The Aussie dollar is making a massive head and shoulder spanning months. The right shoulder is now forming at .9500 to .9550 zone. A break above .9650 means the right shoulder is negated. Till that time, the AUDUSD has a right shoulder with a measured target at 100 DMA at .9260.

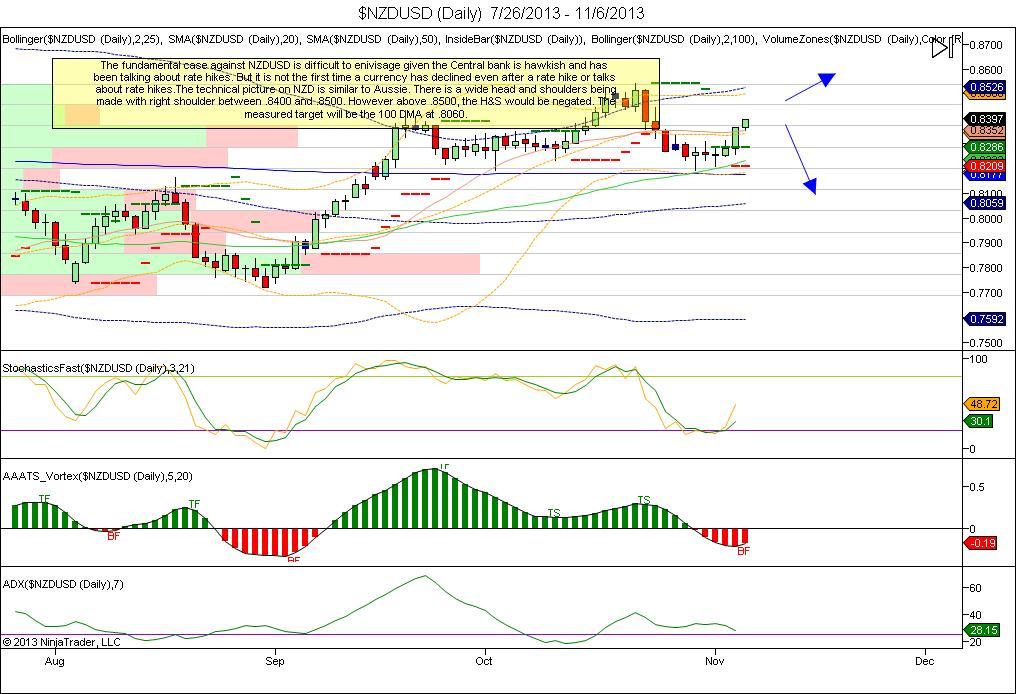

Similar arguments to NZDUSD but the right shoulder has not yet fully formed and hence give it some time. The fundamental case against NZDUSD is difficult to envisage given the Central bank is hawkish and has been talking about rate hikes. But it is not the first time a currency has declined even after a rate hike or talks about rate hikes.The technical picture on NZD is similar to Aussie. There is a wide head and shoulders being made with right shoulder between .8400 and .8500. However above .8500, the H&S would be negated. The measured target will be the 100 DMA at .8060.

EURAUD continues to consolidate between 1.4100 and 1.4550. EURAUD needs to resolve this week as the 25 DMA is starting to bend down and hence if it intends to continue higher, we need to see resolution.

Performance

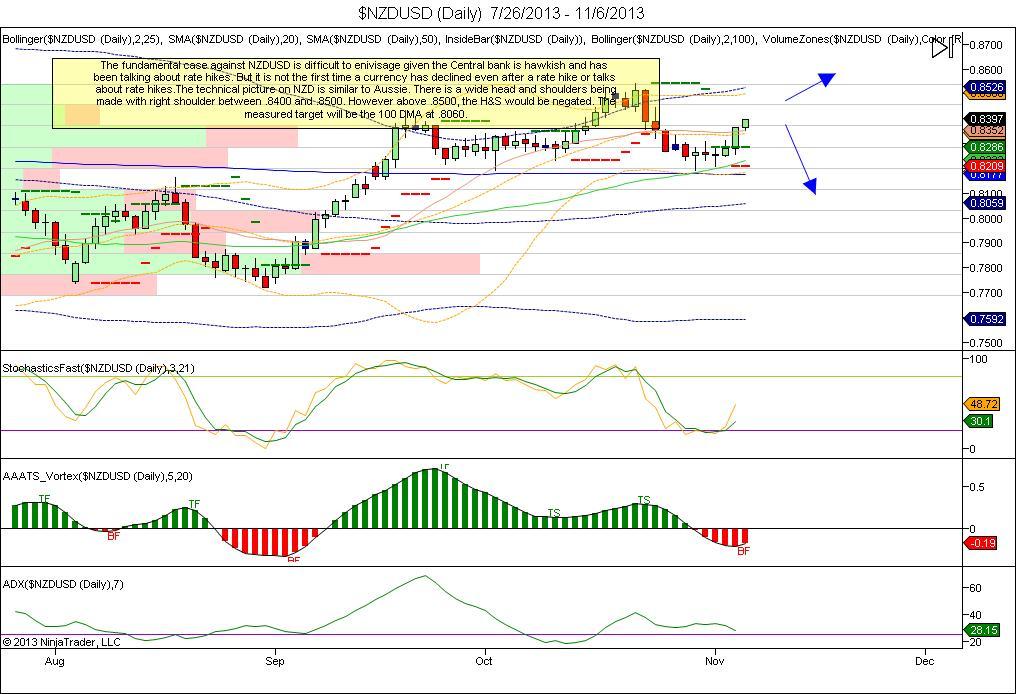

The total performance stands at +19,527 pips over 806 trades and 37.84 lots. The largest trade was +353 pips. The success ratio of trades stand at 64% for long and 61% for short trades. These numbers are audited and verified. The trades were recorded and executed on Alpari UK and MT4 statements can be downloaded.

The total performance stands at +19,527 pips over 806 trades and 37.84 lots. The largest trade was +353 pips. The success ratio of trades stand at 64% for long and 61% for short trades. These numbers are audited and verified. The trades were recorded and executed on Alpari UK and MT4 statements can be downloaded.The performance varies depending on the various parameters that a sub has control over within the trade copier EA but a sub will make a bare minimum of the above performance we declare.

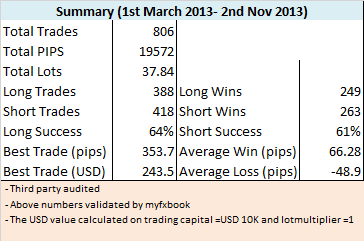

Monthly report: October 2013 Performance at +2145 pips

Capital3x trade copier closed +2145 pips in October and +3915 pips in Sept 2013. Previously it closed +2896 pips in Aug 2013.

Nov 2013 Trading has commenced with +305 pips of profit. 4.71 lots were traded in Aug . For September a mere 2.8 lots were traded while for October 3.66 lots were traded. (The numbers are verified by myfxbook). The lots traded are for the master account which has generated the performance as shown above. These lots will vary from subs to subs depending upon the lotmultiplier being used within the trade copier EA.

Recommended Content

Editors’ Picks

EUR/USD holds above 1.0700 after German inflation data

EUR/USD trades modestly higher on the day above 1.0700. The data from Germany showed that the annual HICP inflation edged higher to 2.4% in April. This reading came in above the market expectation of 2.3% and helped the Euro hold its ground.

USD/JPY recovers above 156.00 following suspected intervention

USD/JPY recovers ground and trades above 156.00 after sliding to 154.50 on what seemed like a Japanese FX intervention. Later this week, Federal Reserve's policy decisions and US employment data could trigger the next big action.

Gold holds steady above $2,330 to start the week

Gold fluctuates in a relatively tight channel above $2,330 on Monday. The benchmark 10-year US Treasury bond yield corrects lower and helps XAU/USD limit its losses ahead of this week's key Fed policy meeting.

Week Ahead: Bitcoin could surprise investors this week Premium

Two main macroeconomic events this week could attempt to sway the crypto markets. Bitcoin (BTC), which showed strength last week, has slipped into a short-term consolidation.

Five Fundamentals for the week: Fed fears, Nonfarm Payrolls, Middle East promise an explosive week Premium

Higher inflation is set to push Fed Chair Powell and his colleagues to a hawkish decision. Nonfarm Payrolls are set to rock markets, but the ISM Services PMI released immediately afterward could steal the show.