USD/NOK

The dollar was lower against all of its G10 counterparts during the European morning Wednesday, ranging from -0.3% against SEK to -1.5% vs AUD and JPY.

The Norwegian krone strengthened after the country's core inflation rate beat estimates and rose to 2.4% yoy in May from 2.1% yoy in April. The positive surprise is likely to take off some pressure from the Norges bank to lower its key policy rate at its meeting next week. We have mentioned several times that the country's fundamentals are solid, with CPI near the Bank's target, unemployment below 3% and higher oil prices recently. The only drawback that could prompt the Bank to cut rates are lower wage settlements and subdued wage growth. I would expect NOK to remain supported going into the meeting, and if the Bank remains on hold again, the currency could strengthen further.

In the UK, industrial production rose more than expected in April, and March's figure was revised up a bit. Following the narrowing of the trade deficit on Tuesday, the improved IP keeps the scenario for a rebound in Q2 growth alive. We would expect this to generate some support for sterling in the near term.

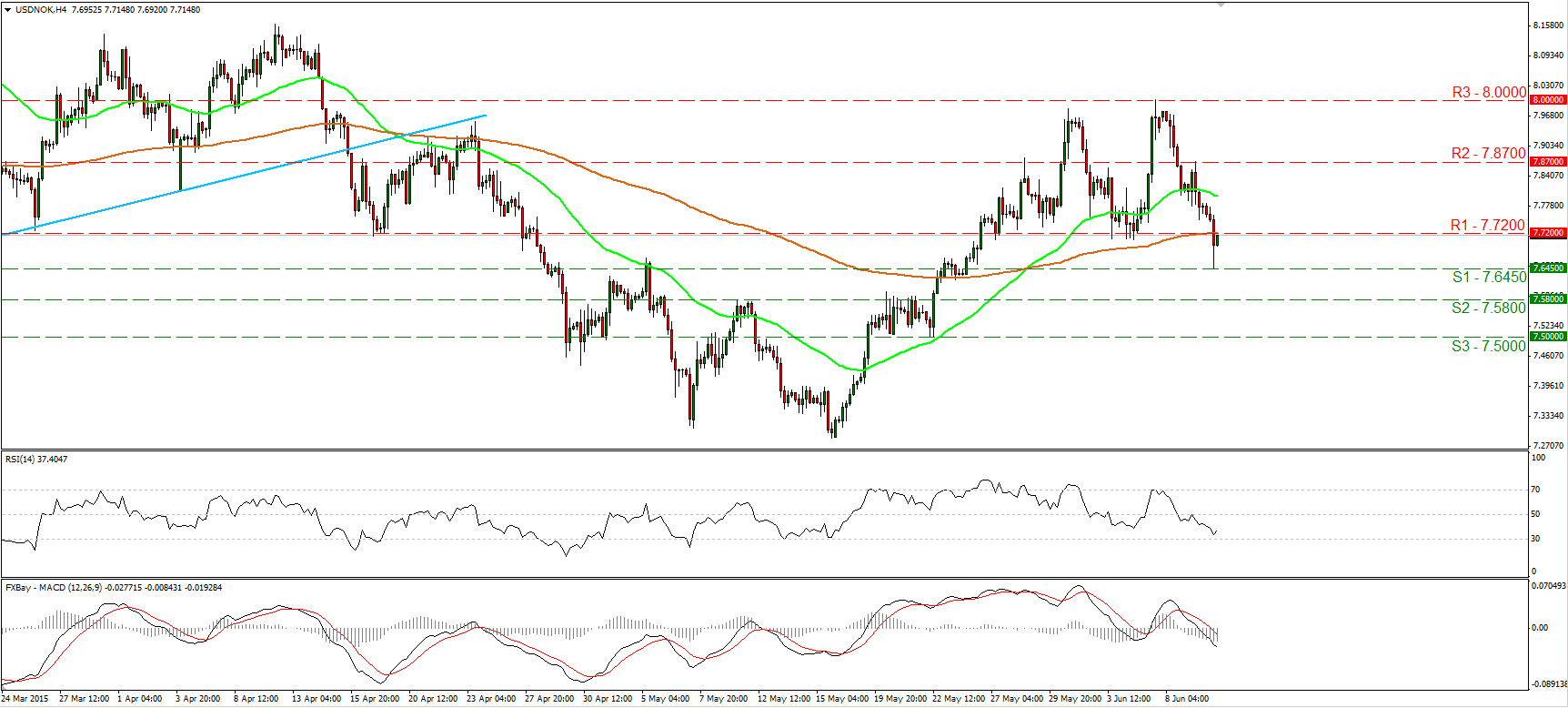

USD/NOK tumbled during the European morning Wednesday following Norway's higher-than-expected core inflation rate for May. The pair fell below the key support (now turned into resistance) territory of 7.7200 (R1) and signaled the completion of a possible double top formation on the 4-hour chart. This shifted the short-term outlook of the pair to the downside in my view. Therefore, I would expect a clear move below the support of 7.6450 (S1) to target our next hurdle area of 7.5800 (S2). Our momentum studies detect negative momentum. The RSI stands below its 50 line, slightly above its 30 barrier, while the MACD lies below both its zero and signal lines. Nevertheless, the RSI has turned up, hinting that an upside corrective bounce could be on the cards before sellers shoot again. But even if the bounce occurs, the likelihood of a lower peak is high and therefore I would not bet on a possible rebound. I prefer to wait for a move below 7.6450 (S1). Switching to the daily chart, I see that the daily oscillators corroborate my view as well. The 14-day RSI looks able to fall below its 50 line, while the daily MACD, although positive, has topped and could fall below its trigger soon. There is also negative divergence between the 14-day RSI and the price action.

Support: 7.6450 (S1), 7.5800 (S2), 7.5000 (S3).

Resistance: 7.7200 (R1) 7.8700 (R2), 8.0000 (R3).

Recommended Content

Editors’ Picks

EUR/USD stays below 1.0700 as focus shifts to Fed policy decisions

EUR/USD stays in its daily range below 1.0700 following the mixed macroeconomic data releases from the US. Private sector rose more than expected in April, while the ISM Manufacturing PMI fell below 50. Fed will announce monetary policy decisions next.

GBP/USD holds steady below 1.2500 ahead of Fed

GBP/USD is off the lows but stays flatlined below 1.2500 on Wednesday. The US Dollar stays resilient against its rivals despite mixed data releases and doesn't allow the pair to stage a rebound ahead of the Fed's policy decisions.

Gold rebounds above $2,300 after US data, eyes on Fed policy decision

Gold gained traction and recovered above $2,300 in the American session on Wednesday. The benchmark 10-year US Treasury bond yield turned negative on the day after US data, helping XAU/USD push higher ahead of Fed policy announcements.

A new stage of Bitcoin's decline

Bitcoin's closing price on Tuesday became the lowest since late February, confirming the downward trend and falling under March and April support and the psychologically important round level.

US Federal Reserve Decision Preview: Markets look for clues about interest rate cut timing

The Federal Reserve is widely anticipated to keep interest rates unchanged. Fed Chairman Powell’s remarks could provide important clues about the timing of the policy pivot.