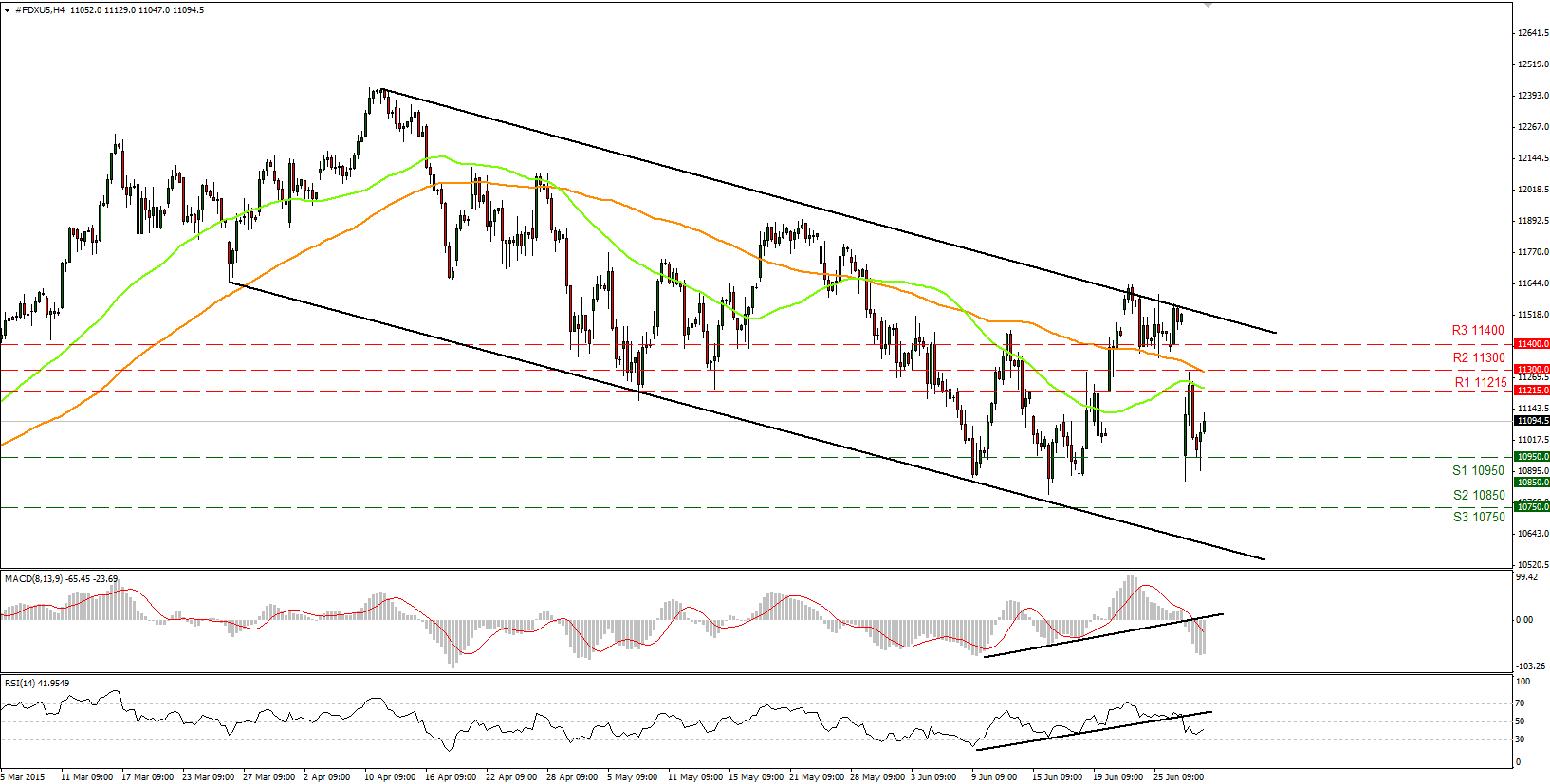

DAX futures

The dollar traded mixed against its G10 peers during the European morning Tuesday. It was higher against NZD and EUR, in that order, while it was lower against NOK and AUD. The greenback was virtually unchanged against CHF, SEK, GBP, CAD and JPY.

The Eurozone's preliminary CPI rose 0.2% yoy in June, a slowdown from +0.3% yoy previously and in line with expectations. The slowdown in the Eurozone's inflation rate raises concerns over the bloc's recovery path and over the ECB's stimulus programs. In addition to the decline in the headline rate, the core figure also fell to 0.8% yoy from 0.9% yoy. Even though the market reaction was limited on the news due to the Greek crisis, we would sound a note of caution in the medium term as deflation fears may reappear if prices continue to fall. EUR/USD declined a bit in the course of the morning, but remained above the key level of 1.1145, which keeps the outlook neutral for now.

In the UK, the final estimate of the Q1 GDP showed moderately stronger momentum than previously estimated. The final figure showed a +0.4% qoq pace of growth compared to +0.3% in the 2nd estimate, matching market expectations. Further strong UK data could result in rate hike expectations being brought closer, supporting GBP.

DAX futures opened with a huge gap lower on Monday below the round figure of 11000. Since then it recovered a bit but fell again on Tuesday to find support around 10950 (S1). Given that the index remains within the downside channel that had been containing the price action since the last days of March, the outlook remains negative. I would consider any upside moves as corrections of the medium-term decline. However, I would need to see a decisive break of the 10850 (S2) level to get confident for further declines. Looking at our short-term momentum indicators, they support a halt of the decline. The RSI found support at its 30 line and moved higher, while the MACD, although below its zero and trigger lines, has bottomed and points up. These signs support a minor rebound before the next wave lower. In the bigger picture, although the index remains within the downside channel, a clear close below the 10850 zone is needed to make me trust the medium-term downside path.

Support: 10950 (S1), 10850 (S2), 10750 (S3)

Resistance: 11215 (R1) 11300 (R2), 11400 (R3)

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 after the data from the US showed that private sector employment rose more than expected in April. The Federal Reserve will announce monetary policy decisions later in the day.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar holds its ground after upbeat ADP Employment Change data and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold consolidates losses below $2,300, eyes on Fed policy decision

Gold price hovers below $2,300 as uncertainty ahead of the Fed’s policy announcements improves the appeal of the US Dollar and bond yields. The Fed is expected to hold the policy rate unchanged amid stubborn inflation.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.