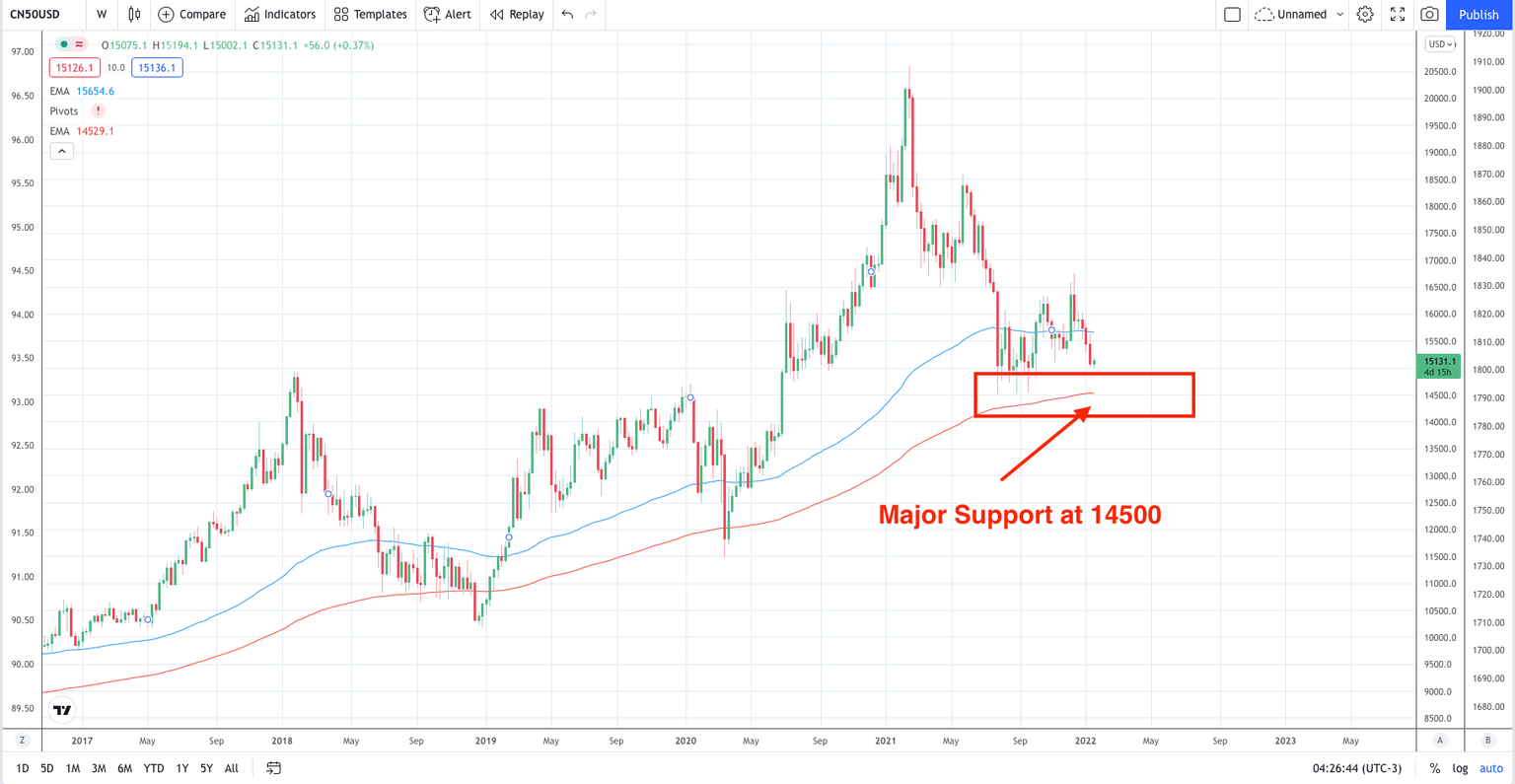

Is this a good time to buy China’s indices?

China’s central bank (PBOC)has cut interest rates for the first time since 2020 in an attempt to stimulate the economy. Does this offer a good time to buy into China’s 50 and 300 indexes?

No inflation concerns

The rest of the world is hyper-focused on rising inflation prompting JP Morgan to postulate that the fed will hike interest rates by 6 or 7 times this month. The Bank of England surprised markets with a 15 bps hike in December and the spectre of rising inflation is making many central banks nervous. However, the PBOC is not worried about stable inflation levels and are now on a footing to boost growth.

The pressure on China’s economy

The property sector makes up around 20% of China’s GDP. However, this heavy reliance has meant the recent slowdown in the property’s sector performance has been a drag on the economy. Companies like Evergrande highlight the ripple effect that the property sector can have on the whole economy. This led to China trying to squeeze the financing available to property companies and, according to Bloomberg, property investment has fallen by 14% in December gone from a year earlier.

China’s economic growth has been slowing, so the PBOC is trying to stimulate growth once again/ This is despite the economy expanding above the 6% Gov’t target, but some of this can be put down to base effects from 2020’s Covid impacted year.

More cuts to come?

The head of macro strategy research at China Renaissance Securities forecasts the PBOC will further cut the reserve ratio requirement for banks by 100bps this year. This move makes it easier for banks to give loans as they need to hold less physical cash in deposit against the loan.

The trade?

If support for China’s economy continues to be forthcoming over the coming days and weeks, then this could mean some good dip-buying opportunities in China’s leading indices. 14500 on China’s 50 Index looks excellent as a good place to manage risk.

Author

Giles Coghlan LLB, Lth, MA

Financial Source

Giles is the chief market analyst for Financial Source. His goal is to help you find simple, high-conviction fundamental trade opportunities. He has regular media presentations being featured in National and International Press.