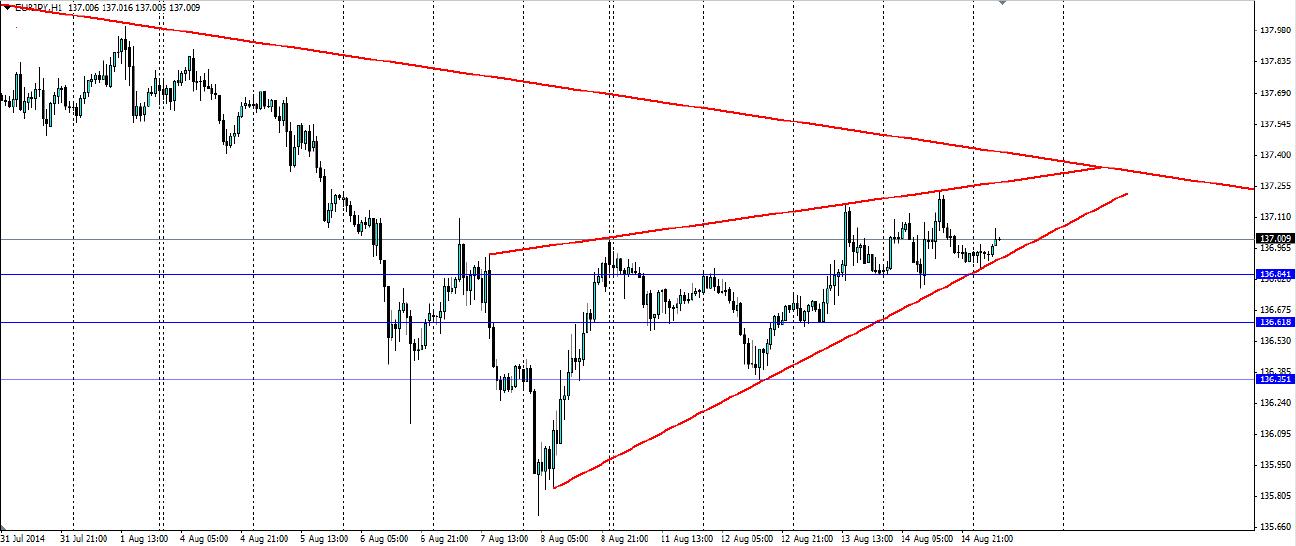

The EURJPY pair is forming an upward sloping wedge as it heads towards the upper level of a bearish trend. A breakout could be to the downside, taking the Euro passed the recent nine month low.

The Euro Yen pair is an interesting one to watch as they battle for prize of ultimate central bank. At this stage the Bank of Japan (BoJ) seems to be winning as Japan comes out of decades of deflation. The European Central Bank (ECB) hasn’t taken such an aggressive approach, opting more for talking the currency down and acting only when absolutely necessary. The result is that the yen is looking more robust as Japan recovers and the Euro continues to weaken as more stimulus is likely.

The leaves the EURJPY pair in a downward channel and the price looks set to touch the upper channel and bounce off it lower. This will coincide nicely with the point of the upward sloping wedge that has been forming on the H1 chart below.

There is little news out for either the Yen or the Euro over the next 24 hours so we should see technicals take over and the price to continue to consolidate. It would pay to catch the momentum down only once a breakout has been confirmed. It would also pay to keep an eye on key technical levels as they may stall to downward momentum. These can be found at 136.84, 136.62 and 136.35.

The EURJPY pair is looking to continue consolidating in a upward sloping wedge before it comes in contact with the upper level of a bearish channel. This could provide a decent breakout to the downside.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.