What the ECB would do (rate cut/QE) or whether the fed liftoff would happen or not or would it be a 25bps hike or less than 25bps hike can be kept aside for now, and we can have a look at how the EUR/USD pair behaved in the last few Fed tightening cycles.

Before that, few of the following things may be worth noting –

- EUR is no longer a risk-on currency: It is not a safe haven as well, however, it surely is a funding currency and it is pretty much evident from the sharp spike in the EUR during the bouts of risk aversion seen in August.

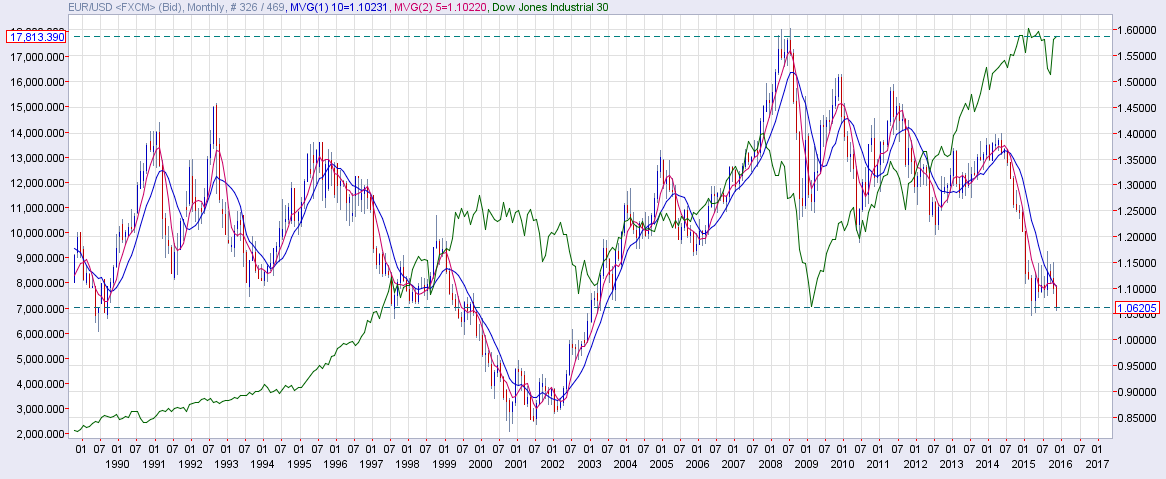

EUR/USD and DJIA Comparison

Since the 1990s, the EUR’s risk-currency status had started building up. Post the Dot com bubble, the direct correlation between the EUR/USD and DJIA strengthened and remained intact till the EUR crisis erupted in 2010. But the direct correlation came under fire in May 2014 when the ECB hinted at unprecedented policy stimulus.

From June 2014, the EUR and the DJIA have moved in the opposite direction, which clearly states the EUR is a funding currency now and not a risk currency any more.

- Fed is facing a new normal: The Fed hiked rates by 25 bps are regular intervals during the last three tightening cycles. Furthermore, liftoff back then did not follow QE taper, since there was no QE back then. This time, the Fed has had unprecedented 3 rounds of QE, followed by a Taper and now the bank is on the verge of raising rates for the first time in a decade. The response to the 2008 recession was unprecedented (3 QEs+record low rates i.e new normal) compared to previous recessions (easing cycles), hence the tightening is more likely to be at a new normal pace of less than 25bps hikes.

EUR/USD response to past Fed tightening cycles

- 1994-1995: EUR/USD rallied from 1.1148 (Jan 94) to 1.3822(topped out in 1995)

- 1999-2000: The Dotcom bubble was in the making, and thus attracted capital flows. The bond yield differential was in favour of the USD. Asian crisis also reversed flows to the West, mainly to US. EUR/USD fell from 1.1750 (Jan 1999) to 0.8230 (bottomed out in 2000). Post 2000, the EUR became a classic risk-on currency and EUR/JPY a global barometer of risk sentiment.

- 2004-2006: The tightening began from May 2004 and it was accompanied by a spike in the EUR/USD from 1.2593 to 1.3660 (in December 2004), which was then followed by a drop in the EUR/USD pair as signs of the crisis started emerging! (EUR was risk-on currency)

Hope ECB meets market expectations or EUR bears could suffer heartbreak

- Is ECB action priced-in: Following Draghi’s Oct presser, the German 2-year yields hit record lows and the EUR/USD is down almost 1000 pips. And now the EUR/USD has stalled around 1.07 levels. The chart is showing indecisiveness. The RSI is forming higher lows, while the price is forming lower lows. Overall, it appears the ECB action – deposit rate cut and extension/expansion of QE could have been priced-in.

- If the ECB falls short of the expectations, the history could repeat itself after the Fed liftoff in December.

- What is worth noting is that EUR rallied (2 out of 3 times) in last fed tightening cycles even though it was a risk-on currency back then.

- Now, the EUR is a funding currency and thus a spike could be sharp following Fed’s liftoff if the equity markets turn risk averse.

On monthly chart

The sell-off could come to a halt around 1.0390 (long term trend line support). A monthly close below the same would mean a bearish break from the falling channel and could reinforce expectations of sub-parity levels.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

EUR/USD trades above 1.0700 after EU inflation data

EUR/USD regained its traction and climbed above 1.0700 in the European session. Eurostat reported that the annual Core HICP inflation edged lower to 2.7% in April from 2.9% in March. This reading came in above the market expectation of 2.6% and supported the Euro.

GBP/USD recovers to 1.2550 despite US Dollar strength

GBP/USD is recovering losses to trade near 1.2550 in the European session on Tuesday. The pair rebounds despite a cautious risk tone and broad US Dollar strength. The focus now stays on the mid-tier US data amid a data-light UK docket.

Gold price remains depressed near $2,320 amid stronger USD, ahead of US macro data

Gold price (XAU/USD) remains depressed heading into the European session on Tuesday and is currently placed near the lower end of its daily range, just above the $2,320 level.

XRP hovers above $0.51 as Ripple motion to strike new expert materials receives SEC response

Ripple (XRP) trades broadly sideways on Tuesday after closing above $0.51 on Monday as the payment firm’s legal battle against the US Securities and Exchange Commission (SEC) persists.

Mixed earnings for Europe as battle against inflation in UK takes step forward

Corporate updates are dominating this morning after HSBC’s earnings report contained the surprise news that its CEO is stepping down after 5 years in the job. However, HSBC’s share price is rising this morning and is higher by nearly 2%.