The USDJPY is looking interesting when it comes to market movements.

Over the recent months the USD weakness has been riding the markets heavily, many would argue that US weakness will continue for some time – and most likely they are right. The US economy is going through a bit of a bad patch when it comes to GDP. However, the labour market is still looking very strong despite this downturn, which shows that firms are expecting a pickup instead of a deep recession.

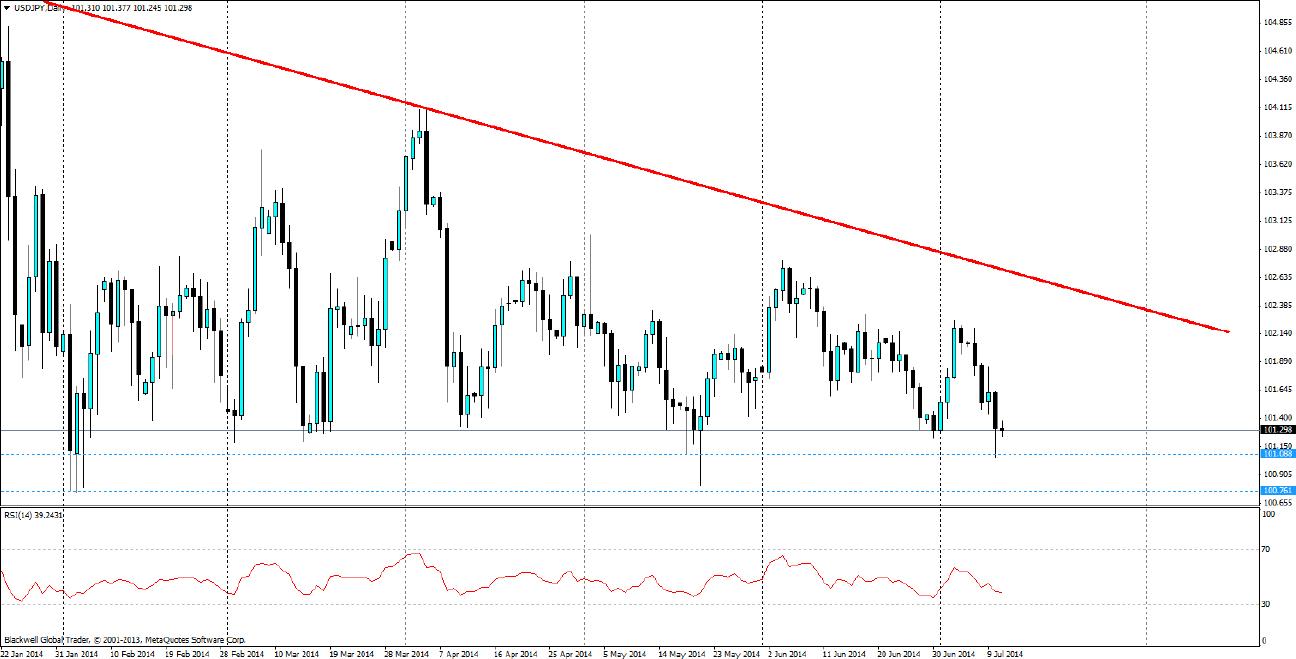

Someone should tell this to the USDJPY though, which has been slowly trending down now for some time. The Yen is not going to get any stronger from here, and for some time it has been acting in a bearish way; while mostly ranging.

The current market sentiment from the Bank of Japan (BoJ) is that the economy is going as planned so they are likely to hold until they see any changes that may warrant action. While the stimulus was talked up throughout the early months of the year, it seems less and less unlikely as CPI is currently in-line with the BoJ’s expectations. Many will now be waiting to see if CPI does actually drop off and if the BoJ will be forced into action. The reality of such an event is not so clear and seems rather distant.

What is clear though are the support levels at play in the market, and they have held for the most part. Current immediate support can be found at 101.088 and 100.761, both of which thus far have acted as serious levels of support and last night we even saw the 101.088 level tested. It’s likely we will see more testing of the 101.088 level of the next week as markets look to apply pressure.

Market participants will be watching the 100.00 level carefully as well, as this level is likely to stoke concern from the BoJ if reached, and may even cause some sort of currency intervention.

A ranging market is not always popular, people prefer a clear trend. In this case the support levels are quite strong and provide opportunities for traders. With small spreads, and a readable market I can see why the USDJPY is such a popular trade as of late.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

AUD/USD: Gains appear capped near 0.6580

AUD/USD made a sharp U-turn on Tuesday, reversing six consecutive sessions of gains and tumbling to multi-day lows near 0.6480 on the back of the robust bounce in the Greenback.

EUR/USD looks depressed ahead of FOMC

EUR/USD followed the sour mood prevailing in the broader risk complex and plummeted to multi-session lows in the vicinity of 1.0670 in response to the data-driven rebound in the US Dollar prior to the Fed’s interest rate decision.

Gold stable below $2,300 despite mounting fears

Gold stays under selling pressure and confronts the $2,300 region on Tuesday against the backdrop of the resumption of the bullish trend in the Greenback and the decent bounce in US yields prior to the interest rate decision by the Fed on Wednesday.

Bitcoin price tests $60K range as Coinbase advances toward instant, low-cost BTC transfers

BTC bulls need to hold here on the daily time frame, lest we see $52K range tested. Bitcoin (BTC) price slid lower on Tuesday during the opening hours of the New York session, dipping its toes into a crucial chart area.

Federal Reserve meeting preview: The stock market expects the worst

US stocks are a sea of red on Tuesday as a mixture of fundamental data and jitters ahead of the Fed meeting knock risk sentiment. The economic backdrop to this meeting is not ideal for stock market bulls.