FTSE 100 futures

The dollar started Monday weak in Asian trading but regained its glamour and traded higher against all of its G10 peers during the European morning as investors start to see improving US economic fundamentals and the Fed preparing for rate hikes. On top of which, pressure on Europe at the G20 finance ministers and central bank chiefs’ summit increased the perception of a divergence between the economic prospects for the US and the Eurozone. The dollar’s biggest advance was against the AUD amid speculation that the slowdown in China will lower demand for commodities and will hurt the Australian economy.

Asian and European shares fell during European midday as China’s finance minister admitted that there won’t be major changes in policy despite downward pressure on the Chinese economy. However, his remarks contradict somewhat last week’s liquidity stimulus by the People’s Bank of China to support loan growth and boost the country’s economy. Manufacturing data expected on Tuesday could provide more evidence of a slowdown in China and put further selling pressure on the equity markets.

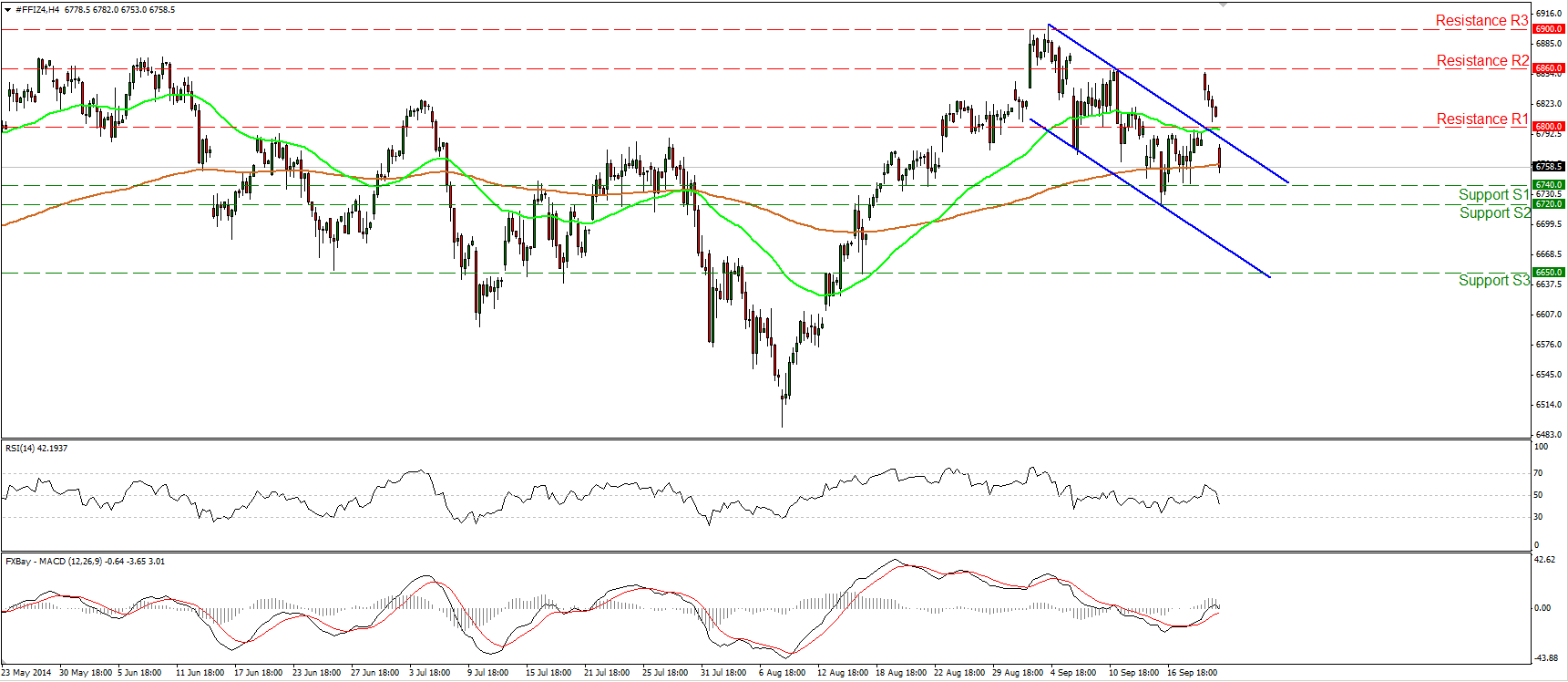

After the results of the Scottish independence referendum were announced, FTSE 100 futures opened Friday’s session with a bullish gap, breaking above the upper line of the near-term downside channel. However, the price found resistance at 6860 (R2) and, after China’s finance minister diminished expectations for further stimulus measures, it opened today’s session with a gap down to return back within the aforementioned channel. Taking that into account, I would see a cautiously negative near-term picture, but I would prefer to wait for a dip below the support line of 6720 (S2) before getting more confident about further declines. Such a move is likely to set the stage for extensions towards the next support line of 6650 (S3), determined by the lows of the 15th of August. Our momentum studies also confirm the recent bearish momentum. The RSI crossed below its 50 line and is pointing down, while the MACD appears to have topped marginally above its zero line and could dip below its trigger in the close future. In the bigger picture, on the daily chart, a longer-term upside channel contains the price structure, thus I would consider any further declines within the channel as a corrective phase of the longer-term uptrend.

Support: 6740 (S1), 6720 (S2), 6650 (S3).

Resistance: 6800 (R1), 6860 (R2), 6900 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after US data

EUR/USD struggles to build on Wednesday's gains and fluctuates in a tight channel near 1.0700 on Thursday. The data from the US showed that weekly Jobless Claims held steady at 208,000, helping the USD hold its ground and limiting the pair's upside.

GBP/USD fluctuates above 1.2500 following Wednesday's rebound

GBP/USD stays in a consolidation phase slightly above 1.2500 on Thursday after closing in the green on Wednesday. A mixed market mood caps the GBP/USD upside after Unit Labor Costs and weekly Jobless Claims data from the US.

Gold retreats to $2,300 despite falling US yields

Gold stays under bearish pressure and trades deep in negative territory at around $2,300 on Thursday. The benchmark 10-year US Treasury bond edges lower following the Fed's policy decisions but XAU/USD struggles to find a foothold.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.