Inflation week: Eyes on Germany’s numbers, Eurozone and the US PCE

Outlook

This is inflation week. Tomorrow we get Germany’s numbers and on Friday, both the eurozone and the US PCE.

For the eurozone, expectations are for core to remain the same at 2.7% (with the headline up to 2.5% from 2.4%) and for the ECB to cut in June. This is being named a “hawkish cut,” one of those inherently self-contradictory terms.

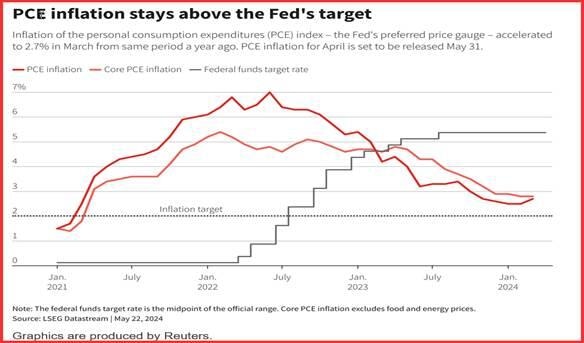

In the US, the flash PMI last week reversed the gloomy expectations and core PCE is now seen at 0.2%, down from 0.3%, or 2.7%, down from 2.8% last time. Headline CPI is expected to remain steady at 2.7% y/y. The Cleveland Fed’s Nowcast agrees and has both headline and core at 2.7%. This is hardly the extent of disinflation one would wish for, or the extent needed to trash the dollar.

On the Friday before the US holiday, the dollar’s upward correction came to an abrupt halt, purportedly on both the durables and University of Michigan survey that pointed to the economy softening and thus disinflationary and the Fed perceived as likely to return to a rate cutting mindset.

Poppycock. The Fed doesn’t make policy decisions on PMI’s, durables or surveys. They are a minor input to the overall decision, which is based on inflation and employment. Not trends in inflation and employment, but the actual data. Traders are, of course, welcome to over-extrapolate and to mistake one thing for another, but this kind of whipsawing makes them appear even dumber than usual. To point out that it’s a rush of short-covering is no help—it’s still a form of panic.

Last December when the Fed hinted that rates could start falling, the remarks were indeed based on what looked like a disinflation trend forming. But it turned out to be a mistake, not only because the markets went overboard and started to count no fewer than six cuts this year, but also because all three months of the first quarter delivered a stalling disinflation trend.

Stalling is not the same thing as a fatal reversal. But again the markets decided that if FOMC members could contemplate a hike, they should, too (at least for a week or so). Neither the Fed nor the market appreciate that trend-following doesn’t mean straight lines. They also fail to grasp that oddball factors and side effects can influence trends.

A major instance of this is the demogaphic and pandemic effects that so deeply influence the labor market, especially in the US. They have also affected the housing market, with so many Baby Boomers unwilling to sell their homes even at inflated prices because homes for the retirement years are too expensive, come with 7% mortgages and are not well built. Then there are the upper middle-class homeowners who got a second home and reduced the inventory so drastically.

The pandemic is probably the biggest influence in the US, while elsewhere the citizens had actual war in their backyards and took Covid more in stride. Like the Great Depression, economic conduct after the Depression surprised politicians and economists, who credited the GI Bill, Levitt villages and unionization for the massive recovery, but there was also something mysterious about the surge in optimism that reversed the fearful, frugal mood of the Depression era. The cycle gang says it’s part of a 9 or 11-year cycle, or maybe 17, and for all anyone knows, they may be right.

This is not really a digression from the inflation story. Logically, we should be recognizing that the US economy is madly different from all other economies for a dozen reasons, including relatively less regulation, the entrepreneurial spirit, and the availability of credit. It is more robust and resilient than other economies, and has a higher proportion of self-employed and small businesses. It’s not exactly cowboy spirit and “Go west, young man,” but it’s a lot less conformist than in the UK and Europe.

Anyone can hang out a shingle in the US offering to paint your house. In Germany, you need a license and the license entails the expense and time wasted of “training.” The world has 400 small businesses and 33.3 million are in the US. Oddly, Japan has a high ratio, too, but nobody matches the US, where 99.9% of all businesses are small (fewer than 250 employees).

These differences make central-bank decision-making different, too. All the talk about “divergence” in central bank decision-making is also poppycock. Disinflation is about the same in all the major economies. The BoE and ECB can contemplate earlier rate cuts not because of inflation, but rather because their economies have such lower growth rates. That means less employment growth and also less of the consumer spending that drives inflation.

Therefore, the ECB can be happy with core at 2.7% minus something and cut rates in June with relatively less anxiety than the Fed facing the same data. Not apples and oranges, but not far from it, either.

See the chart from Reuters. As we wrote last Friday, another tick up could well set off a frenzy of overreaction that pushes the first cut out into the coming year or even make real the idea of a hike. Conversely, a nice drop would restore the idea of a Sept cut, taking it away from November. And a Nov cut is, to our mind, out of the question, for all the reasons listed below.

We are in the grip of one bit of data, relevant to the Fed or not, having the power to move yields and the dollar. This means traders are scared, if only because they lack a coherent most-likely scenario and they are vulnerable to what seems like a switcheroo. Example—we get another estimate of GDP on Thursday and it may well look softer, nourishing the idea that the Fed can move earlier. Again, GDP is a background factor, not an immediate Fed driver.

Expectations are for both headline and core PCE inflation to slide only a little, if at all, with core down a measly 0.1%. This is not significant enough to name it a trend reversal after the lousy Q1 CPI data. And if the eurozone comes up with the same 2.7%, the ECB can cut while the US has to wait. The implication is that the current dollar weakness is “wrong” in terms of the economics and institutional context. Sentiment cannot be wrong, but fact interpretation sure can be. It’s time to be very , very careful and take only small positions I which you do not fall in love.

Reasons for the Fed to cut rates

Avoid embarrassment from getting inflation wrong twice.

Normalize the yield curve.

Head off any recessionary tendencies.

Help housing via mortgage rates.

Help banks rollover commercial property loans.

Help the stock market.

Synchronize with the ECB (and Riksbank and SNB).

Help the current White House and/or avoid accusations of political bias if delayed to after the Nov election.

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

This is an excerpt from “The Rockefeller Morning Briefing,” which is far larger (about 10 pages). The Briefing has been published every day for over 25 years and represents experienced analysis and insight. The report offers deep background and is not intended to guide FX trading. Rockefeller produces other reports (in spot and futures) for trading purposes.

To get a two-week trial of the full reports plus traders advice for only $3.95. Click here!

Author

Barbara Rockefeller

Rockefeller Treasury Services, Inc.

Experience Before founding Rockefeller Treasury, Barbara worked at Citibank and other banks as a risk manager, new product developer (Cititrend), FX trader, advisor and loan officer. Miss Rockefeller is engaged to perform FX-relat