USD/CAD

The dollar traded unchanged or higher against its G10 peers during the European morning Tuesday. The greenback was higher against GBP, AUD, CAD and NZD, in that order.

The British pound was the main loser during the European morning despite the better-than-expected construction PMI reading for August. Sterling weakened however against the dollar after a survey by Yougov, a British opinion research firm, showed support for Scottish independence had risen to 47% vs 53% opposed, a sharp increase for the “yes” vote from just two weeks ago. Although this poll’s results are not borne out by other polls, nonetheless it does raise the risk that as the Sep. 18th referendum is approaching, support for Scottish independence is rising, increasing the negative sentiment over the pound.

The Canadian dollar weakened ahead of the country’s central bank policy meeting on Wednesday. It is unlikely that the Bank will change its neutral stance with respect to the timing and direction of the next change to the policy rate, but investors’ concerns are whether the governing council will attempt to talk down the CAD. The nation’s manufacturing PMI is due out later in the day but no forecast is available.

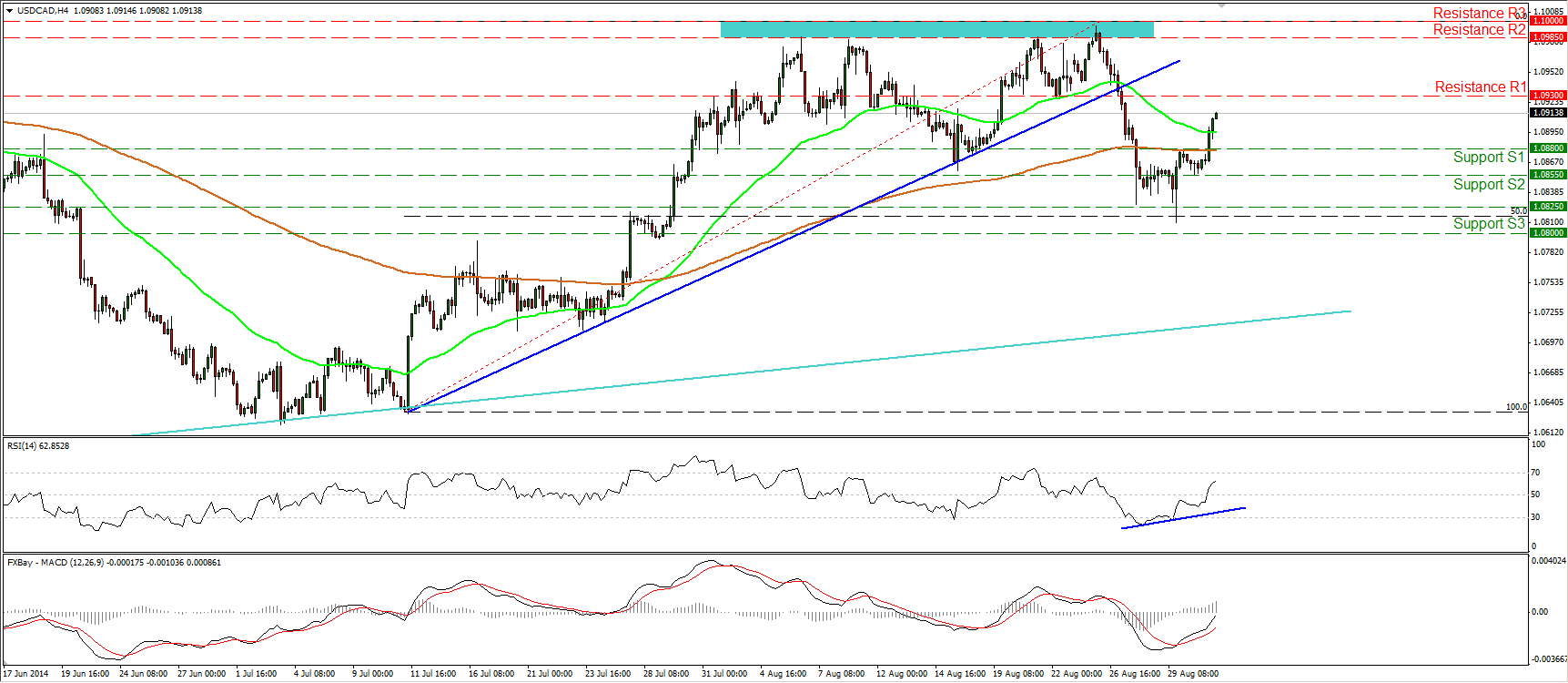

USD/CAD recovered approximately half of its last week losses after finding support near the 50% retracement level of 11th July – 26th August near-term uptrend. Today, during the Asian morning, the pair moved above the 1.0880 (resistance turned into support) barrier and at midday, in Europe, is heading towards the resistance line of 1.0930 (R1). A successful move above that hurdle could drive the battle towards the critical and strong resistance zone of 1.0985/1.1000. On the daily chart, I see a hammer candle pattern near the 50% retracement level of the aforementioned uptrend, corroborating my view that we are likely to experience the continuation of the up leg. In the bigger picture, the long-term uptrend is still in effect. The pair is still trading above the major uptrend line, drawn from back the beginning of September 2012, connecting the lows on the weekly chart. However I would prefer to see a clear close above the 1.0985/1.1000 strong resistance zone before regaining confidence on the long-term path. Remember that in August, the bulls failed four times to overcome that area.

Support: 1. 0880 (S1), 1.0855 (S2), 1.0825 (S3).

Resistance: 1.0930 (R1), 1.0985 (R2), 1.1000 (R3).

Recommended Content

Editors’ Picks

EUR/USD stays in tight channel above 1.0750

EUR/USD continues to fluctuate in a narrow band slightly above 1.0750 after posting small gains on Monday. Disappointing Factory Orders data from Germany limits the Euro's gains as investors keep a close eye on comments from central bankers.

GBP/USD retreats below 1.2550 as USD recovers

GBP/USD stays under modest bearish pressure and trades below 1.2550 in the European session on Tuesday. The cautious market stance helps the USD hold its ground and doesn't allow the pair to regain its traction. The Bank of England will announce policy decisions on Thursday.

Gold declines below $2,320 amid renewed US Dollar demand

Gold trades in negative territory below $2,320 as the souring mood allows the USD to find demand on Tuesday. Nevertheless, the benchmark 10-year US Treasury bond yield stays below 4.5% and helps XAU/USD limit its losses.

Ripple lawsuit develops with SEC reply under seal, XRP holders await public redacted versions

Ripple lawsuit’s latest development is SEC filing, under seal. The regulator has filed its reply brief and supporting exhibits and the documents will be made public on Wednesday, May 8.

The impact of economic indicators and global dynamics on the US Dollar

Recent labor market data suggest a cooling economy. The disappointing job creation and rising unemployment hint at a slackening demand for labor, which, coupled with subdued wage growth, could signal a slower economic trajectory.