EUR/CHF

The dollar traded unchanged or higher against most of its G10 peers during the European morning Thursday. It was higher against AUD, GBP, NOK and NZD, in that order, and was virtually unchanged against CAD, JPY, EUR, SEK and CHF.

Cable was among the losers during the European morning, after the UK house prices for July rose at their slowest pace since April 2013. House prices as measured by the Nationwide index rose +0.1% mom in July, down from +1.0% mom in June, recording their 15th consecutive increase but missing estimates of a +0.5% mom rise. Recent tighter mortgage-lending policy rules introduced by the Bank of England in an attempt to prevent home buyers taking on too much debt are most likely behind this month’s slowdown. The Bank’s Governor, Mark Carney, had point out the booming housing market as the biggest threat to UK’s recovery.

The Hungarian forint was one of the losers among the EM currencies. The dollar has been rallying against most EM currencies recently and investors have been particularly punishing the currencies of the former Soviet bloc nations along with the RUB recently despite the fact that they are now EU member states. The recent rebound in Hungary’s CPI rate and the moderate decline in the country’s unemployment rate were ignored by the market, sending USD/HUF to levels last seen in April 2013.

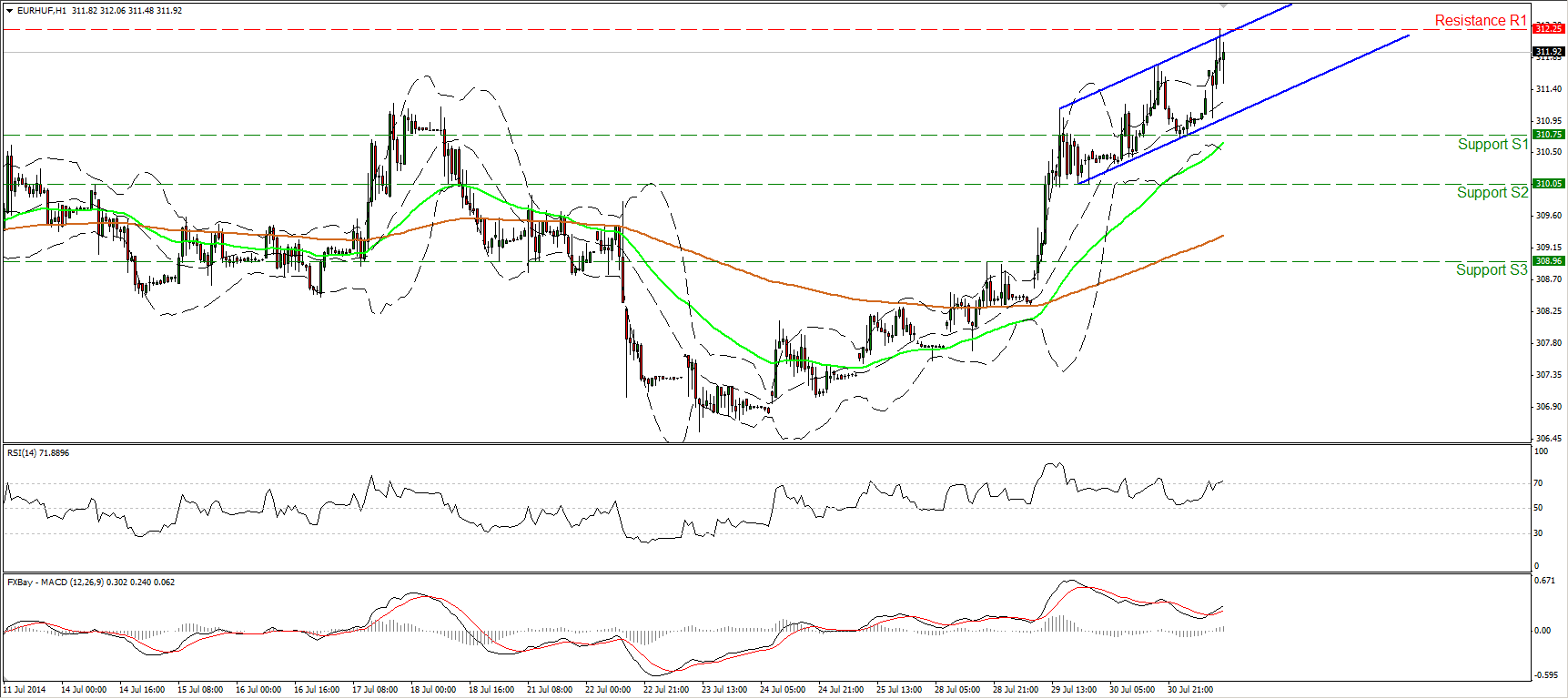

EUR/HUF edged higher during the European morning Thursday, after finding support at 310.75 (S1). However, the advance was halted by the upper boundary of the blue upside channel and the resistance barrier of 312.25 (R1). The rate is printing higher highs and higher lows within the channel and above both the moving averages and this keeps the short-term picture to the upside. The MACD, already within its positive field, moved above its signal line, confirming the recent bullish momentum of the rate. I would ignore the overbought reading of the RSI for now, since the indicator is pointing up and could stay within its extreme territory for a noticeable period of time. A decisive violation of the 312.25 (R1) obstacle could trigger further bullish extensions and could pave the way towards the next resistance at 313.00 (R2).

Support: 310.75 (S1), 310.05 (S2), 309.00 (S3) .

Resistance: 312.25 (R1), 313.00 (R2), 314.00 (R3).

Recommended Content

Editors’ Picks

EUR/USD retreats toward 1.0850 on modest USD recovery

EUR/USD stays under modest bearish pressure and trades in negative territory at around 1.0850 after closing modestly lower on Thursday. In the absence of macroeconomic data releases, investors will continue to pay close attention to comments from Federal Reserve officials.

GBP/USD holds above 1.2650 following earlier decline

GBP/USD edges higher after falling to a daily low below 1.2650 in the European session on Friday. The US Dollar holds its ground following the selloff seen after April inflation data and makes it difficult for the pair to extend its rebound. Fed policymakers are scheduled to speak later in the day.

Gold climbs to multi-week highs above $2,400

Gold gathered bullish momentum and touched its highest level in nearly a month above $2,400. Although the benchmark 10-year US yield holds steady at around 4.4%, the cautious market stance supports XAU/USD heading into the weekend.

Chainlink social dominance hits six-month peak as LINK extends gains

-637336005550289133_XtraSmall.jpg)

Chainlink (LINK) social dominance increased sharply on Friday, exceeding levels seen in the past six months, along with the token’s price rally that started on Wednesday.

Week ahead: Flash PMIs, UK and Japan CPIs in focus – RBNZ to hold rates

After cool US CPI, attention shifts to UK and Japanese inflation. Flash PMIs will be watched too amid signs of a rebound in Europe. Fed to stay in the spotlight as plethora of speakers, minutes on tap.