USD/CAD

The dollar traded unchanged or higher against almost all of its G10 peers during the European morning Friday as the FX market got back to normal following the Scottish referendum. It was higher vs its early European levels against GBP, SEK, EUR, CHF and NOK, in that order, while it remained stable vs CAD, NZD and AUD. The greenback was lower only against JPY.

The Canadian dollar remained resilient during the European morning despite the broad rebound from the USD. A reason for this could be the recent robust Canadian data as well as Tuesday’s comments from Bank of Canada Governor Stephen Poloz that they are cautiously optimistic about the future for exports. During his speech the Governor also acknowledged signs of early recovery and strong data to be released later Friday could confirm the Bank’s view. However, a soft reading would likely to put CAD under selling pressure and USD/CAD to follow the broad USD-strength sentiment.

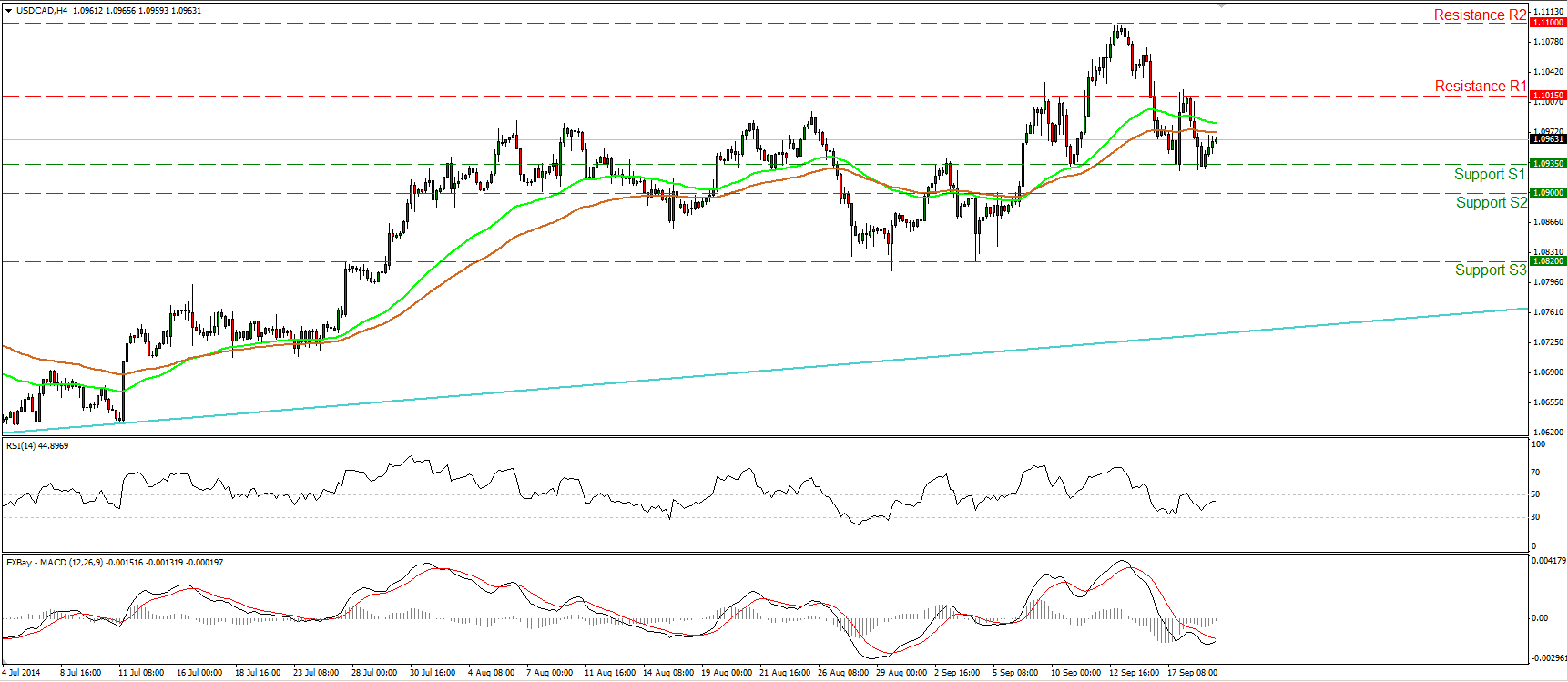

USD/CAD moved slightly higher on Friday after finding once again support near the 1.0935 (S1) barrier. Today we get Canada’s CPI data for August. Although the headline rate is forecast to have remained unchanged, the core CPI is expected to have accelerated, something that could trigger a leg down in USD/CAD. A clear move below 1.0935 (S1) is likely to challenge our support line at 1.0900 (S2). Taking a look on the daily chart, the pair declined after forming a bearish harami candlestick pattern, while I see negative divergence between both our daily momentum studies and the price action. These signs amplify the case for further declines in the near-term. However, on the longer-term timeframes, I still see a major uptrend marked by the light blue trend line, connecting the lows on the weekly chart from back the beginning of September 2012. As a result, I would consider the recent declines or any future ones as a corrective phase of the larger trend. I believe that any future setbacks are likely to provide renewed buying opportunities.

Support: 1.0935 (S1), 1.0900 (S2), 1.0820 (S3).

Resistance: 1.1015 (R1), 1.1100 (R2), 1.1200 (R3).

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.