The EUR suffered broad based losses after the ECB President Mario Draghi basically sent a message to the markets that some kind of dovish adjustment in the bank’s QE program is in the offing in the short-term, especially if the situation in emerging markets (China) continues to worsen.

ECB ready to do more

ECB’s response to the recent turmoil in the markets indicates the bank is not comfortable with the strength in the EUR, which was mainly due to carry unwind. A risk-on currency prior to negative deposit rate, the EUR turned into a carry currency and was increasingly used since Q3 2014 to fund risk-on carry trades.

Consequently, the message is clear – if the china turmoil continues to rattle markets, the EUR would strengthen on carry unwind; something which the ECB is not comfortable with and thus, may actually increase its QE program.

The renewed dovish tilt, though hardly surprising, has increased the risk of a sharp sell-off in the EUR/GBP pair in case the US August month payrolls report paints an optimistic picture of the labor market.

NFP above 200K could weigh over the EUR

The Non-farm payrolls report due tomorrow is expected to show the US economy added 217K jobs in August, compared to 215K in July. The unemployment rate is seen dropping to 5.2% from 5.3%. The average hourly earnings are seen rising at 2.1% in August.

Considering August usually produces a drop in the payrolls number – seasonal weakness and given the pessimism in the markets, an NFP print above 200K would be enough to push up September and December rate hike bets. The probability of September rate hike may not matter much, since we are just two weeks short of September meet and still do not have any clear hint from Fed. However, a print above 200K would be enough to bolster December rate hike bets and strengthen the US dollar.

More importantly, it could clam market nerves. The risk aversion in the equities witnessed of late was more due to falling rate hike bets – negative sign for the US and global economy. Stability in the markets could reinforce Fed rate hike expectations. The combined effect would be bearish for the Euro as it would highlight the diverging monetary policy path adopted by the Fed and ECB.

Consequently, the EUR/GBP faces a risk of a sharp fall in case the NFP prints above 200K. The GBP too would come under pressure against the USD, however, the fall would be relatively less as compared to the drop in the EUR/USD, since the BOE is expected to follow Fed in raising rates.

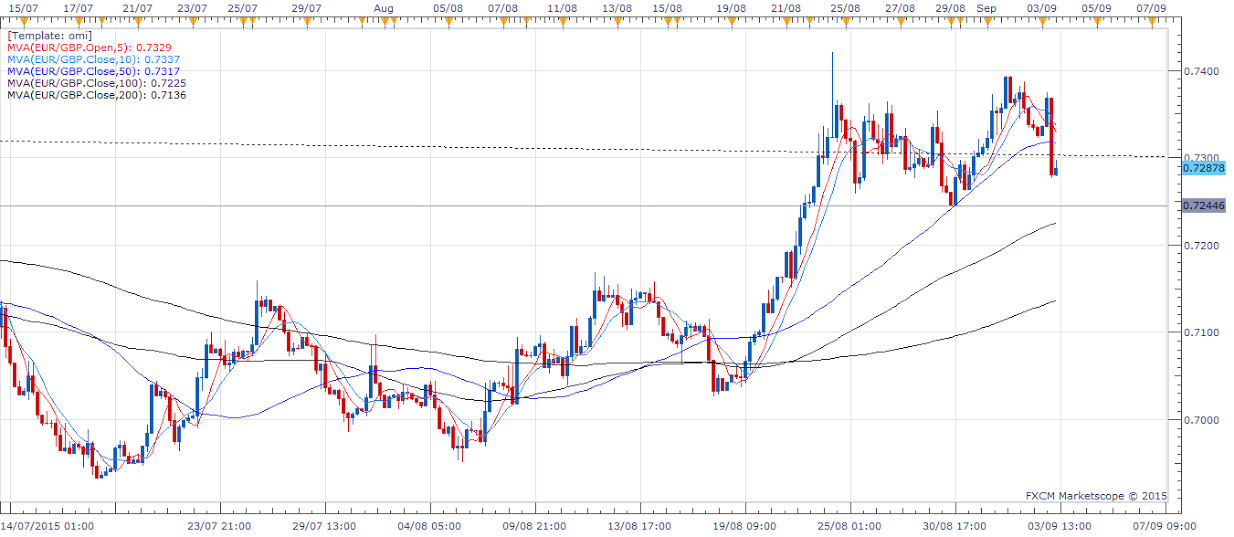

EUR/GBP: 4 –hourly chart

The chart shows a double top formation with a bearish RSI divergence. The neckline is located at 0.7244 (August 30 low).

A break below 0.7244 opens doors for a target of 0.7100.

Moreover, the cross is likely to remain under pressure so long as it trades below 0.74 levels. Consequently, bearish pressure may persist even in case of an NFP print below 200K. However, risk of a break above 0.74 increases in case NFP drops below 200K.

The risk to the bearish view is obviously from an NFP print below 200K accompanied by a sharp drop in average earnings.

Information on these pages contains forward-looking statements that involve risks and uncertainties. Markets and instruments profiled on this page are for informational purposes only and should not in any way come across as a recommendation to buy or sell in these assets. You should do your own thorough research before making any investment decisions. FXStreet does not in any way guarantee that this information is free from mistakes, errors, or material misstatements. It also does not guarantee that this information is of a timely nature. Investing in Open Markets involves a great deal of risk, including the loss of all or a portion of your investment, as well as emotional distress. All risks, losses and costs associated with investing, including total loss of principal, are your responsibility. The views and opinions expressed in this article are those of the authors and do not necessarily reflect the official policy or position of FXStreet nor its advertisers. The author will not be held responsible for information that is found at the end of links posted on this page.

If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

FXStreet and the author do not provide personalized recommendations. The author makes no representations as to the accuracy, completeness, or suitability of this information. FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. Errors and omissions excepted.

The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold advances for a third consecutive day

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.