Silver

The dollar traded virtually unchanged against most of the other G10 currencies during the morning in Europe. In the absence of any material events to drive the forex markets, the greenback was higher only against SEK and AUD, while it was slightly lower against CAD.

The Aussie gave back some of its overnight gains after China’s Q3 GDP slowed by less than anticipated. Although the less-than-expected slowdown in China’s growth was taken as positive by the market, it was the slowest expansion rate since 2009. I still believe that the slowing Chinese economy will eventually weigh on the Australian currency. Tomorrow, Asian time, we get Australia’s CPI for Q3 and the forecast is for the inflation rate to decline on a yoy basis, which could also prove AUD-negative.

The big test for the greenback comes tomorrow, when we get the US CPI data for September. Last week, both retail sales and PPI disappointed, increasing the chances that the CPI rate would come in below forecasts too. The USD strength depressing import prices and the steep fall of energy prices over the recent months also supports this view. As a result, a below-estimate CPI figure could signal that the USD correction is not over yet.

Combining these two points, and taking into account that AUD/USD has been trading in a sideways path for the last month, I would wait for a break below the low of the 3rd of October at 0.8640 to corroborate the view of a weaker Aussie against a stronger dollar.

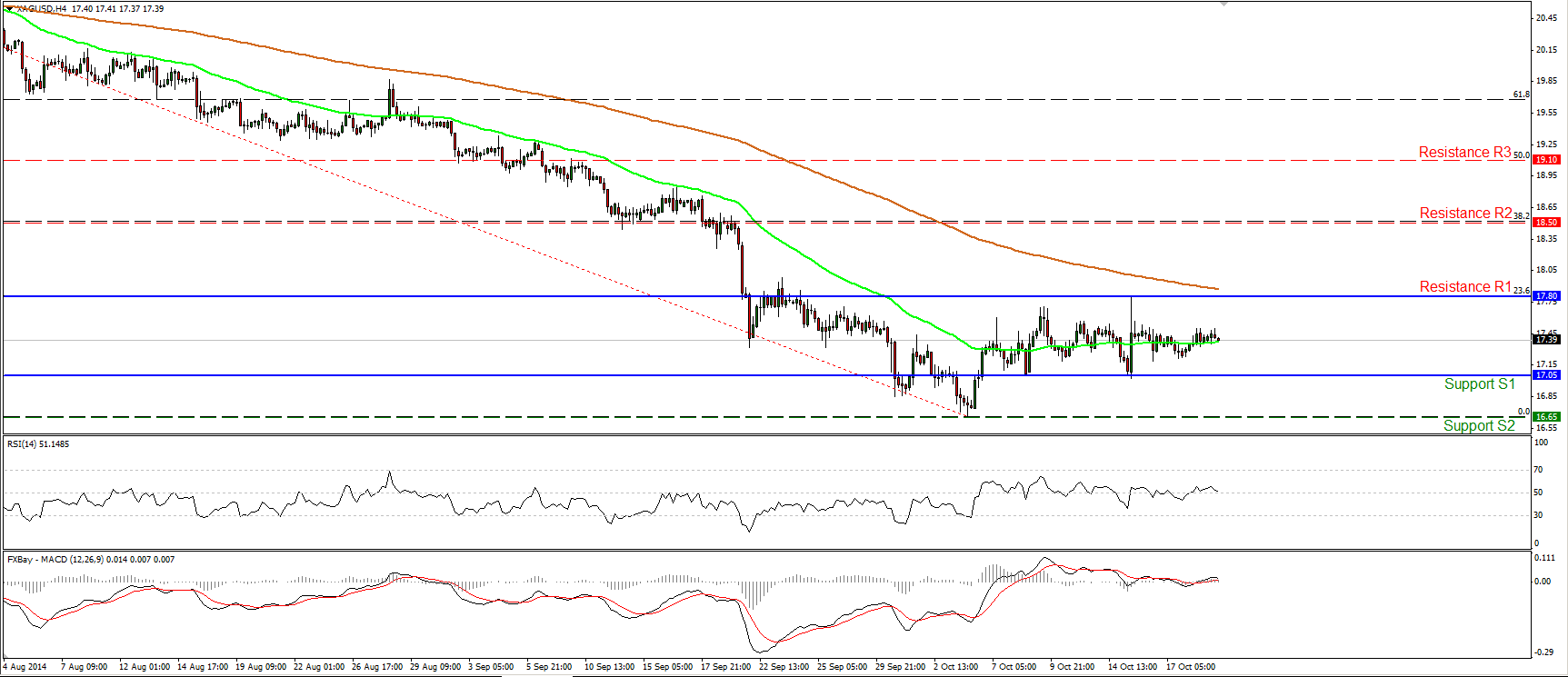

Both gold and silver rose during the European morning ahead of the Hindu festival of Diwali on Wednesday, but although the yellow metal has been in a rising mode since the 6th of October (when it found support within the floor zone of 1180/85), silver has remained stuck within a range.

Silver seems to be trading within a sideways path between the support line of 17.05 (S1) and the resistance of 17.80 (R1), which coincides with the 23.6% retracement level of the 10th of July – 6th of October decline. If the longs of the white metal are willing to follow those of gold, they will have to overcome the 17.80 (R1) resistance hurdle. Such a move could target the 38.2% retracement level of the 10th of July – 6th of October down leg, near 18.50 (R2). On the downside, a decisive dip below the 16.65 (S2) would confirm a forthcoming lower low on the daily chart and could signal the reinforcement of the prior downtrend. Our near-term momentum studies support the flat picture of silver, as they both lie near their equilibrium lines.

Support: 17.05 (S1), 16.65 (S2), 16.00 (S3) .

Resistance: 17.80 (R1), 18.50 (R2), 19.10 (R3) .

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.