Market focus has moved from stimulus to yields

It is a cautious start to the week as the markets focus has turned from US Fiscal stimulus to the move higher in US yields, which has driven a short squeeze of USD positioning. News about increased global Covid cases is likely to keep sentiment supressed, certainly through today.

The US NFP last Friday was weak, showing employment was down 140k. Although the unemployment rate stayed constant at 6.7%. Canada employment was also weak, down 62.6k although all of the drop was in part-time. The unemployment rate ticked up marginally to 8.6%

Fed’s Clarida noted on Friday that he does not see the Fed tapering this year, which was at odds with Evans and Bostic. Clarida was not concerned about the rise in US yields which this time supported comments from other FOMC members and could mean the Fed is unlikely to cap the current move in US yields. US CPI on Wednesday will also be important given the recent rise in inflation expectations.

Biden should lay out his stimulus plans on Thursday. It is expected to include $2,000 stimulus checks. Originally this large stimulus was expected to be USD negative but so far, the reaction of higher US yields has driven a rally in USD that has caught the market wrong footed.

The rise in US yields is likely to keep pressure on EM, the cracks already showing in ZAR but expect them to spread more broadly across EM and growth currencies in G10. Long USDCAD makes sense as that higher US yields along with a worsening global virus situation could drive some short-term risk off and unwinding of USD shorts.

For those looking to join the USD lower trend EURUSD has cleared out short term positioning so would expect some to start looking at buying dips. Similarly, USDJPY on its push above 104.00, next resistance at base of ichimoku at 104.32.

EURGBP lower is still attractive as the risk of no deal Brexit is now passed. With the UK rolling out vaccinations much faster than the EU it should allow the UK to recover quickly in a few months time, whilst the EU will still be struggling with the more contagious strain that has already had its impact on the UK.

Our overview and outlook of the key trading pairs and indices is as follows:

EURUSD – The euro fell below 1.22 amid rising US yields, which is putting the US equities under pressure and pushing the greenback higher. If treasury yields keep on the rise, then the advantage of buying stocks for higher return argument will soon become obsolete. As we head into a new week, the single currency might start heading lower towards 1.20, if the US Treasury yields keep breaking higher.

GBPUSD – The pound breached below 1.35 amid the recent broad-based dollar strength following a strong rally in the US Treasury yields. Moreover, concerns about the continuous surge in new coronavirus cases and the imposition of strict lockdown restrictions in Europe, the U.K. and China further backed the greenback's safe-haven status. Moving forward, the Cable will be at the mercy of the overall market risk sentiment and the USD price dynamics with 1.3440 acting as next major key support level.

USDJPY – The USD gained momentum after a strong rally in the US bond yields pushing the pair above 104 for the first time this year. A softer tone in the equity markets, extended some support on the pair as concerns about the continuous surge in coronavirus cases might lead to stricter lockdown restrictions. A break above 104.20 could open doors for further upside towards 104.70.

FTSE 100 – The British Department of Health stated nearly 54900 people tested positive for coronavirus in the last 24 hours and the death toll climbed by 563. London’s FTSE is seen opening slightly lower this Monday morning with investors focused on the alarming surge in infections however from a technical perspective, we haven’t yet seen signs of extreme bearishness therefore no major correction is expected. Our next key support on the hourly timeframe is the 6800 level.

DOW JONES – The Dow hit our short support target at 31050 while ending Friday’s session on a 4th consecutive/record daily close in the green as President Elect Biden said to lay out proposals this week for Trillions of dollars in fiscal support. A resurgence of Covid-19 infections, fears of further lockdowns in Asia, and increasing geopolitical risks is dampening bullish momentum with 30800 as the closest support target.

DAX 30 – In Europe, investors are focused on the alarming surge in coronavirus cases as EU countries race to vaccinate their elderly and healthcare workers. DAX futures are trading slightly below 14000 however given a great deal of optimism in stocks is linked to the rollout of vaccines we don’t expect any sharp negative market reaction for now. On the data front, there are no major figures scheduled today out of Europe.

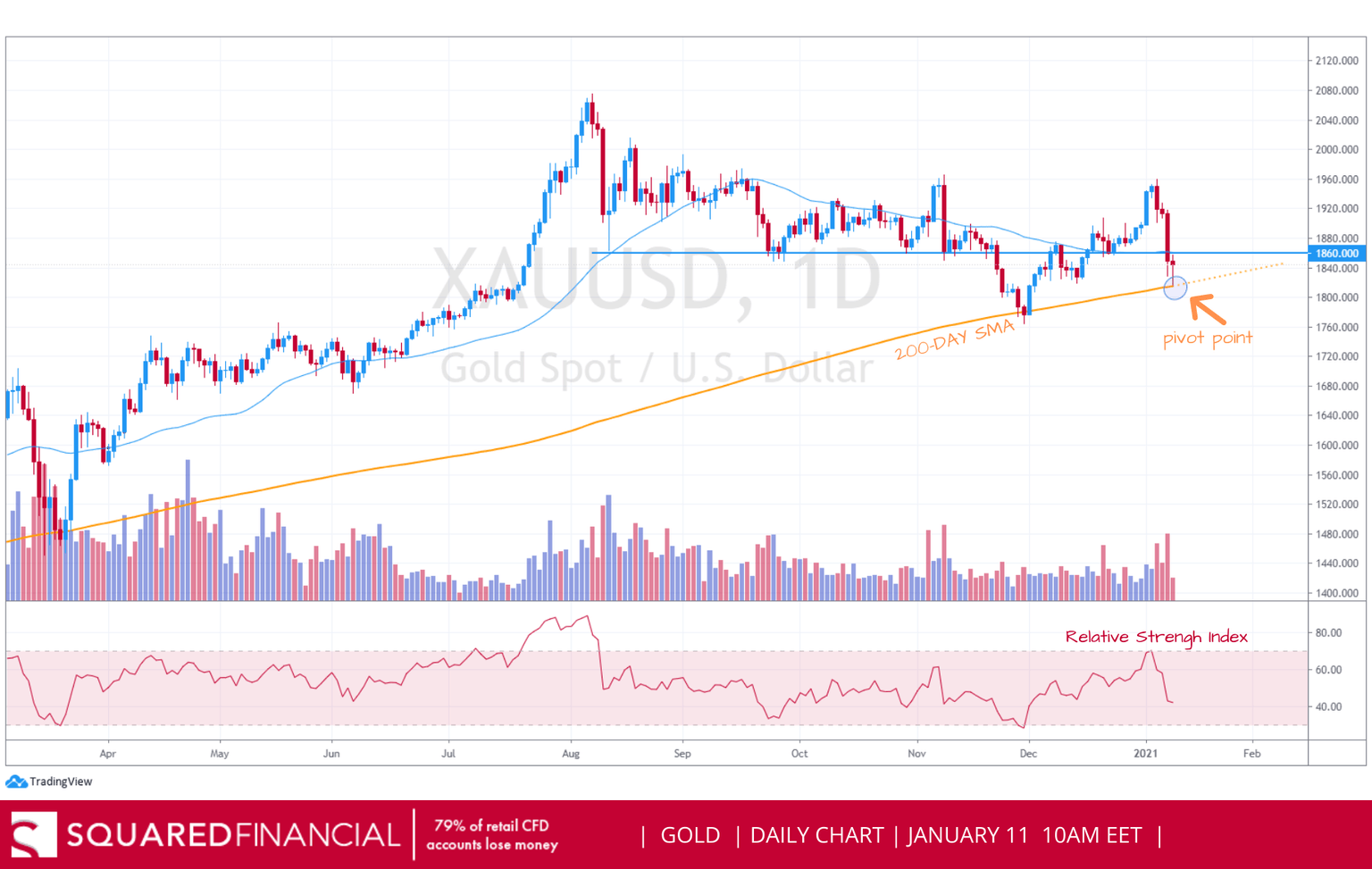

GOLD – The yellow metal shed more than 3% on Friday’s session despite further weakening in the labour market with NFP data coming in at -140k vs. expectations of 70k and a previous of 245K, as equities continued to hover around all-time highs and a rise in US yields buoyed demand for the greenback. Failure to breach 1950 resistance level will indicate ongoing bearish momentum with 1825 as the closest support target.

USOIL – WTI Crude hit our long resistance targets at $51.60 and $52 during Friday’s session as investors priced in further stimulus from Biden’s administration, however, a third wave of Covid-19 infections in Europe and Asia is capping higher gains. Crude is consolidating in a tight support/resistance range between $51.60 and $52 with a break needed in either direction for further clarity.

Author

Rony Nehme

SquaredFinancial

Rony has over twenty years of experience in financial planning and professional proprietary trading in the equity and currency markets.