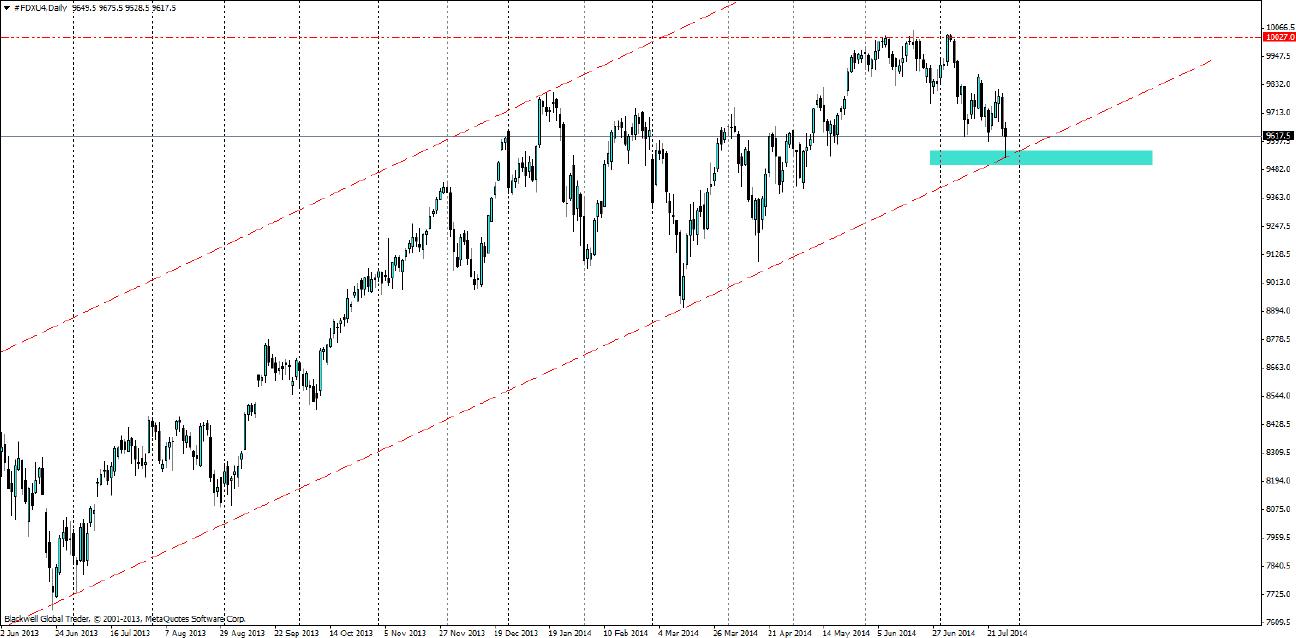

The DAX index is generally a good representation of the economy and has as of late been struggling to break through key resistance on the daily chart. After looking for it to fall further in recent articles that has certainly come true and it has dropped back sharply to touch support levels in the current channel.

So the fall that was likely to happen has happened, and indexes and commodities generally play of technicals more so than forex – so it’s much easier to watch and wait in the market.

With the DAX we can see that the trend has extended lower as markets have pushed down on the back of Draghi comments. But have managed to find support on the trend line at 9528. Markets were waiting for this point and the strong wick that we see on the candle is a result of this heavy buying pressure by markets as they still see value in the DAX, and were not keen to see it enter bullish territory.

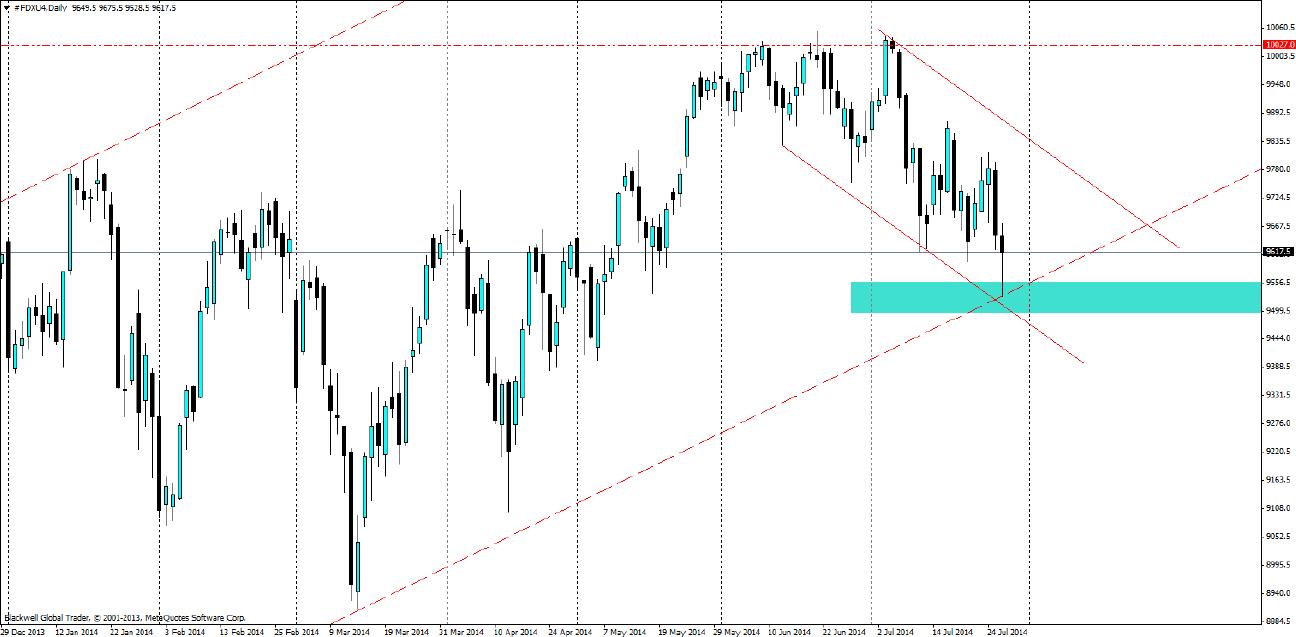

Zoomed in, it’s clear that there is a possibility of a channel forming, however, there is certainly the possibility of bullish movements higher for the DAX in the medium term.

Just like the FTSE, markets prefer equity indexes to range between defined parameters, and in this case the bullish trend line is acting as dynamic support and is likely to stay.

People looking to play this chart should look for a bullish movement higher before jumping in for another crack at the upper level of resistance at 10027. And by bullish movement I believe a rise above the present level and some bullish candles showing market desire to push higher.

While the technical patterns are strong, one must also be aware of the present situation in the Euro-zone. As a raft of data is due out this week it could negatively affect the Euro-zone and future outlook for the fragile economy. Any serious negative news could see the trend line tested and if it does push lower, it would be worth looking to catch momentum if there was a breakout to the south.

Either way, at present the DAX is providing clear opportunities for markets and the possibilities that are at hand when it comes to movements. Catching momentum either side will likely pay off in some regards, but it will be interesting to see if we have another push higher in the face of economic weakness to the present trend line. But hey, with all the money Draghi is trying to push into the system, it has to go somewhere, and American markets showed clearly that equity markets are more than happy to eat it up in the long run.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.