The second estimate of the US Q3 GDP released today turned out to be non‐event for the markets as expected, since the actual figure of 2.1% matched estimates. The report was pretty much dull, with just one key takeaway – consumption dropped to 3%.

Durable goods orders seen rebounding

The durable goods orders figure for October is seen rebounding from the low of 1.5% from September’s 1.2% drop. The durable goods ex transportation is seen rising 0.3% in October, compared to the 0.4% drop seen in September.

The corporate spending represented by the durable goods report stayed anaemic over the last one year. Even the talk of a rate hike has not had any major positive impact on the corporate spending (businesses/households prepone spending in anticipation of higher rates in the future). This may be an indication of weak activity or because corporate see Fed tightening policy in a small baby steps as opposed to conventional 25 bps rate hike.

However, the Fed’s rate hike decision is mainly centred around the labor market, which as per Fed is well near full employment levels. Hence, a weaker durable goods report could only lead to a technical correction in the USD index.

On similar lines, the personal spending and personal consumption numbers due for release tomorrow may attract little attention if they are in line with the estimates. A weaker figure could lead to minor technical correction, while a surprisingly strong number is likely to result in USD strength.

Personal spending is seen rising 0.3% in Oct from Sep’s 0.1%, while personal income is seen rising 0.4% from 0.1%.

Given the strong expectations of liftoff in December, the drop in demand for the USD is relatively less in the face of a weaker data, while a strong data could see the demand for the USD pick up fast as it would mean the economy is ready for a 25bps rate hike. Moreover, a weak data keeps liftoff bets intact, but the likelihood of a move much slower than 25bps increases, therefore making way for a technical correction in the USD.

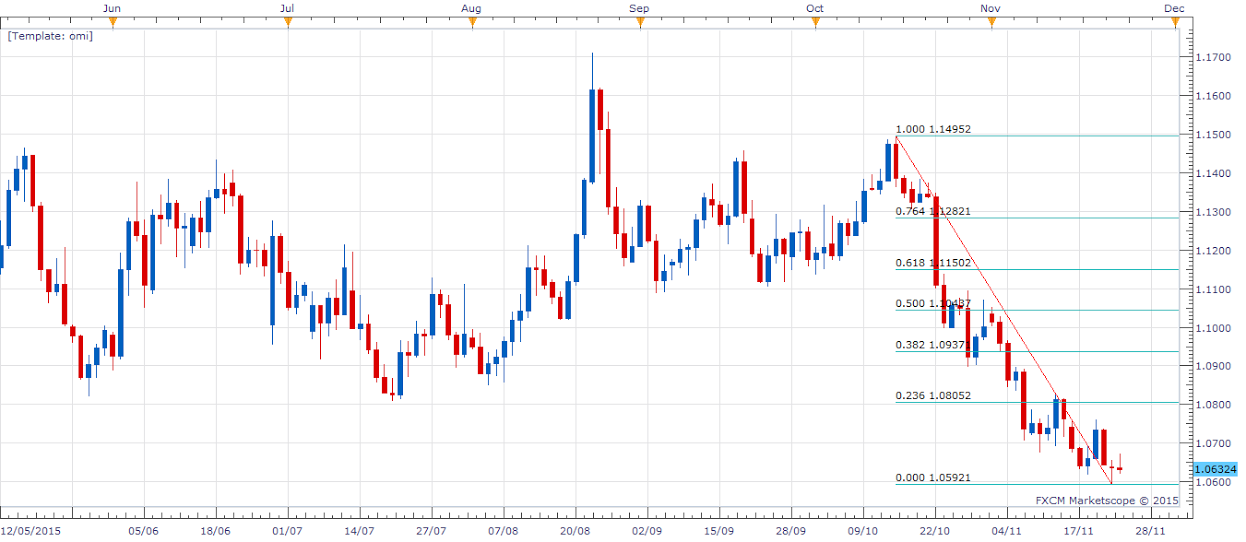

EUR/USD Daily Chart ‐ Scope for correction

The EUR/USD pair found support in the risk aversion today and may continue to remain upbeat tomorrow in case the European markets extend today’s weakness.

The technical story points to a correction to 1.075‐1.0811 (23.6% of 1.1496‐1.0600) as the lower lows on price chart is accompanied by higher lows on the RSI.

The pair also formed a Dragonfly Doji on the daily charts after hitting six month low yesterday, which is an indication the bears may be exhausted and await technical correction before driving the pair to fresh multi‐month lows.

The prospects of a move to 1.075‐1.0811 are high, so long as the pair sustains above 1.0590 and the US data – durable goods and personal spending – are weak/or in‐line with the estimates.

GBP/USD Daily Chart – Eyes set on 1.50‐1.4980

As expected, the GBP/USD pair fell to a low of 1.5087 (61.8% of Apr‐Jun rally). Only a horribly weak US economic data tomorrow could act as a saving grace for the pair.

Sterling’s inverted head and shoulder failure in June, followed by a lower highs formation – latest at 1.5335 – indicates the currency is likely to extend the drop to falling channel support around 1.50‐1.4980.

However, the currency pair is oversold on the hourly and 4‐hour RSI. Sterling could recover to 1.5120 ahead of the US data tomorrow.

A horribly weak US data could open doors for a re‐test of 1.5163 (Sep 4 low) and 1.52 handle.

Overall, the pair looks weak with a high probability of a drop to 1.50‐1.4980 levels in the shortterm.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold holds below $2,300, Fedspeak eyed

Gold price loses its recovery momentum around $2,295 on Monday during the early Asian session. Investors will keep an eye on Fedspeaks this week, along with the first reading of the US Michigan Consumer Sentiment Index for May on Friday.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.