The EUR/USD has been having a bumpy ride during the past 3 weeks as price has zig zagged between 1.1200 and 1.1370. Volatility has been on the decline as a consequence of this sideways price action, however, that may be about to change as we have a couple of events this week that could reignite the markets.

This evening at 18:00GMT, there will be a scheduled Federal Open Market Committee (FOMC), where the board of directors of the Federal Reserve will make a decision on monetary policy. There have been calls from senior executives from local Federal Reserve banks stating that an interest rate hike could happen as soon as April. It would seem, at this point, that the markets may not be completely backing this theory. In fact, at one point there had been forecasts of 4 interest rate hikes for 2016, recently that call was reduced to only 2, with some analysts’ comments betting on only 1.

Of course things can change a lot and economic data from the US will be the main factor to determine a shift in monetary policy. In the meantime, what may cause an increase in volatility is the wording of the statement released after the FOMC is held. The markets will be watching closely for any further hints as to how quickly the Federal Reserve may proceed with hiking interest rates.

From Europe we can expect important economic data for the Euro area to be released on the last Friday of every month. This is an improvement on the usual procedure, and brings Europe in line with the UK and the US. Starting this Friday at 10 am, we will have data releases of the Euro area for Unemployment, Inflation and GDP. So we could see another bout of volatility if numbers diverge from expectations.

If you think volatility will increase over the next week then you may buy a Straddle strategy which consists of simultaneously buying a Call and a Put option with the same strike, expiry and amounts.

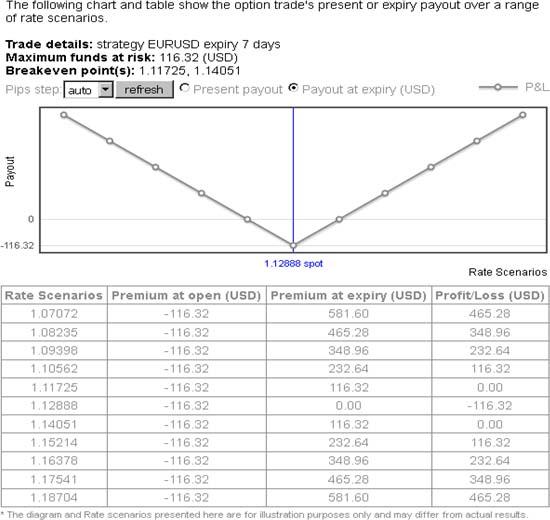

The screenshot below shows a EURUSD Buy Straddle with a 1.12885 strike, 7 day expiry and for €10,000 would cost $116.32, which would also be the maximum risk.

This screenshot shows the profit and loss profile of the above Buy Straddle strategy, just click the Scenarios button.

On the other hand, if you feel volatility we remain flat or fall over the next week then you may sell a Straddle strategy which consists of simultaneously selling a Call and a Put option with the same strike, expiry and amount.

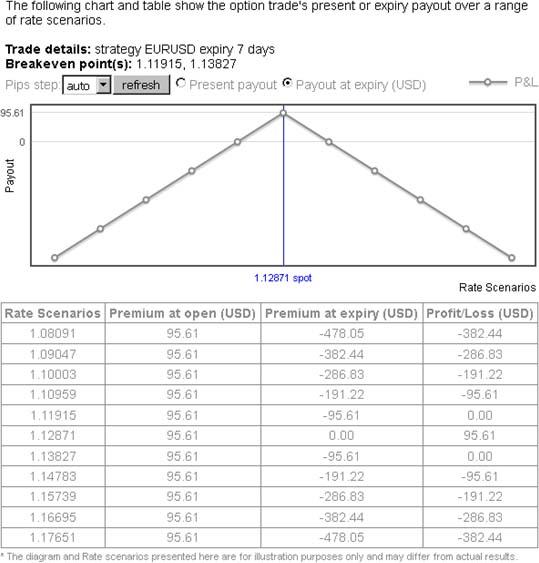

The screenshot below shows a Sell Straddle strategy with a 1.12887 strike, 7 day expiry and for €10,000 would generate a revenue of $95.60, with a total risk of $321.38.

This screenshot shows the profit and loss profile of the above Sell Straddle strategy.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD extends gains due to improved risk appetite

The Australian Dollar maintained its winning streak for the fourth consecutive session on Monday, buoyed by a hawkish sentiment surrounding the Reserve Bank of Australia. This optimism bolsters the strength of the Aussie Dollar, providing support to the AUD/USD pair.

USD/JPY snaps three-day losing streak above 153.50, Yellen counsels caution on currency intervention

The USD/JPY pair snap a three-day losing streak during the Asian trading hours on Monday. The uptick of the pair is bolstered by the modest rebound of the US Dollar and US Treasury Secretary Janet Yellen’s comments on potential Japanese interventions last week.

Gold price rebounds on downbeat NFP data, softer US Dollar

Gold price snaps the two-day losing streak during the Asian session on Monday. The weaker-than-expected US employment reports have boosted the odds of a September rate cut from the US Federal Reserve. This, in turn, has dragged the US Dollar lower and lifted the USD-denominated gold.

Bitcoin Cash could become a Cardano partnerchain as 66% of 11.3K voters say “Aye”

Bitcoin Cash is the current mania in the Cardano ecosystem following a proposal by the network’s executive inviting the public to vote on X, about a possible integration.

Week ahead: BoE and RBA decisions headline a calm week

Bank of England meets on Thursday, unlikely to signal rate cuts. Reserve Bank of Australia could maintain a higher-for-longer stance. Elsewhere, Bank of Japan releases summary of opinions.