AUD/USD

The dollar traded mixed against its G10 peers during the European morning Monday. It was higher against AUD, JPY, CHF, NZD and NOK, in that order, while it was stable vs EUR, GBP and CAD. The greenback was lower only against SEK.

The euro was stable after all of the German regional CPIs accelerated on a yoy basis. These figures indicate that the national inflation rate, due out late this afternoon, is likely to turn positive. The data add to the growing body of evidence that Germany’s economy, the bloc’s largest, is strengthening again. This also increases the likelihood that Tuesday’s Eurozone CPI is likely to show that deflation moderated somewhat in March, which could support EUR temporarily.

Despite the lack of data or news from Australia, AUD continued its slide after failing to hold above 0.7900 in the previous week. Overnight, Australia’s private sector credit for February is to be released. Loans to the housing sector will be closely watched, as the risks in the housing and mortgage market are monitored by the RBA. The recent rate cut could boost further prices and prompt the Bank to take additional measures to cool down the market, perhaps even delay another possible rate cut. Currently the market has priced in a 65% probability of a 25bps rate cut at April’s meeting. If loans have increased significantly this could hint at a delay in the rate cut and push AUD/USD a bit up again. Otherwise, AUD is likely to weaken further, in my view.

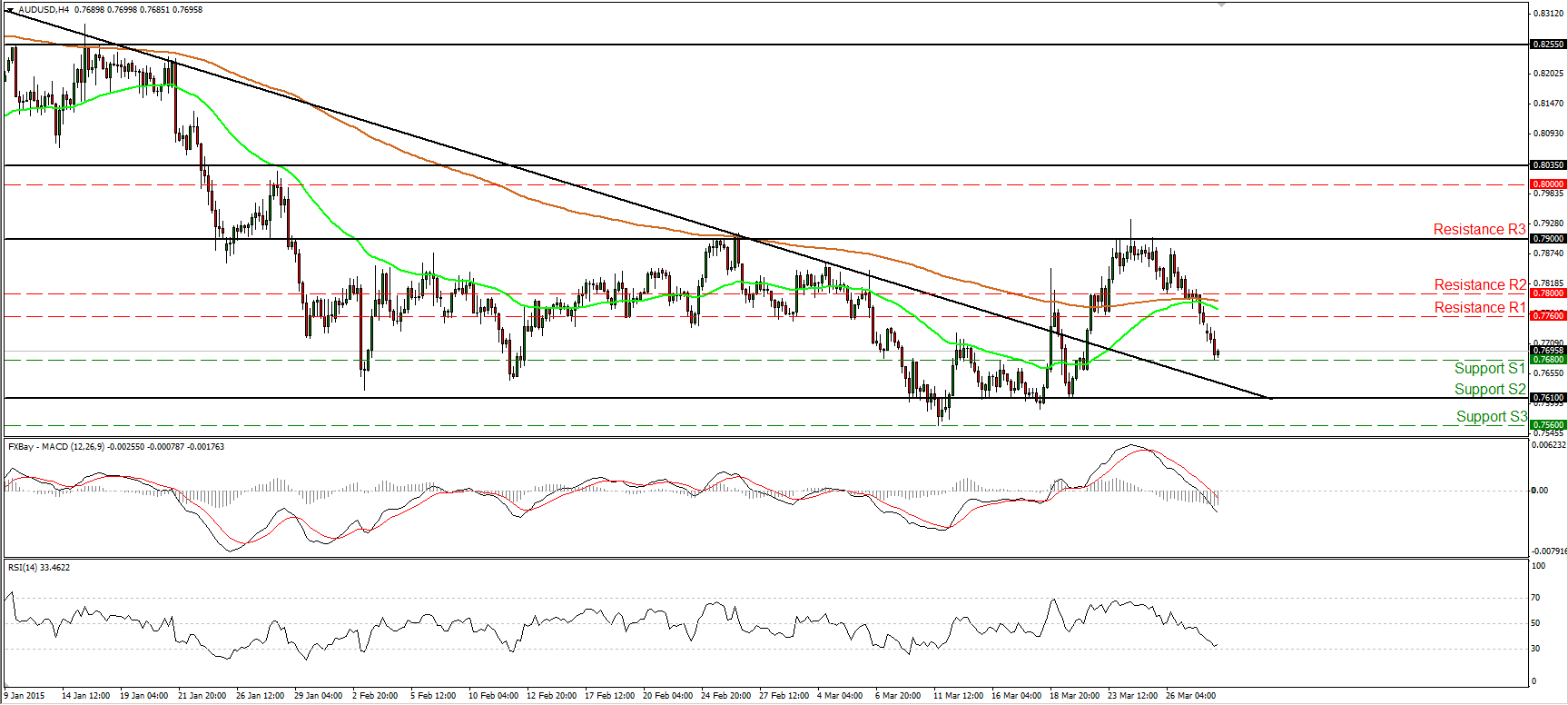

AUD/USD kept falling during the European morning Monday, but the tumble was halted at 0.7680 (S1). Based on our momentum signs, I would expect the down leg to extend lower, perhaps for a test of the key support line of 0.7610 (S2). The RSI continued lower after falling below 50, and now stands near its 30 barrier, while the MACD lies below both its signal and zero lines, pointing south. Although I would expect the recent short-term decline to continue, I hold my neutral view as far as the overall outlook is concerned. First, the rate has been oscillating between 0.7610 (S2) and 0.7900 (R3) since the end of January. It traded slightly outside of that range for a very short amount of time. Second, AUD/USD is still trading above the downtrend line taken from back the peak of the 5th of September, and third, there is still positive divergence between our daily momentum indicators and the price action.

Support: 0.7680 (S1), 0.7610 (S2), 0.7560 (S3).

Resistance: 0.7760 (R1), 0.7800 (R2), 0.7900 (R3).

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.