AUDUSD received a boost in its momentum to continue the recent Bull trend last night, just after midnight at 00:30GMT data was released for Australian unemployment. Expectations had been for worse data, instead not only were figures released much better than expected but they were also much better than previous numbers.

The unemployment rate was expected at 6% and was released at 5.8% lower than the previous month at 5.9%. Probably the most striking data was employment change, which represents the number of jobs added. This figure was expected at negative 10 thousand but was actually released at plus 71.4 thousand.

Not surprising then that the AUDUSD rallied from pre‐data levels of 0.7239 to 0.7333 within the space of 18 minutes. It has since been trading in a range and we may expect that to remain so until the Royal Bank of Australia (RBA) monetary policy meeting minutes are published next Tuesday 15th.

The meeting minutes can give insight as to how the board members feel about the economic outlook going forward and the resulting pressure on inflation. At the last meeting on December 1st there had been great anticipation the RBA would lower interest rates. However that did not materialize and the minutes published two weeks later stated stable employment and GDP growth predictions along with inflation pressure as reasons for their decision.

Further volatility may be seen tomorrow after data is released in the US for Retail sales at 13:30GMT and Michigan Consumer Confidence at 15:00GMT. Retail Sales show how active consumers are and account for a large proportion of economic activity. Data for Retail Sales is expected at 0.3% MoM, up from last month at 0.1%. Consumer Confidence is expected at 91.0 with a previous release at 91.3. Higher than expected data for either of those two releases could send AUDUSD back down again at least in the short term.

If you think AUDUSD will continue its recent trend higher then you may buy a Call option, this gives you the right to buy this pair at a preset price (strike) for a preset date (expiry) and for an amount of your choice.

The screenshot below shows that a Call option on AUDUSD with a strike at 0.7305, expiry 7 days and for A$ 10,000 would cost $57.74, which would also be your maximum risk.

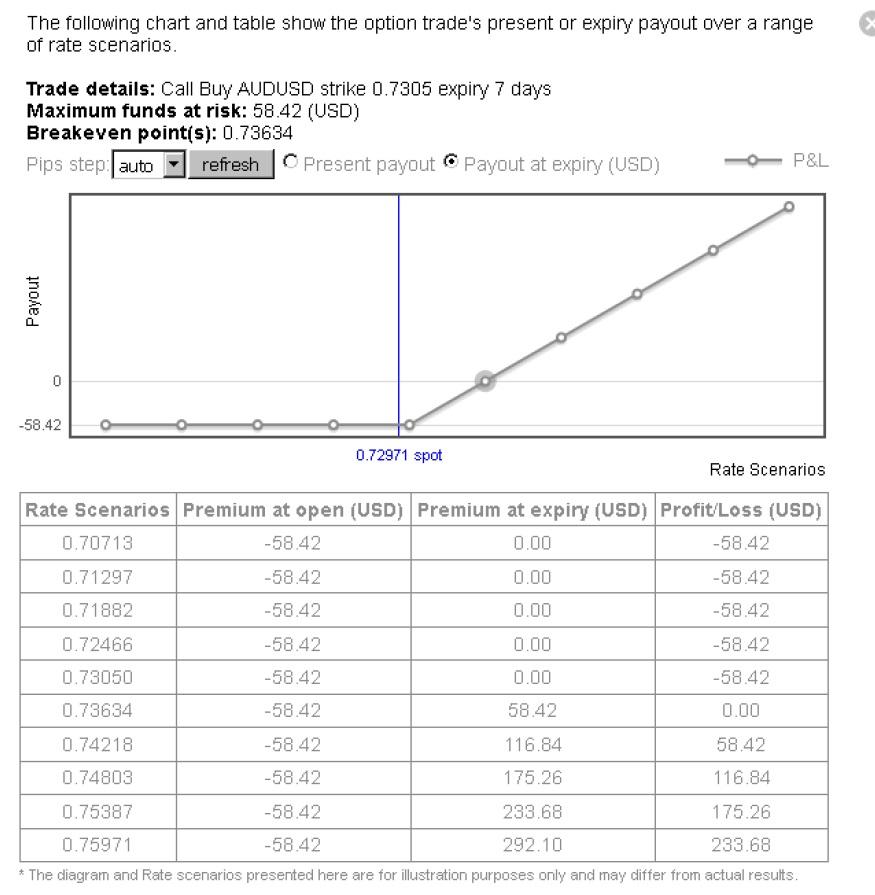

This screenshot shows the Profit and Loss profile for the above Call option, which you can see by pressing the Scenarios button.

If you think the AUDUSD will revert to its previous Bear trend then you may buy a Put option which gives you the right to sell AUDUSD at a preset strike, expiry and for an amount of your choice.

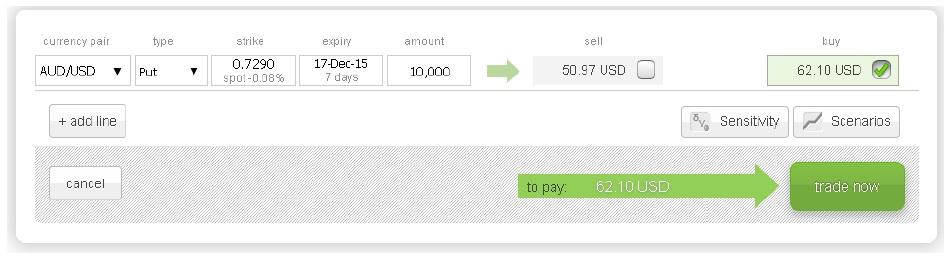

The screenshot below shows that a AUDUSD Put option with 0.7290 strike, expiry 7 days and for A$10,000 would cost $62.10, which would also be your maximum risk.

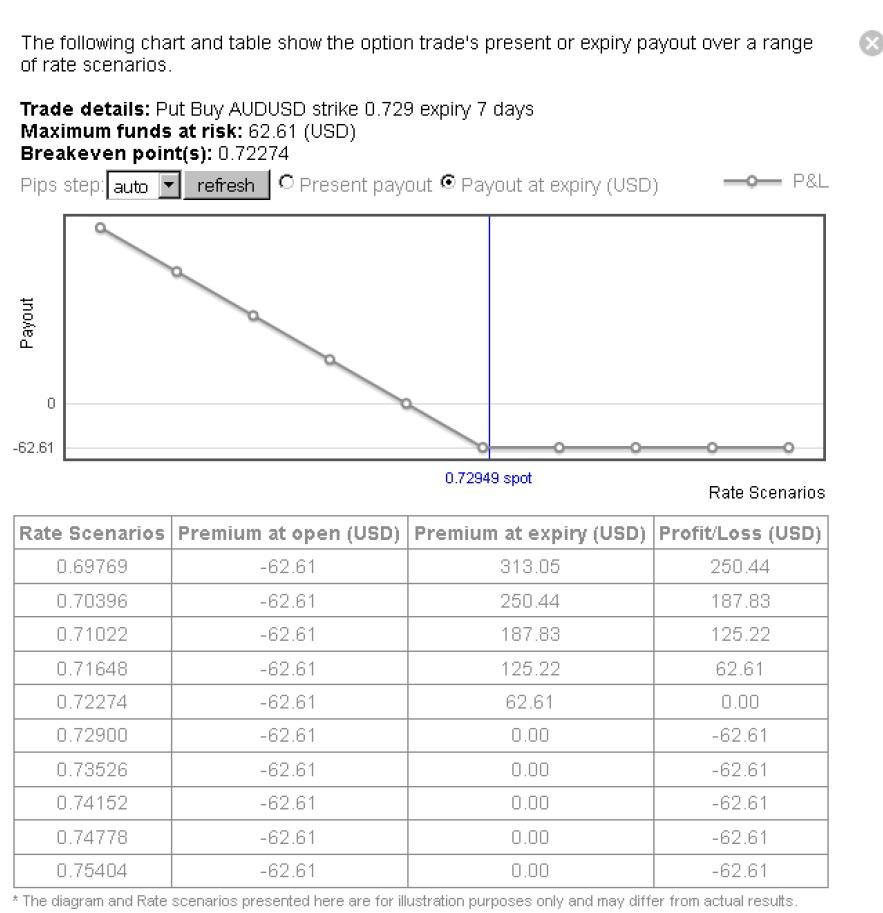

The screenshot below shows the Profit and Loss profile for the above Put option.

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

AUD/USD holds gains near 0.7000 amid PBOC's status-quo, Gold price surge

AUD/USD is clinging to mild gains near 0.7000 early Monday. The pair benefits from a risk-on market profile, China's steady policy rates and surging Gold and Copper prices. Focus now remains on Fedspeak for fresh impetus.

Gold price hits an all-time high to near $2,440

Gold price (XAU/USD) climbs to a new record high near $2,441 during the Asian trading hours on Monday. The bullish move of the precious metal is bolstered by the renewed hopes for interest rate cuts from the US Federal Reserve (Fed).

EUR/USD gains ground above 1.0850, focus on Fedspeak

The EUR/USD pair trades on a stronger note around 1.0875 on Monday during the early Asian trading hours. The uptick in the major pair is bolstered by the softer Greenback. The Federal Reserve’s Bostic, Barr, Waller, Jefferson, and Mester are scheduled to speak on Monday.

AI tokens could really ahead of Nvidia earnings

Native cryptocurrencies of several blockchain projects using Artificial Intelligence could register gains in the coming week as the market prepares for NVIDIA earnings report.

Week ahead: Flash PMIs, UK and Japan CPIs in focus. RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.