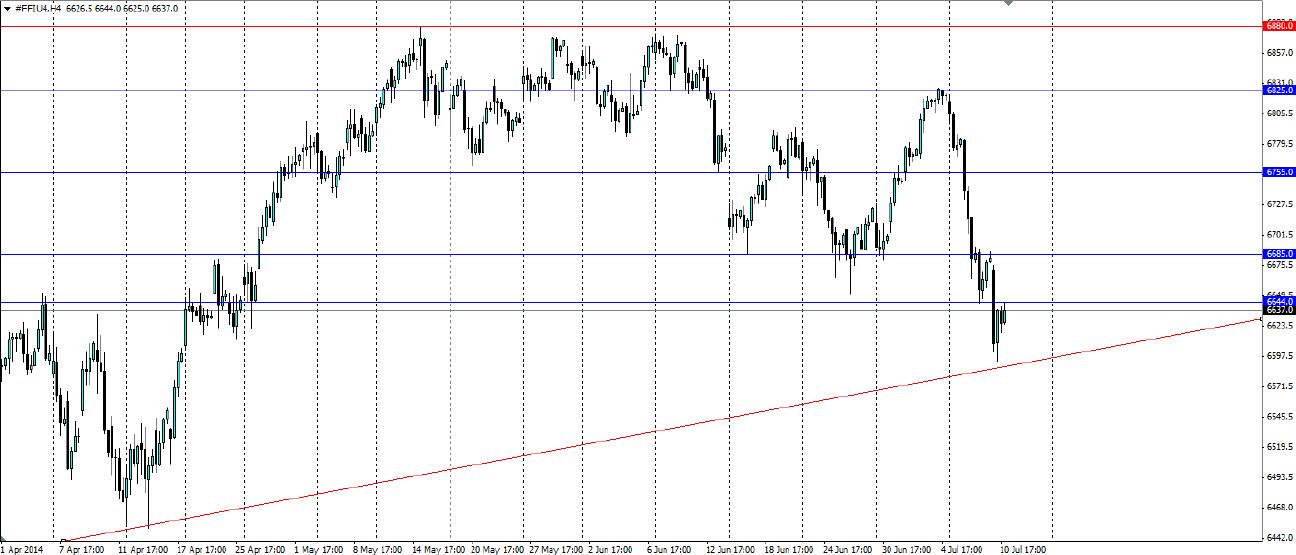

The FTSE 100 index is close to the long term trend line. It is likely to bounce off this line given the fundamental state of the UK, however a possible banking crisis in the EU could prove otherwise.

The FTSE 100 Index has been in a fairly predictable pattern for the past 18 months as the trend line dominates, forming higher lows, however the resistance around 6880 is proving tough to break. The wave patterns are being squeezed into an ever tightening pattern and a breakout too the upper side is the likely outcome. But this may not be for some time.

At present we are at the lower end of one of the waves back down to the trend line, which was tested yesterday. The trend line held and a solid bullish rejection off it formed a long wick on the bearish candle.

Overall, the news reports out for the UK economy have been very positive and there is still a lot of bullish sentiment in the market. Interest rates were held at their all-time low of 0.5% again, which encourages investment in equities as fixed income assets are comparatively less attractive. The services PMI, which accounts for over three quarters of the UK economy, reported 57.7 last week. This was down slightly on the 58.6 a month earlier, however 57.7 is solid expansion and shows how robust the UK economy is at the moment. Construction and Manufacturing also reported PMIs of 62.6 and 57.5 respectively.

The News out tonight is not likely to shock the FTSE into doing anything rash. One current story to watch is the banking situation in Portugal. Banco Espirito Santo shares were suspended yesterday as the bank failed to meet debt obligations. This sent main indices lower as investors sold off shares on fears this could spread to a Euro wide banking crisis. The FTSE is deeply entwined with the European banking system and the economy as a whole, so will feel the effects first hand if this situation deteriorates.

Is it likely we will see the trend line tested again? Probably not, but the candle tomorrow will no doubt have a long wick to the bottom of it which could provide an entry point for a long position. Otherwise a stop entry can be set above the resistance line at 6644 to catch the momentum as it forms another wave back to the top of the triangle at 6880. A stop loss should be set below the trend line, possibly around 6580 to minimise losses in the event of a breakout. Traders can target previous levels of support/resistance as exit points for a movement higher. Levels at 6755, 6825 and the top at 6880 will all act as sticking points for the index.

The FTSE 100 index has shifted lower on fears of a renewed banking crisis in Europe, however the trend line and the fundamentals look solid, leading to a probable bounce.

Forex and CFDs are leveraged financial instruments. Trading on such leveraged products carries a high level of risk and may not be suitable for all investors. Please ensure that you read and fully understand the Risk Disclosure Policy before entering any transaction with Blackwell Global Investments Limited.

Recommended Content

Editors’ Picks

EUR/USD hold comfortably above 1.0750 as USD recovery loses steam

EUR/USD clings to small daily gains above 1.0750 in the early American session on Monday. In the absence of high-tier data releases, the US Dollar finds it difficult to gather recovery momentum and helps the pair hold its ground.

GBP/USD range bound around 200-DMA, awaiting BoE’s decision

The Pound Sterling registers anemic losses against the US Dollar as traders brace for the Bank of England’s (BoE) monetary policy decision on Thursday. The pair remained within the 1.2529-1.2594 boundaries during the last few days, capped by key support and resistance levels. The GBP/USD trades at 1.2556, down 0.04%.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.