GBP/JPY

The dollar traded higher against most of its G10 peers during the European morning Wednesday. It was higher against CHF, NZD, JPY, GBP and AUD, in that order, while it was lower against NOK and SEK. The greenback was stable vs CAD and EUR.

The British pound weakened after the country's manufacturing PMI missed expectations and fell to 51.4 in June from 51.9 previously vs the forecast of a rise to 52.5. Even though it was a moderate decline from May, this appears to be a push back against recent market expectations for rate hike being brought closer following the improved Q1 GDP figure. GBP/USD fell below the 1.5675 support level and if the bears prove strong enough they could push the rate towards 1.5620.

EUR continued its choppy price action after various reports said that the Greek PM accepted in large the terms offered to Greece last Friday. But this was then rejected as important differences still remain. A deal is still possible but it is questionable if the creditors are willing to negotiate or if they have decided to end the conversations and come back after the referendum. In any case, EUR is likely to remain sensitive to headlines and trade accordingly.

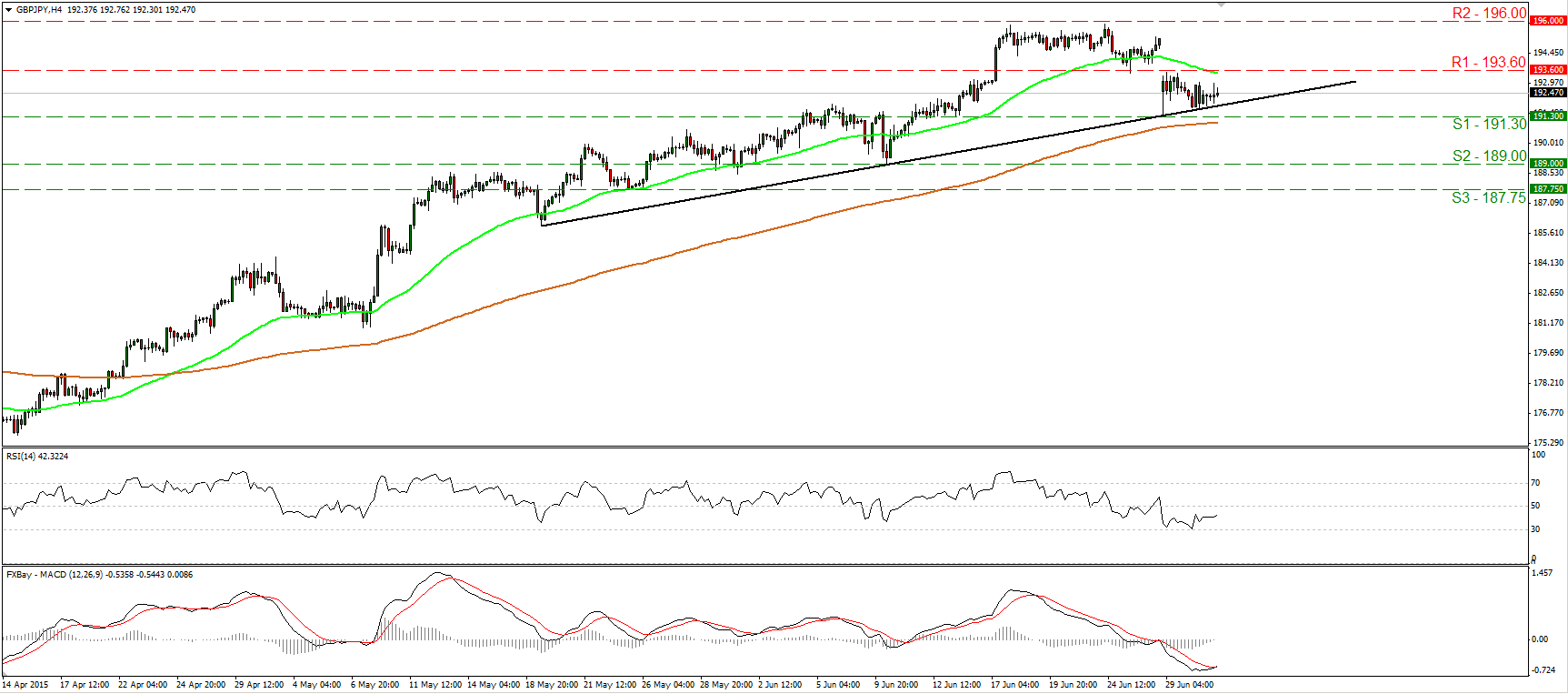

GBP/JPY traded in a consolidative manner during the European morning Wednesday, staying near the upside support line taken from the low of the 19th of May. Taking that into account and bearing in mind our short-term momentum studies, I would expect the forthcoming wave to be positive. The RSI rebounded from its 30 line and is now headed towards its 50 line, while the MACD has bottomed and crossed above its trigger line. A clear break above the resistance zone of 193.60 (R1) is likely to confirm the rebound and perhaps pull the trigger for another test at the 196.00 (R2) key zone. On the daily chart, the pair is trading well above both the 50- and the 200-day moving averages, while on Monday, it rebounded from 191.30 (S1), which lies slightly above the 23.6% retracement level of the 14th of April – 23rd of June advance. These technical signs support the continuation of the short-term uptrend started back on the 14th of April.

Support: 191.30 (S1), 189.00 (S2), 187.75 (S3)

Resistance: 193.60 (R1), 196.00 (R2), 197.00 (R3)

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.