The Japanese economy ended the longest winning streak in 28 years. Data from the Cabinet office showed that the GDP contracted by negative 0.2% in the last quarter. This was against the 0.1% gain in the fourth quarter and the 0.0% analysts were expecting. On an annualized basis, the economy contracted by negative 0.6%, which was lower than the expected contraction of negative 0.2%. The slowdown in the Japanese economy was attributed to the low private consumption and low capital expenditure.

The euro continued falling against the dollar after the inflation data showed signs of weakness. In Germany, the consumer prices remained the same as last month which was in line with analysts’ estimates. In the EU countries however, the rate of inflation fell from 1.0% to 0.3% in April. On an annualized basis, consumer prices rose by 1.2%, which was in line with expectations. At this time last year, prices rose by 1.5%. In addition to the inflation data, the decline of the euro and the rise in Italian bonds were attributed to the two populist parties in Italy planning to write off more than 250 million of debt and exit from the euro.

In the United States, the 10-year treasury bonds rose to above 3.08%, which is the highest level since 2012. The rise in yields yesterday led to a sell-off in stocks, a surge in the dollar, and a decline in gold. Another reason for the sell-off yesterday was the announcement from North Korea that it would reconsider meeting with the US president to discuss denuclearization.

In addition, in April, the US issued more than 1.35 million building permits, which was higher than the expected 1.34 million but lower than the 1.37 issued in March. The building permits contracted by negative 1.8%, which was better than the expected -2.3%.

XAU/USD

Gold continued to decline, reaching a low of $1286. This is the lowest level since December last year. The decline was mostly caused by the stronger dollar. At the current price, the commodity has breached the important support level of $1300 and is trading below the 100 and 200-day moving average. A strengthening dollar could see gold test the important $1370 support level.

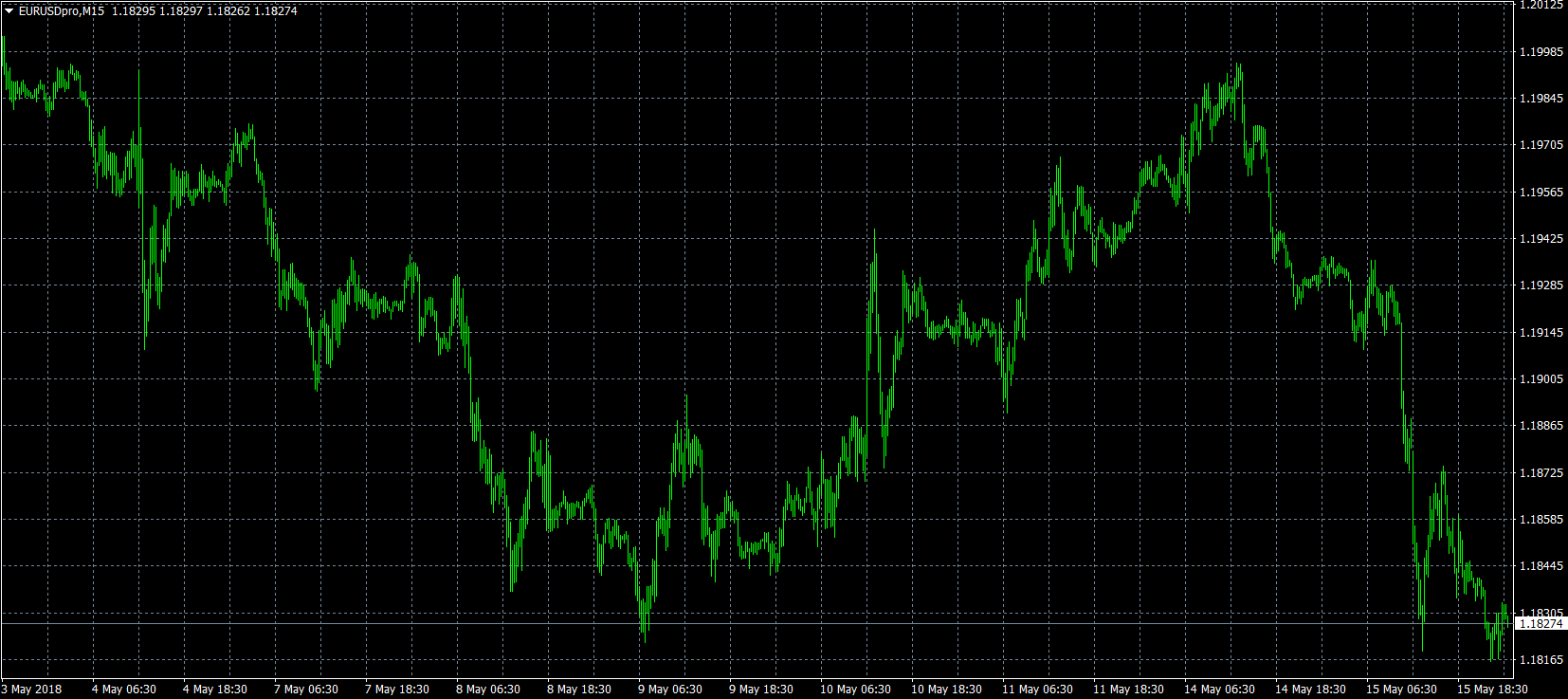

EUR/USD

The Euro continued to slide against the dollar reaching a low of 1.1780, which is the lowest level since December last year. The pair is trading below the short and long-term moving averages. On the other hand, the bears power is at the lowest level since February, while the bulls power is rising. Using the four-hour chart, the RSI is at 28. This implies that the pair could move slightly higher as bulls take over.

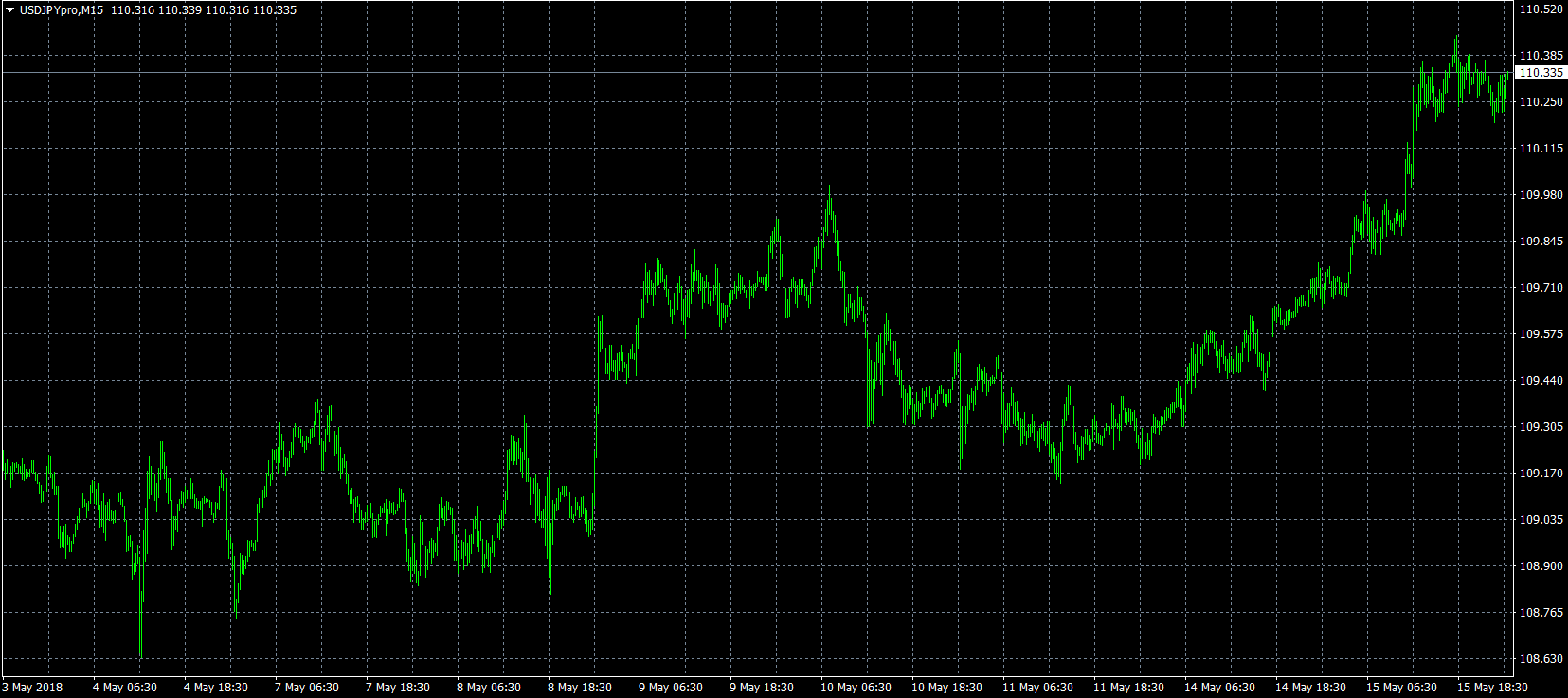

USD/JPY

The USD/JPY pair was little moved today. This is because of the divergence of economic data and geopolitical issues. While the Japanese GDP numbers disappointed, the news from North Korea provided support to the yen. The pair is now trading in line with the 30-day moving average and slightly lower than the 50-day moving average. As the pair continues to move in a sideways direction, traders should wait for a trend to start before initiating positions.

General Risk Warning for FX & CFD Trading. FX & CFDs are leveraged products. Trading in FX & CFDs related to foreign exchange, commodities, financial indices and other underlying variables, carry a high level of risk and can result in the loss of all of your investment. As such, FX & CFDs may not be appropriate for all investors. You should not invest money that you cannot afford to lose. Before deciding to trade, you should become aware of all the risks associated with FX & CFD trading, and seek advice from an independent and suitably licensed financial advisor. Under no circumstances shall we have any liability to any person or entity for (a) any loss or damage in whole or part caused by, resulting from, or relating to any transactions related to FX or CFDs or (b) any direct, indirect, special, consequential or incidental damages whatsoever.

Recommended Content

Editors’ Picks

EUR/USD consolidates weekly gains above 1.1150

EUR/USD moves up and down in a narrow channel slightly above 1.1150 on Friday. In the absence of high-tier macroeconomic data releases, comments from central bank officials and the risk mood could drive the pair's action heading into the weekend.

GBP/USD stabilizes near 1.3300, looks to post strong weekly gains

GBP/USD trades modestly higher on the day near 1.3300, supported by the upbeat UK Retail Sales data for August. The pair remains on track to end the week, which featured Fed and BoE policy decisions, with strong gains.

Gold extends rally to new record-high above $2,610

Gold (XAU/USD) preserves its bullish momentum and trades at a new all-time high above $2,610 on Friday. Heightened expectations that global central banks will follow the Fed in easing policy and slashing rates lift XAU/USD.

Week ahead – SNB to cut again, RBA to stand pat, PCE inflation also on tap

SNB is expected to ease for third time; might cut by 50bps. RBA to hold rates but could turn less hawkish as CPI falls. After inaugural Fed cut, attention turns to PCE inflation.

Bank of Japan set to keep rates on hold after July’s hike shocked markets

The Bank of Japan is expected to keep its short-term interest rate target between 0.15% and 0.25% on Friday, following the conclusion of its two-day monetary policy review. The decision is set to be announced during the early Asian session.

Moneta Markets review 2024: All you need to know

VERIFIED In this review, the FXStreet team provides an independent and thorough analysis based on direct testing and real experiences with Moneta Markets – an excellent broker for novice to intermediate forex traders who want to broaden their knowledge base.