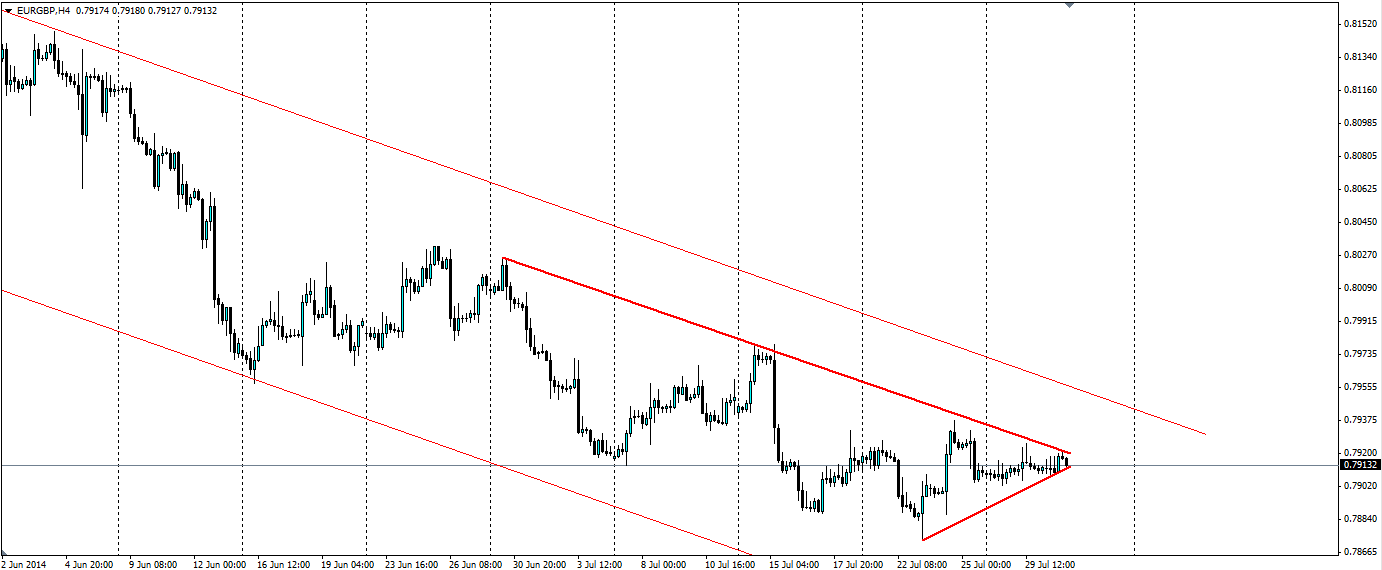

The Euro versus the pound is seeing somewhat of a price consolidation and should break out. With all of the news due out in the next 36 hours, we could see some large movements.

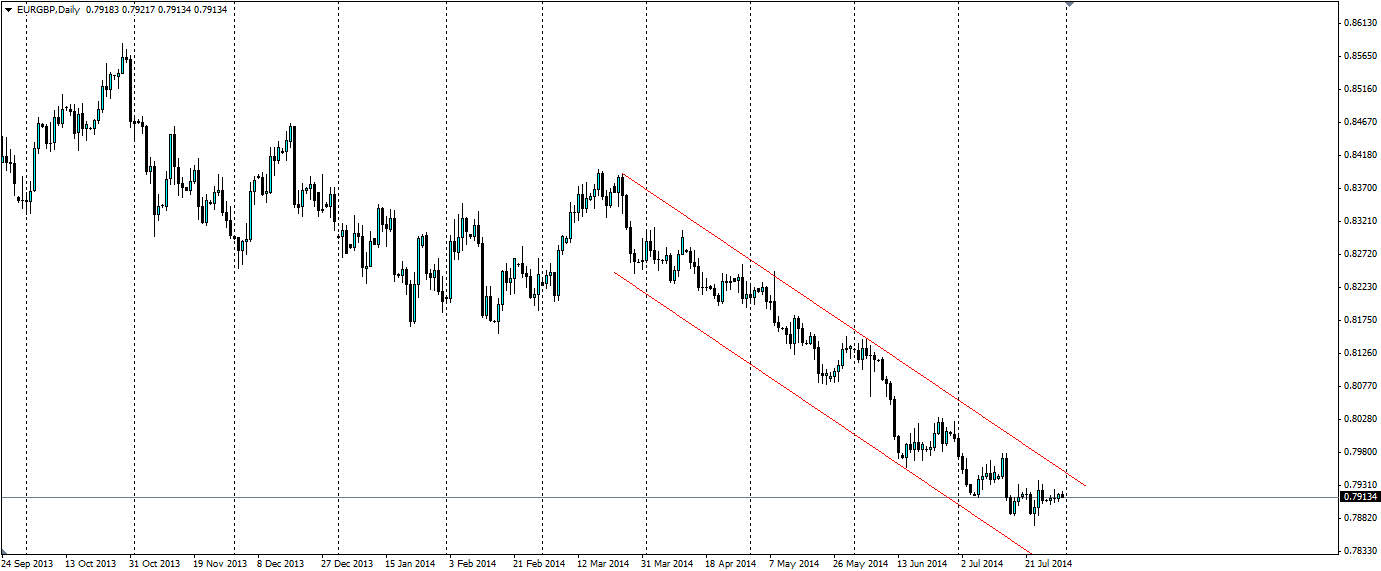

The EURGBP pair is following a fairly clear bearish channel as the Euro depreciates and the Pound looks ever more attractive. The European Central Bank (ECB) is releasing stimulus to combat deflation, and stagnating growth contrasts with the expectation that the Bank of England (BoE) will begin to talk about raising interest rates as they now see less risk to the recovery from higher interest rates.

The recent news has painted the Euro in a slightly better picture. Unemployment in Spain has fallen and Manufacturing PMI in Germany beat expectations. Yesterday saw the EU Economic Sentiment rise from 102.0 to 102.2 (the market expected a fall) and German CPI also did not fall as expected, staying firm at 0.3%.

The News for the rest of the week is heavily USD orientated, which should add plenty of volatility to the markets (especially with nonfarm payroll on Friday). But it is the Euro and Pound news that will give this pair direction.

On the Euro side, we have German Retail Sales at 06:00 GMT, which are expected to rise by 1.1% m/m; French consumer spending at 06:45 is expected to fall, however, German Unemployment at 07:55 GMT is expected to be favourable. Later in the day we see a very important piece of news, the Flash CPI estimate. This is expected to remain at 0.5%, but any fall could heavily impact the Euro as inflation has been the main driver for the stimulus from the ECB. On Friday we have several EU member states releasing revised Manufacturing PMI figures, which were positive last week.

The Pound will have a little less to contend with and sees the Nationwide Bank releasing the House Price Index at 06:00 GMT, which is expected to rise by 0.6% from a month ago. The UK also releases their own Manufacturing PMI, which is expected to be higher than last month’s 51.0 at 51.4.

Anything favourable for the Pound will see the Euro-Pound pair break out to the downside of the triangle shape on the H4 chart, however, if EU CPI rises above the 0.5% it is currently stuck at, we could see the Euro breakout of the bearish trend and begin to reverse its recent slide.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.