WTI Crude Oil, which is priced in the US Dollar, has seen a continuous decline with the strengthening of the dollar making its purchase more expensive to overseas consumers and investors. Other than USD value, oversupply has been a big concern weighing on the market; Iraq is nearing a new monthly record exporting 3 million barrels a day, Saudi Arabia are increasing their output and more supply is expected to come especially once Iran’s sanctions are lifted in early 2016.

Tomorrow the U.S. Federal Reserve will begin its two day policy meeting. Since the beginning of the year, expectations of a rate hike have been slowly but surely building. These expectations are highly anticipated and the USD has traded strongly off the back of this. As a result, all commodities priced in USD (including oil and gold) have been greatly affected and it's yet to be seen if this has caused commodities to be undervalued.

Commodity prices may be strongly influenced by the Fed's meeting followed by a press statement on Wednesday at 18:00 GMT. If they hint that an interest rate hike will not occur this year, the dollar may weaken and commodities may claw back some of their losses. On the other-hand, if comments reassure that a hike will take place then USD may remain strong at these levels.

How to Trade Oil with Vanilla Options

Through buying options you may trade a rising or falling oil price on limited risk and high leverage.If you expect the Fed to push-back an interest rate hike and USD to weaken (hence Oil price to rise), you may buy a Call option. A Call gives the right to buy oil at a certain price over a certain period of time. You may benefit because as the price of oil rises, the value of the Call option also rises.

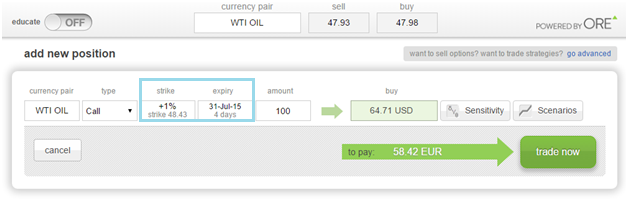

The image below is an example traded on the ORE web-platform. It is a Call trade, with the right to buy 100 barrels of oil, at a price that is 1% above the current levels of $47.93 (see strike +1% at $48.43) over the next 4-days (expiry). If the price of oil moves up by more than 1% in the next 4-days the option will payout. The premium paid to buy this option is 64.71 USD.

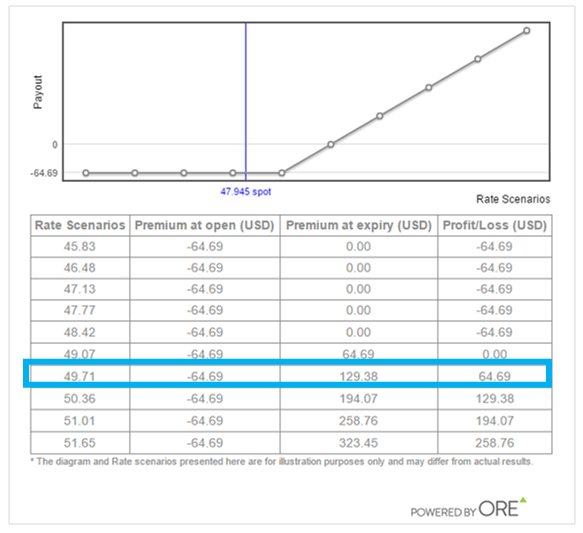

The below Scenarios chart and table, shows profit or loss of the trade over a range of oil prices at expiry. A profit will be made if oil price rises above $49.07 (strike price 48.43 + option's cost per barrel of oil, 0.6471) with 100% profit if oil reaches $49.71, as highlighted by the blue box on the table below. If the price of oil does not rise then a loss will be made, this loss will not be greater than the premium paid.

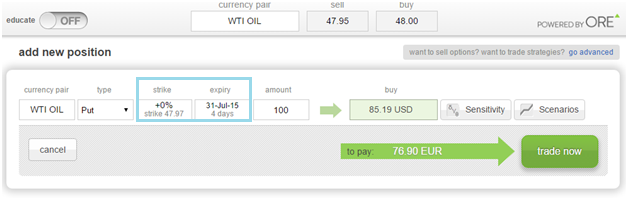

If you believe oil will continue to fall this week, you may buy a Put option. A Put gives the right to sell oil at a certain price over a certain period of time. The image below is an example traded on the ORE web-platform. It is a Put option, with the right to sell 100 barrels of oil, at the current levels of $47.97 (strike 0%) over the next 4-days (expiry). If the price of oil falls from its current levels this option will payout by expiry. The premium paid to buy this option is 85.19 USD.

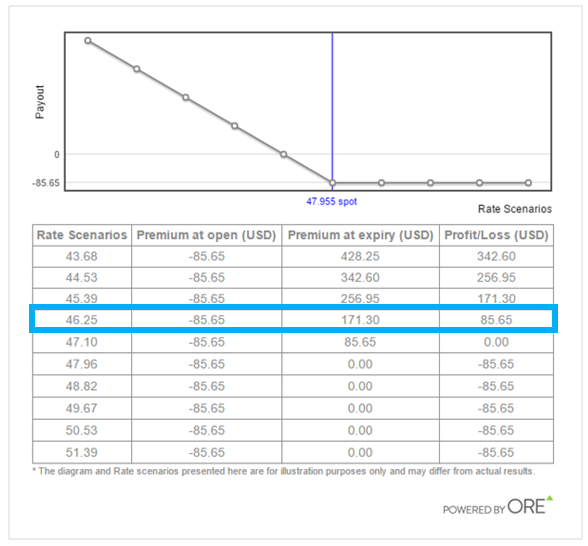

The below Scenarios chart and table, shows the profit or loss of the Put trade over a range of oil prices at expiry. A profit will be made if oil price falls below $47.10 (strike $47.95 - option's cost to buy 1 barrel, 0.8519) with 100% profit made if oil reaches $46.25, as highlighted in the table below. If oil price does not fall a limited loss is made (limited to the premium paid to buy the option).

The content provided is made available to you by ORE Tech Ltd for educational purposes only, and does not constitute any recommendation and/or proposal regarding the performance and/or avoidance of any transaction (whether financial or not), and does not provide or intend to provide any basis of assumption and/or reliance to any such transaction.

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.