Copper

The dollar was unchanged against most of the other G10 currencies during the European morning Monday, as no major market-affecting indicators were released. It was slightly higher against CAD, AUD and NOK, in that order.

The Russian ruble was the main loser among the EM currencies we track, as talks between Russia and Ukraine over gas prices failed. Russian stocks were also down as OAO Gazprom, Russia’s biggest natural gas producer, slumped. Gazprom said Ukraine will only receive gas paid for in advance due to chronic non-payment of its bills.

The Polish zloty was also among today’s EM losers after seeped recordings of a conversation between NBP (National Bank of Poland) Governor Marek Belka and a minister raised concerns about Governor’s future and triggered a government crisis.

Copper edged higher after the central bank in China, the world’s biggest consumer of the metal, extended a reserve requirement cut in an attempt to support its economic growth.

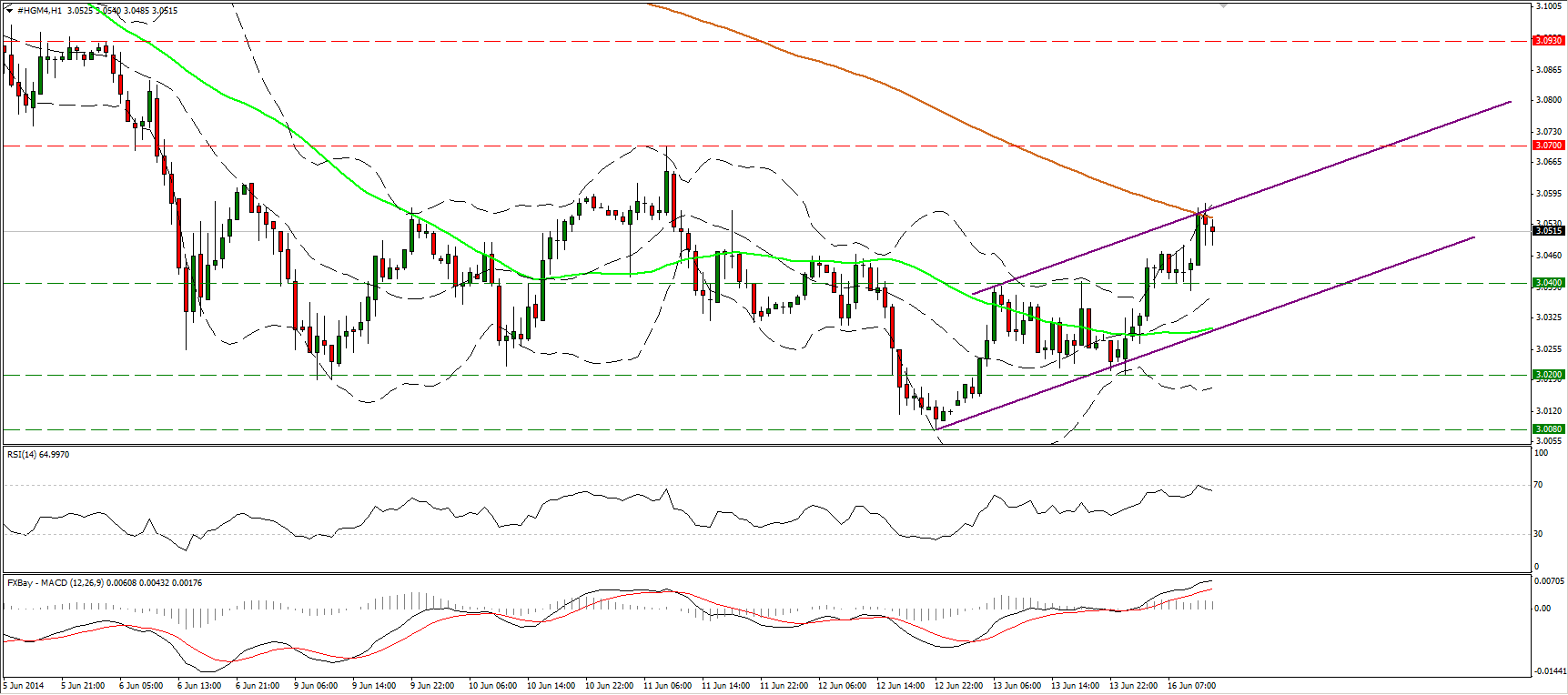

Copper moved higher during the European morning, but the decline was halted by the 3.0560 (R1) barrier, near the upper boundary of the purple upward slopping channel and the 200-hour moving average. Considering that the RSI met resistance at its 70 level and moved lower, I would expect the forthcoming wave to be to the downside. However, as long as the rate remains within the purple uptrend channel, I see a positive picture and I would consider a possible decline as a pullback before the bulls prevail again.

Support: 3.0400 (S1), 3.0200 (S2), 3.0080 (S3).

Resistance: 3.0560 (R1), 3.0700 (R2), 3.0930 (R3).

Recommended Content

Editors’ Picks

AUD/USD: Uptrend remains capped by 0.6650

AUD/USD could not sustain the multi-session march north and faltered once again ahead of the 0.6650 region on the back of the strong rebound in the Greenback and the prevailing risk-off mood.

EUR/USD meets a tough barrier around 1.0800

The resurgence of the bid bias in the Greenback weighed on the risk-linked assets and motivated EUR/USD to retreat to the 1.0750 region after another failed attempt to retest the 1.0800 zone.

Gold eases toward $2,310 amid a better market mood

After falling to $2,310 in the early European session, Gold recovered to the $2,310 area in the second half of the day. The benchmark 10-year US Treasury bond yield stays in negative territory below 4.5% and helps XAU/USD find support.

Bitcoin price coils up for 20% climb, Standard Chartered forecasts more gains for BTC

Bitcoin (BTC) price remains devoid of directional bias, trading sideways as part of a horizontal chop. However, this may be short-lived as BTC price action consolidates in a bullish reversal pattern on the one-day time frame.

What does stagflation mean for commodity prices?

What a difference a quarter makes. The Federal Reserve rang in 2024 with a bout of optimism that inflation was coming down to their 2% target. But that optimism has now evaporated as the reality of stickier-than-expected inflation becomes more evident.