USD/SEK

The dollar traded unchanged or higher against most of its G10 counterparts during the European morning Wednesday. It was higher against SEK, AUD, JPY and CAD, in that order, and was virtually unchanged against NOK, EUR, NZD, CHF and GBP.

SEK plunged after Sweden’s preliminary Q2 GDP grew +0.2% qoq, disappointing the market with its below consensus reading. Although a rebound from the final Q1 -0.1% qoq, the worse-than-expected figure send the krona down approximately 0.5% against the dollar to trade at 6.8900 at the time of writing. On top of the recent rise in the unemployment rate to 9.2% and the decline in the nation’s consumer confidence, the poor GDP growth adds to the growing body of evidence that the economy is not as strong as the market was expecting.

EUR/USD dropped below 1.3400 during the European morning for the first time since 13th of November, ahead of the preliminary German CPI for July and amid expectations of strong US data coming later in the day. The first indication of a decline in the German inflation rate came several hours before the country’s headline figure. The CPI for the region of Saxony slowed to 0.8% yoy in July from 0.9% yoy the previous month, increasing the likelihood of an overall slowdown in Germany’s consumer prices. However, expectations for robust US data are most likely the main reason for the tumble of EUR/USD. If the forecasts are met, I would expect the rate to slide further and see as a first target the 1.3350 zone in the near future.

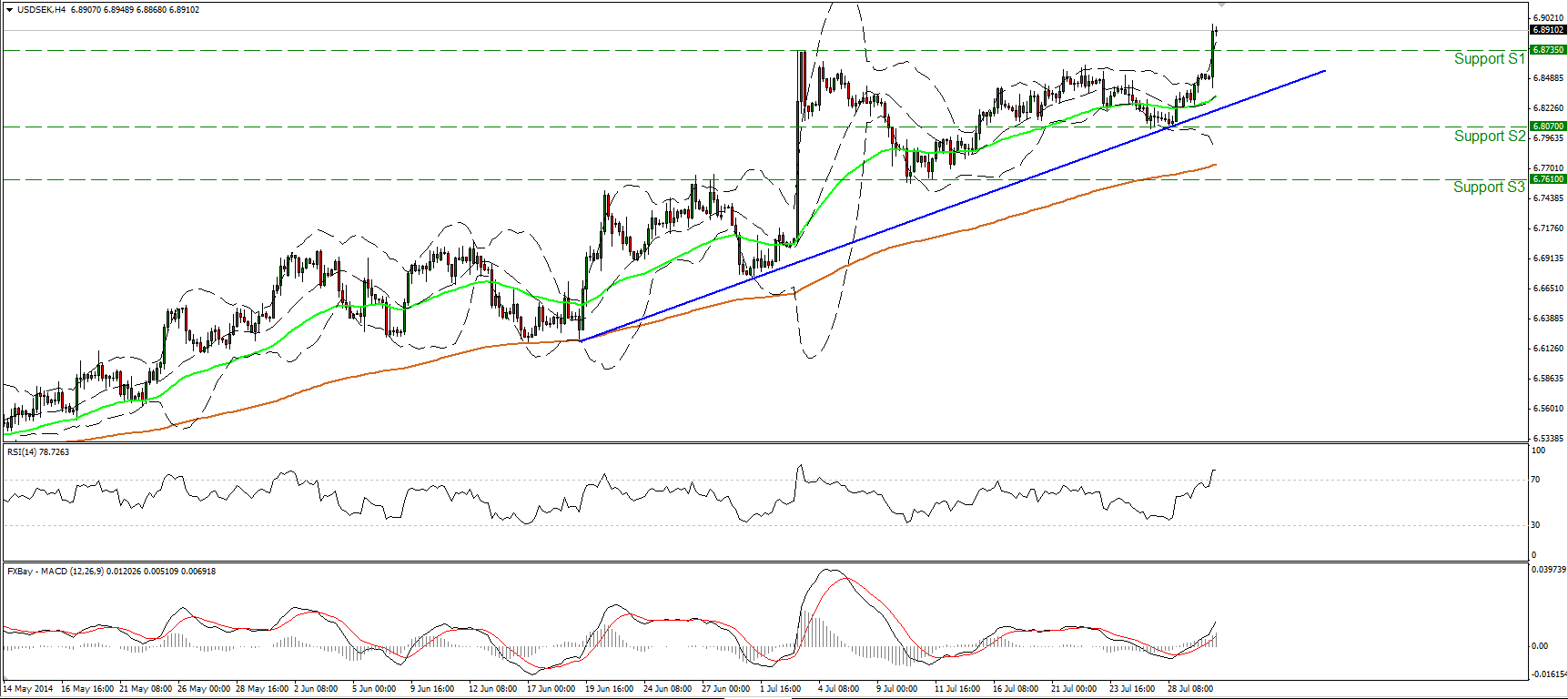

USD/SEK rallied during the European morning Wednesday, breaking above 6.8735 (resistance turned into support), the highs of the 3rd of July. Such a move confirms a forthcoming higher peak and could pave the way towards the 6.9200 (R1) zone. As long as the rate is trading above the blue uptrend line and above both the moving averages, I see a positive near term picture. Nevertheless, zooming on the hourly chart, the 14-hour RSI lies within its overbought field and is pointing down, thus I would expect a pullback before the longs take control again. In the bigger picture, the major upside path is in force since the 19th of March, while the 50-day moving average lies above the 200-day one and is pointing up. This amplifies the case for the continuation of the longer-term uptrend.

Support: 6.8735 (S1), 6.8070 (S2), 6.8610 (S3) .

Resistance: 6.9200 (R1), 7.0000 (R2), 7.0775 (R3).

Recommended Content

Editors’ Picks

AUD/USD post moderate gains on solid US data, weak Aussie PMI

The Australian Dollar registered solid gains of 0.65% against the US Dollar on Thursday, courtesy of an upbeat market mood amid solid economic data from the United States. However, the Federal Reserve’s latest monetary policy decision is still weighing on the Greenback. The AUD/USD trades at 0.6567.

USD/JPY: Japanese Yen advances to nearly three-week high against USD ahead of US NFP

The Japanese Yen continues to draw support from speculated government intervention. The post-FOMC USD selling turns out to be another factor weighing on the USD/JPY pair. Investors now look forward to the crucial US NFP report for a fresh directional impetus.

Gold recoils on hawkish Fed moves, unfazed by dropping yields and softer US Dollar

Gold price clings to the $2,300 figure in the mid-North American session on Thursday amid an upbeat market sentiment, falling US Treasury yields, and a softer US Dollar. Traders are still digesting Wednesday’s Federal Reserve decision to hold rates unchanged.

Solana price pumps 7% as SOL-based POPCAT hits new ATH

Solana price is the biggest gainer among the crypto top 10, with nearly 10% in gains. The surge is ascribed to the growing popularity of projects launched atop the SOL blockchain, which have overtime posted remarkable success.

NFP: The ultimate litmus test for doves vs. hawks

US Nonfarm Payrolls will undoubtedly be the focal point of upcoming data releases. The estimated figure stands at 241k, notably lower than the robust 303k reported in the previous release and below all other readings recorded this year.