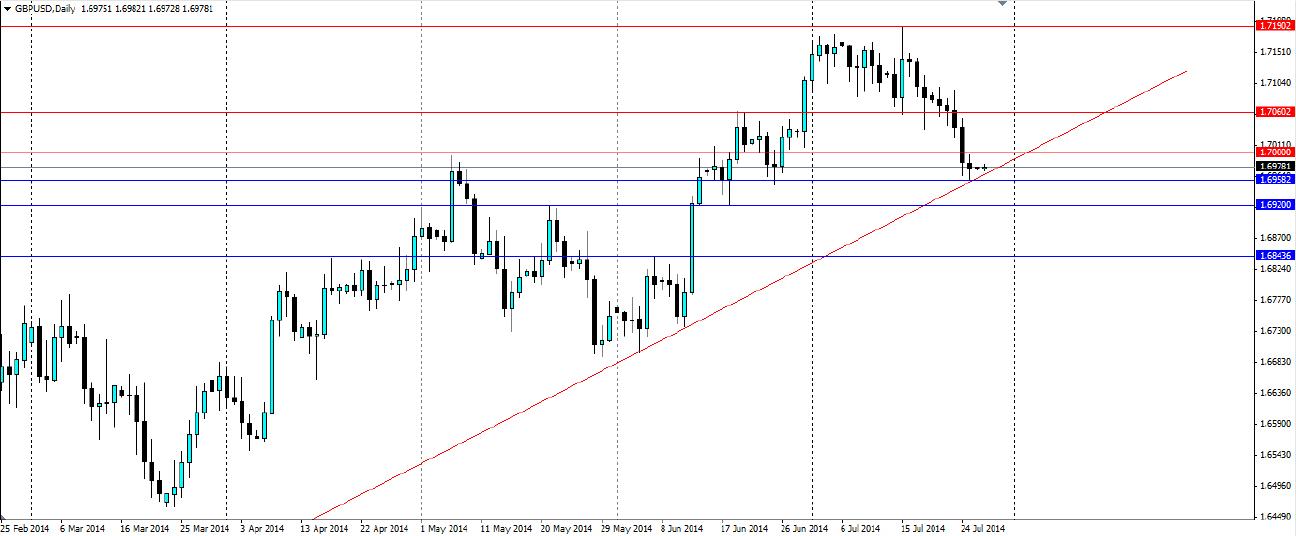

The Pound has given back all of the gains made early in the month and is now on the trend line. There is not a great deal of news in the market early this week so it is likely to play off technicals, in which case we can expect a bounce off the trend line and a movement higher, however, later in the week it will be volatile.

The Pound has been on a bull run against the US dollar for over a year as the outlook for the UK looks ever betterdespite the US having its own economic recovery. Recently however, the pound has given back some gains as the timing of potential interest rate rises in the UK still remains unclear and as the US Federal Reserve Chairwoman Janet Yellen gave Dollar bulls hope by saying that US interest rates will rise sooner than expected if the labour market continues to improve.

Inflation in the UK is not really posing a threat at 1.9% annually, however GDP is looking solid at 0.8% per quarter. Essentially there is no desperate need for the Bank of England to raise interest rates, however minutes from their recent meeting suggested that members see diminished risks to growth from a rate increase. This opens the door for the Bank of England to possibly begin to outline a timeframe for a rate increase, which will certainly boost the Pound.

This week will begin quietly for the pound, however, come Friday we have the UK manufacturing PMI figures and the biggest event of all; the US Nonfarm Payroll data. The US is expected to have added 230,000 jobs this month, down slightly on the 288,000 last month, but nonetheless a robust figure if it comes to fruition. This will add plenty of volatility to the market so traders should beware.

Up until Friday, we should see the GBPUSD pair trade off technicals and the most obvious movement is a bounce off the bullish trend line. The price appears to have touched the trend line at the end of last week and found support at the 1.6958 mark. Once the resistance is broken above the 1.7000 mark, we should see a relatively quick movement up to previous levels and to even test the five year high recently posted.

Traders could look to enter once this resistance is broken, with a stop loss below the trend line, in case there is a breakout lower. Several targets can be chosen for a movement higher, with previous resistance at 1.7060 being the first. The previous five year high at 1.7190 will also be a likely target.

The bullish trend line on the GBPUSD is likely to come into play this week and a bounce higher is the probable outcome. US Nonfarm Payroll data is likely to provide volatility at the end of the week and is something traders should keep an eye on.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD drops to near 1.0650 ahead of Fed policy

EUR/USD continues its decline for the second consecutive day, hovering around 1.0650 during Asian trading hours on Wednesday. With European markets largely closed for Labour Day, investors are expecting the Federal Reserve's latest policy decision.

GBP/USD holds below 1.2500 ahead of Fed rate decision

The GBP/USD pair holds below 1.2490 during the early Wednesday. The downtick of the major pair is supported by the stronger US Dollar amid the cautious mood ahead of the US Federal Reserve's interest rate decision later on Wednesday.

Gold sellers keep sight on $2,223 and the Fed decision

Gold price is catching a breather early Wednesday, having hit a four-week low at $2,285 on Tuesday. Traders refrain from placing fresh directional bets on Gold price, anticipating the all-important US Federal Reserve interest rate decision due later in the day.

Ethereum dips below key level as Hong Kong ETFs underperform

Ethereum experienced a further decline on Tuesday following a disappointing first-day trading volume for Hong Kong's spot Bitcoin and ETH ETFs. This comes off the back of increased long liquidations and mixed whale activity surrounding the top altcoin.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.