USD/NOK

The dollar traded unchanged or lower against all of its major G10 counterparts during the European morning Monday in the absence of any material economic events. It was lower against NOK, NZD and SEK, in that order.

The Norwegian krone was the main gainer after the country’s underlying CPI rose 2.5% yoy in October, faster than expected and an acceleration from 2.4% yoy in September. The increase puts core CPI back on Norges Bank’s projected rate path, which makes it unlikely that the Bank will cut rates at its meeting Dec. 11th. The Q3 GDP to be released next week should shed more light on the recent developments in Norway’s economy, thus I would see the current setback as renewed USD-buying opportunity. Until then, the various data coming from the country, would likely put the NOK under selling pressure.

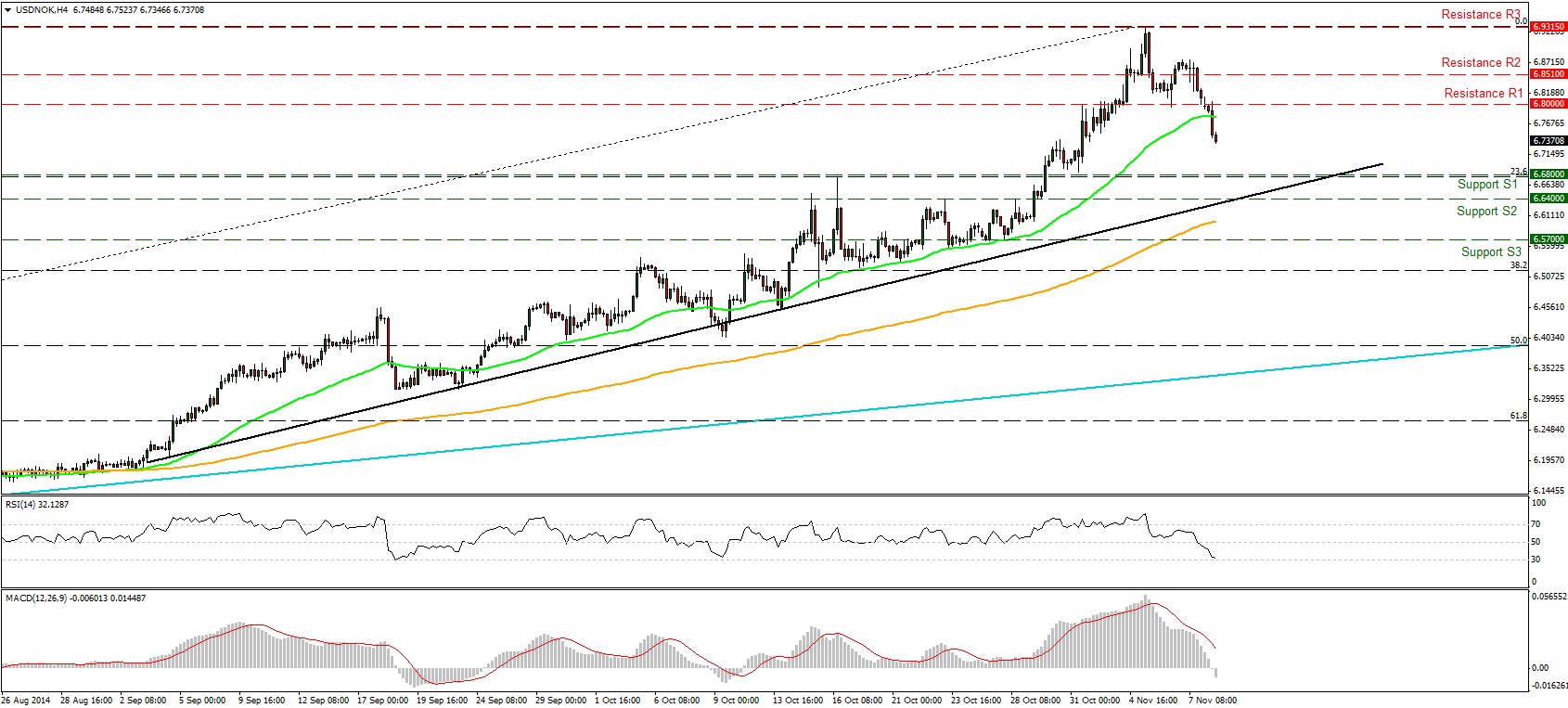

USD/NOK plunged after Norway’s CPI was released and at midday in Europe, the price is heading towards our 6.6800 (S1) support line. This support level currently coincide with the 23.6% retracement level of 8th of May – 5th of November up move. The RSI moved lower and appears likely to enter its oversold field, while the MACD, which was already below its trigger line, entered its negative territory. These two indicators demonstrate accelerating bearish momentum and magnify the case for a further near-term decline towards our 6.6800 (S1) support hurdle. As for the broader trend, the rate is printing higher highs and higher lows above the light blue longer-term uptrend line (taken from back at the low of the 8th of May) and above the 50- and 200-day moving averages. Thus, I would consider the overall path to remain to the upside.

Support: 6.6800 (S1), 6.6400 (S2), 6.5700 (S3) .

Resistance: 6.8000 (R1), 6.8510 (R2), 6.9315 (R3).

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.