USD/SEK

The absence of any major news or events during the European morning Monday, translated into a relatively narrow range in most currencies. The dollar was higher against JPY, GBP, AUD, SEK and NOK, in that order, while it was lower against NZD, CHF and EUR. The greenback was stable vs CAD.

USD/SEK had a very intense intraday movement as it rose 300 pips before the country’s retail sales were released, dropped 300 pips after the figure was out and bounced back up in the following minutes. The initial advance came after a report revealed talks between Swedish Government with Alliance opposition that may allow the country to avoid snap election. The government is expected to announce new elections in March next year, despite being only two months in office, after its budget proposal was rejected earlier this month. The decision will not be officially announced until Dec. 29, as the Swedish Constitution states that a government has to have been in power for at least 3 months before it can call for another election. Later in the day the country’s retail sales rose 0.5% mom in November, at a slower pace from October but better than the forecasts. USD/SEK dipped 0.4% but recovered immediately and advanced even more in the following minutes. I expect the weakening fundamentals and the risk in politics to weigh on SEK, leaving it vulnerable in the following months.

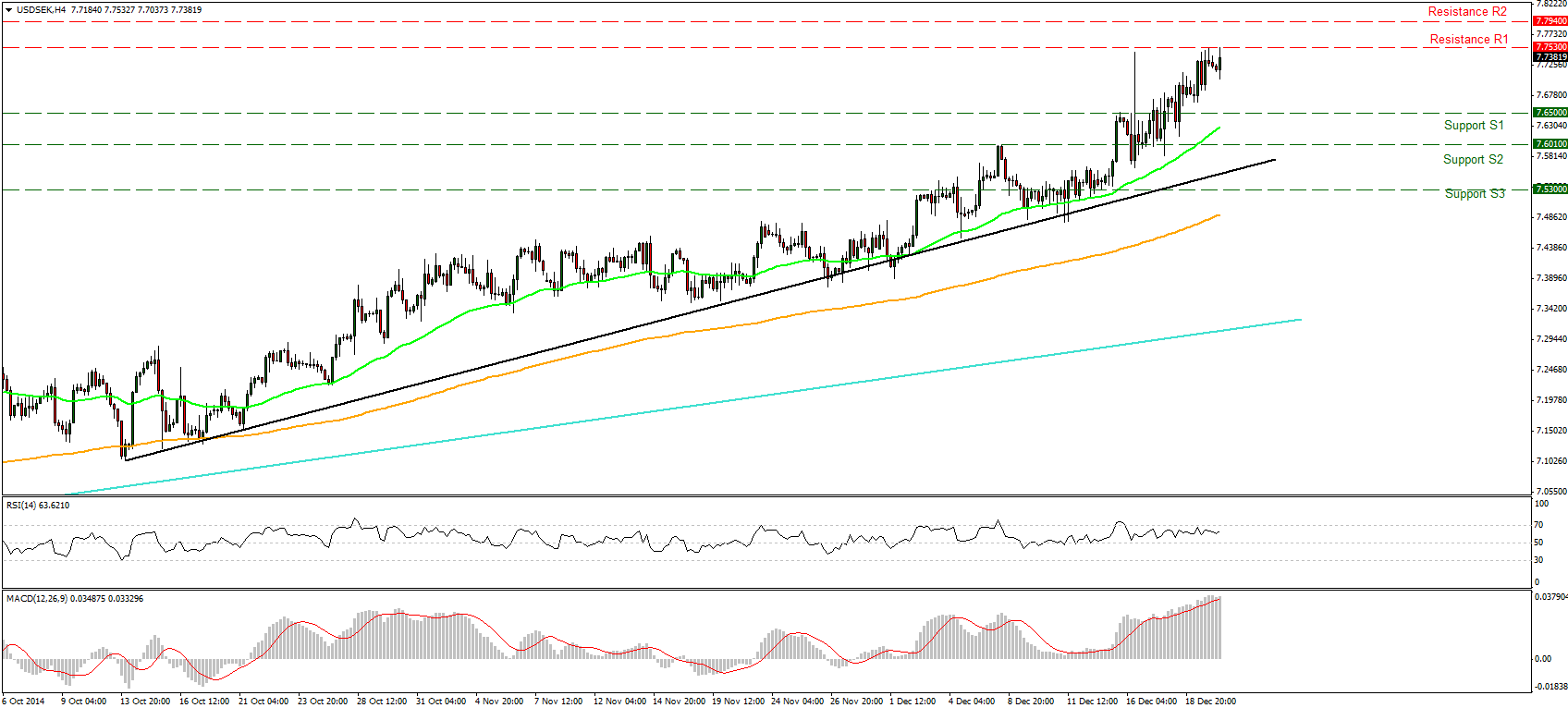

USD/SEK firmed up during the European morning Monday but the move was halted by the 7.7530 (R1) resistance level. A break above that hurdle could push the rate to even higher levels perhaps towards our next resistance line of 7.7940 (R2). Our short-term oscillators support a small halt in the advance as the RSI lies just below its overbought territory and moves along its 70 line, while the MACD, already positive remains above its trigger line. These momentum signals support my view that a break above the 7.7530 (R1) level is necessary for another leg up. In the bigger picture, the rate is trading above the black uptrend line drawn from the low of the 14th of October and above the light blue line taken from the low of 19th March. This confirms that the overall outlook of the pair is to the upside.

Support: 7.6500 (S1), 7.6010 (S2), 7.5300 (S3) .

Resistance: 7.7530 (R1), 7.7940 (R2), 7.8370 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.