DAX futures

The dollar traded mixed against its G10 counterparts during the European morning Friday. It outperformed AUD, NZD, CAD and GBP in that order, while it was lower against SEK, CHF, EUR and NOK. The greenback traded virtually unchanged against JPY.

The only noteworthy release we had today was the German Ifo survey for May. The business climate index edged down to 108.5 from 108.6. Although lower, it still beat market expectations of a decline to 108.3. The current assessment index continued moving north, reaching 114.3 from an upwardly revised 114.0 in April, well above estimates of 113.5. Only the expectations index recorded a noticeable decline (103.0 vs 103.4 prev.), but this was in line with market expectations. In contrast with the decline in the ZEW survey released on Tuesday, and the weak German preliminary manufacturing and service-sector PMIs on Thursday, the Ifo indices are the exception to the recent disappointing data coming out from the country. Today’s release sparked hopes that Germany is still Eurozone’s growth engine and pushed EUR/USD somewhat higher. This adds to my view that EUR/USD can still test the 1.1200 resistance any time soon. A break through that could encourage buyers to aim for our next level at 1.1280.

A few minutes later ECB President Mario Draghi reiterated his call for Eurozone countries to reform their economies. He said that monetary policy is working its way through the economy, growth is picking up, and inflation expectations have recovered from their trough. However, he noted that a cyclical recovery alone does not solve all of Europe’s problems and that monetary policy constitutes an excuse for governments and parliaments to postpone their reform efforts.

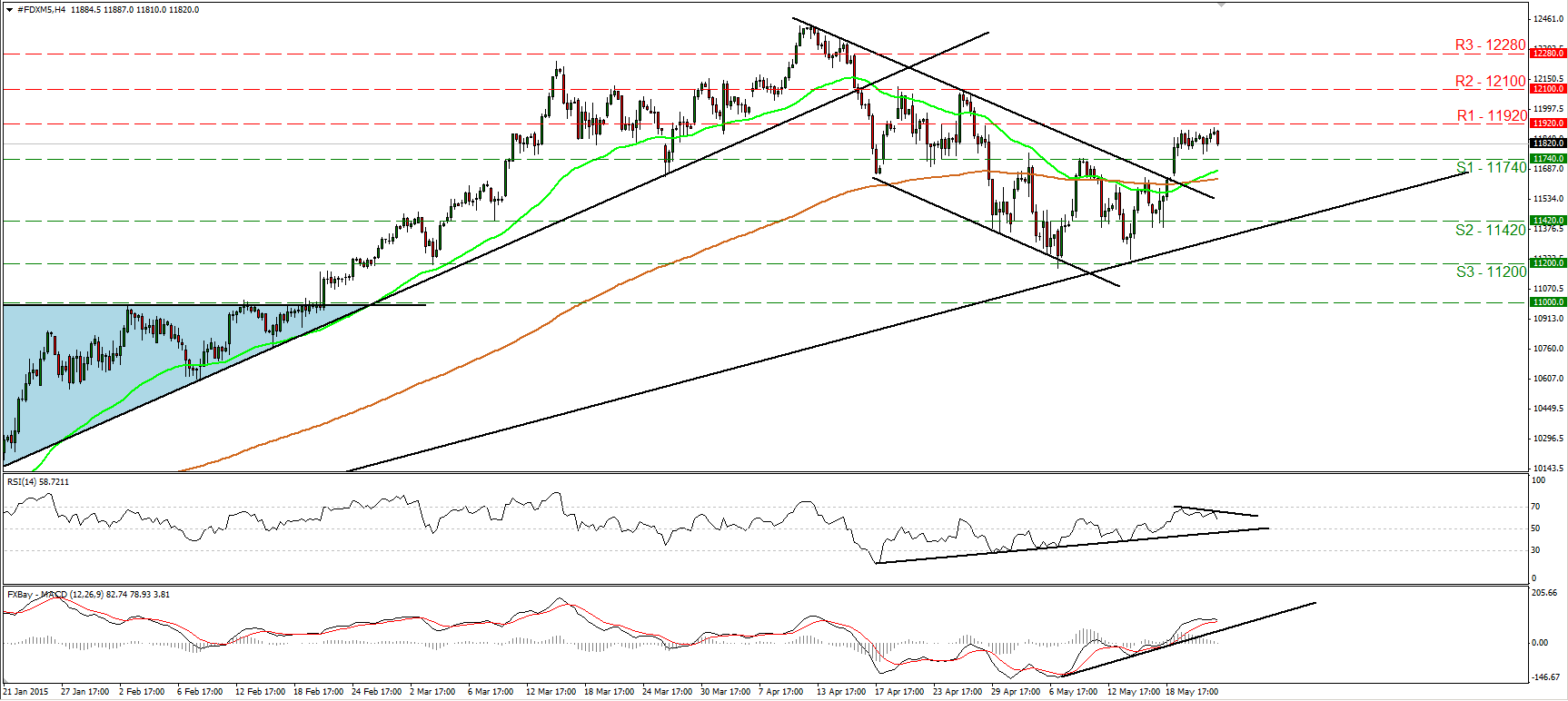

DAX futures traded somewhat lower during the European morning Friday, despite signs of relief from the Ifo survey. The price remained below the resistance line of 11920 (R1). This makes me believe that we are likely to experience a minor correction before the index heads higher. A break above the 11920 (R1) barrier is needed to restore the short-term positive picture, which could prompt extensions towards our next hurdle of 12100 (R2). Our short-term oscillators corroborate my view that further pullback could be on the cards. The RSI turned down, while the MACD has topped and could fall below its trigger any time soon. There is also negative divergence between the RSI and the price action. On the daily chart, the index rebounded from the long-term uptrend line taken from back at the low of the 16th of October. This keeps the longer-term path to the upside in my view. Therefore, I believe that any short-term downside extensions are likely to provide renewed buying opportunities.

Support: 11740 (S1), 11420 (S2), 11200 (S3)

Resistance: 11920 (R1) 12100 (R2), 12280 (R3)

Recommended Content

Editors’ Picks

AUD/USD gains ground on hawkish RBA, Nonfarm Payrolls awaited

The Australian Dollar continues its winning streak for the third successive session on Friday. The hawkish sentiment surrounding the Reserve Bank of Australia bolsters the strength of the Aussie Dollar, consequently, underpinning the AUD/USD pair.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.