1) Stocks; 2) US $; 3) T-Bonds; 4) Oats; 5 tie) Oil & Wheat; 6) Commodity Index; 7) Soybeans;

8) Corn; 9) Copper; 10 tie) Cattle & Cotton; 11) Aussie $; 12) Sugar; 13) Coffee.

US DOLLAR

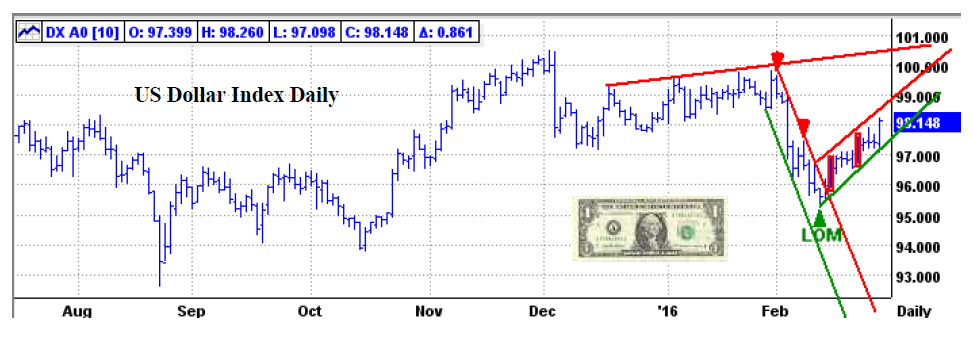

1/29 DX AO CL 99.5312/26 DX AO CL 98.148

February Review – “Technically, the US Dollar seems to be trading in a fairly well defined narrow trading range. Please see the enclosed chart. On 1/28, the Dollar Index was resting on the bottom of its trading channel. By the close of 1/29, it was approaching the top of its trading channel. Currently that sort of price behavior seems to be the pattern for the Dollar. Key Dates – 2/1, 2/8, 2/11 PM, *2/16*, 2/22, 2/26 AC “ Results – 2/1 was very close in price and one day past a very good high. 2/8 was a short term high. 2/11 was the low of the month. 2/16 and 2/22 were not effective. Score = 3 out of 5 good dates = 60%.

March Update – Technically, the US Dollar is in a rebound rally from the mid February low. The two biggest events for this month are 2/29 AC – Moon’s North Node 0 US Neptune. This is a major 18.6 year cycle for the US. 3/24 – Moon’s North Node Contra-Parallel US Saturn.

Key Dates – 2/29, 3/1, 3/9, 3/14, 3/23, 3/28, 3/29, 4/1, 4/1 AC

This is an excerpt from the Astro Trend newsletter. Astro-Trend covers about thirty futures related markets including the major Financial Markets, such as the Stock Market, T-Bonds, Currencies, and most major commodities. We also offer intra day data which identifies potential change in trend points to the minute.

Note: All information on this page is subject to change. The use of this website constitutes acceptance of our user agreement. Please read our privacy policy and legal disclaimer. Opinions expressed at FXstreet.com are those of the individual authors and do not necessarily represent the opinion of FXstreet.com or its management. Risk Disclosure: Trading foreign exchange on margin carries a high level of risk, and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to invest in foreign exchange you should carefully consider your investment objectives, level of experience, and risk appetite. The possibility exists that you could sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading, and seek advice from an independent financial advisor if you have any doubts.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.