Intraday market analysis: GBP sees temporary retreat

GBP/USD retreats for support

The sterling retreated after a dovish BOE kept its policy unchanged, despite higher inflation.

The pair has bounced off the key support at 1.3800 on the daily chart. The break above 1.3900 suggests the short side may have unwound their positions.

However, price action has met stiff pressure at the psychological level of 1.4000, while the RSI was in the overbought territory.

The current pullback is likely to test the bulls’ resolve between 1.3800 and 1.3860. A bullish breakout would open the path towards 1.4200.

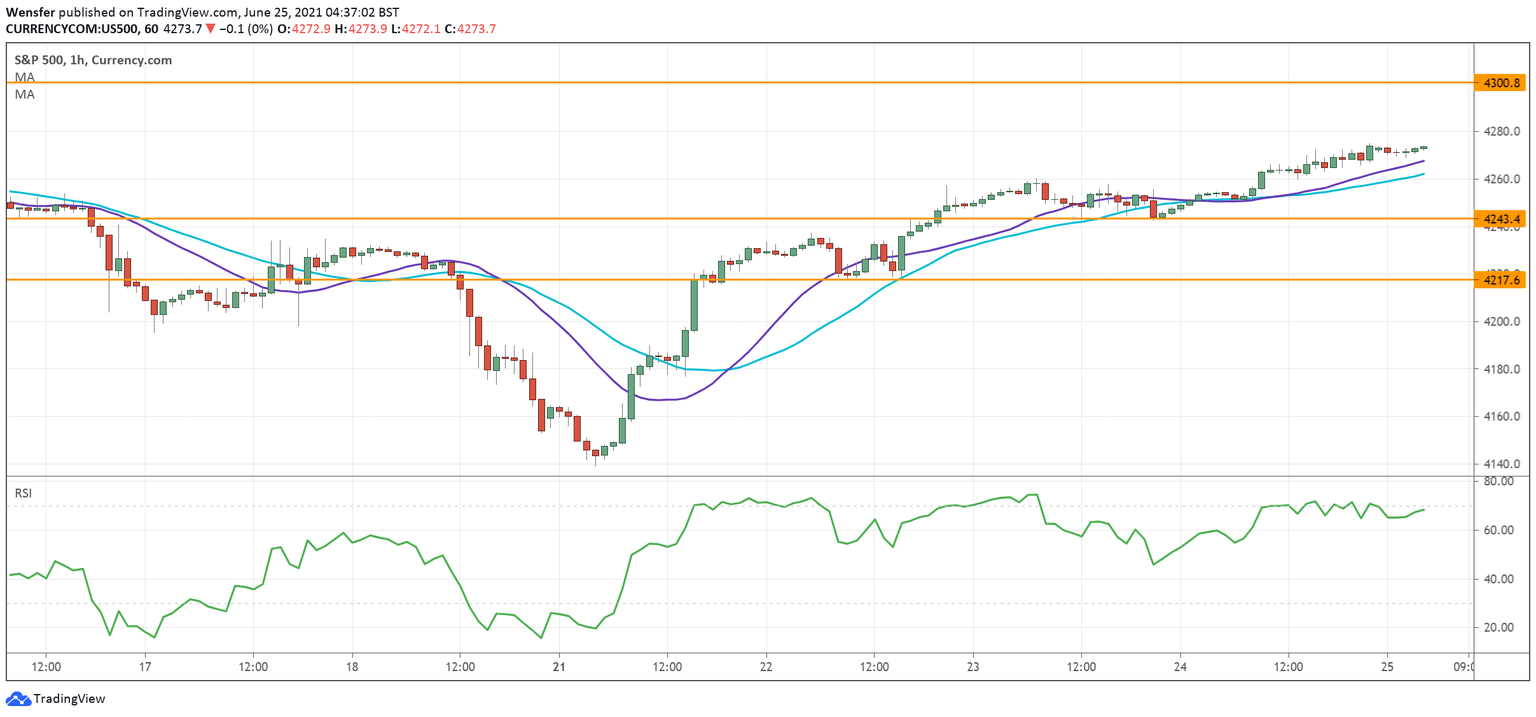

SPX 500 breaks above peak

The S&P 500 has recouped all losses after the Fed Chairman played down inflation pressures.

There is no lack of V-shaped recoveries in recent market conditions as volatility goes wild. Even though it is choppy, the directional bias remains upward, and the rebound above 4250 just confirms the bulls’ commitment.

As price action rallies above the previous peak at 4270, an overbought RSI may hold buyers back. 4243 is the support in case of a limited pullback. Nonetheless, a new round of buying would send the index to new highs above 4300.

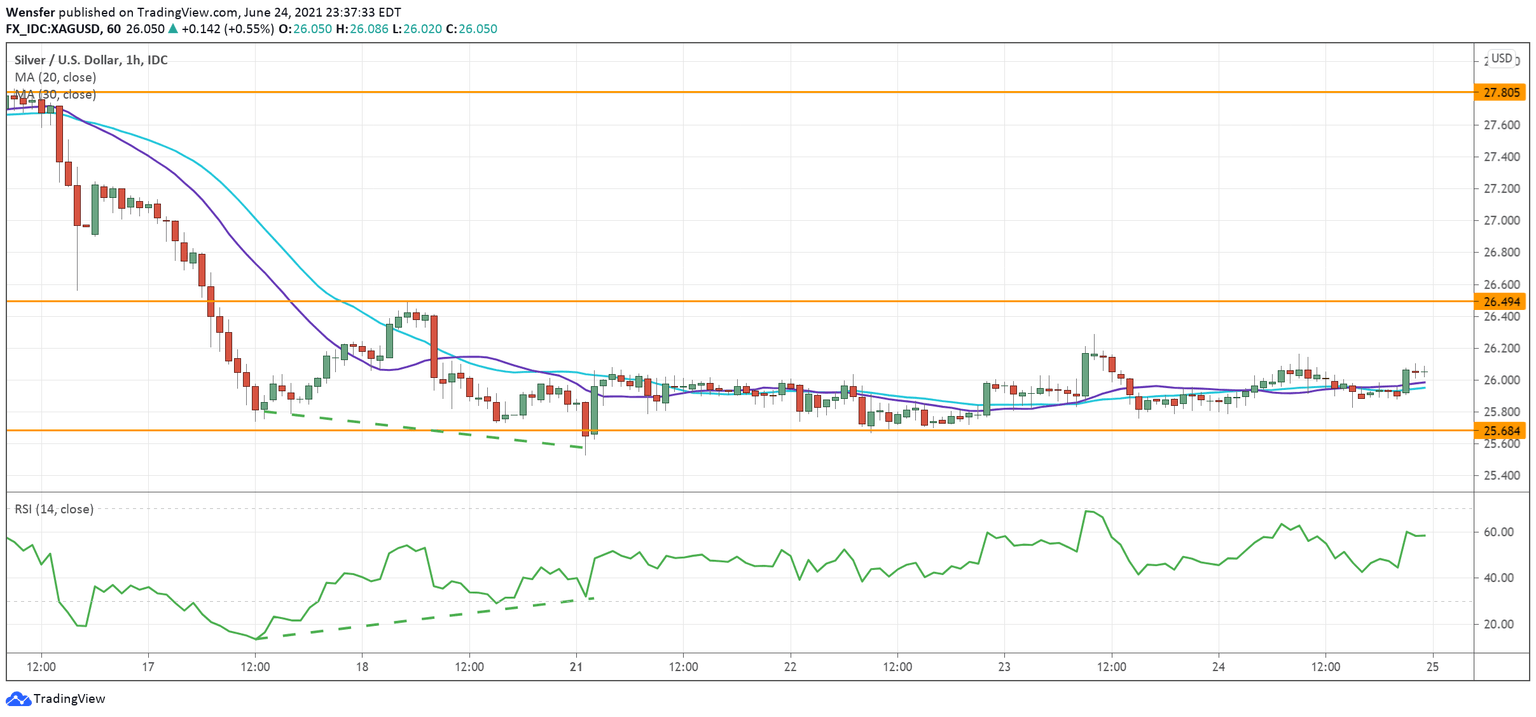

XAG/USD hovers above daily support

Silver takes a breather, as the US dollar softens across the board.

Price action is looking to gain a foothold above 25.70, which is an important support from the daily timeframe. The consolidation is a sign of indecision after a strong impetus.

The RSI divergence indicates a slowdown in the bearish momentum. A close above 26.50 would confirm buying interest and initiate a reversal. 27.80 would be the next target if the rally gains traction. Failing that, a drop below 25.70 could trigger a new round of sell-off towards 25.10.

Author

Jing Ren

Orbex

Jing-Ren has extensive experience in currency and commodities trading. He began his career in metal sales and trading at Societe Generale in London.