Lloyds Jumps 2.5% Despite 26% Fall In Profits

Lloyds, the last of the big 4 banks to report full year earnings. To say the bar was set low would be an understatement.

Results

Annual profit -26% to £4.4 billion vs £3billion expected

Underlying profits -7% to £7.5 billion

Net income -4% to£17.1 billion

Lloyds reported a 26% decline in annual profits owing to bad loans and high compensation payout from PPI. PPI redress totaled £2.5 billion in 2019 however this is expected to be the end of the payouts after the PPI deadline passed at the end of summer 2019.

Impairments on bad loans spiked by 38% to £1.3 billion vs. £937 million, the previous year owing to a reduction in NIM and in part to the failure of two large companies which knocked the commercial division. Whilst the bank couldn’t confirm the name of the companies Lloyds was known to have been one of the main lenders to collapsed holiday firm Thomas Cook.

Tough 2019, improving conditions 2020?

Last year the bank struggled with slowing global growth but perhaps more importantly domestic political uncertainty, as Brexit dragged on business and consumer confidence. This year the macro climate in the UK appears to be setting off on the right foot. GDP at the end of 2019 beat expectations, whilst in January the labour market remained strong, inflation increased, and retail sales jumped indicating a bounce in the UK economy. Given the strong correlation between Lloyds and the UK macro climate, this is encouraging. However, there are still plenty of potential pitfalls ahead as the UK negotiates a trade deal with the EU and the macro climate in the UK is expected to remain challenging. Despite this, the outlook from Lloyds was relatively stable.

March’s Budget To Lift Lloyds Further?

Whilst low interest rates squeezed margins at the lender last year, an expansionary fiscal policy could underpin the share price in early 2020. Higher government spending would take the pressure off the Bank of England to cut interest rates, thus supporting the net interest margin’s at the banks. All eyes will turn towards Rishi Sunak’s Budget next month to see whether he can deliver the higher spending the markets hope for.

Chart thoughts

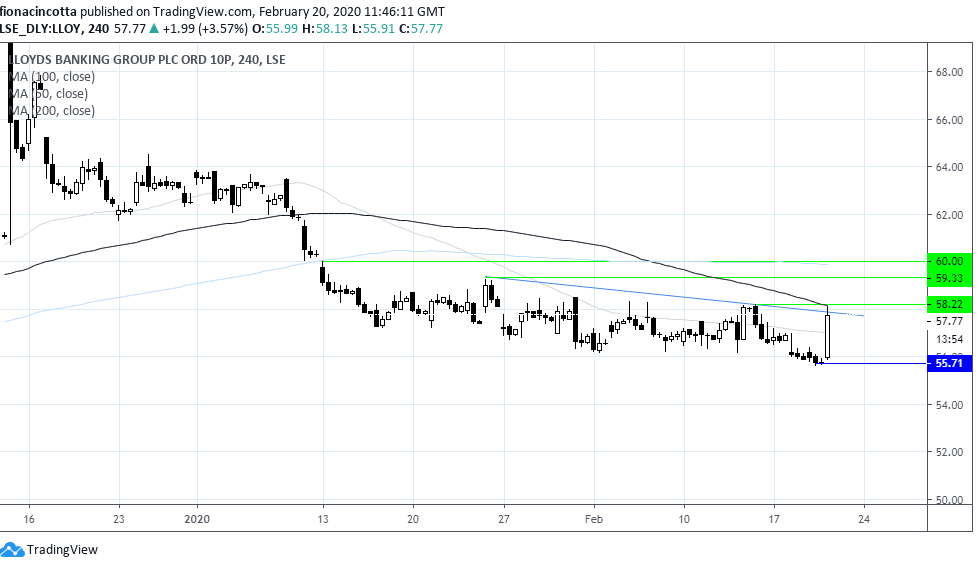

The share price has jumped over 2.5% this morning, taking Lloyds above its 50 sma on 4 hour chart. The rally has been capped by resistance around 58.1p (100 sma & 14 Feb high). A meaningful move through this strog resistance could see the doors opened to 59.3 (24th Jan high) prior to 60p (10 Jan high).

On the flip side support can be see around 55.65p (yesterday’s low).

Author

Fiona Cincotta

CityIndex