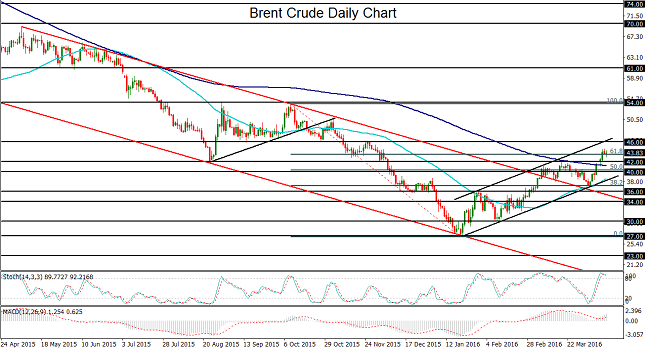

There is no doubt that crude oil has been in a dramatic rebound since late January. In the case of the Brent Crude benchmark, price has risen by more than 60% in less than three months from its January lows below 27.00 to this week’s highs above 44.00.

Much of this rise in the past three months has been due to two key factors: 1) There has recently been much speculation over a potential deal to cap crude oil production levels among Russia and several major OPEC nations, most notably Saudi Arabia. 2) Due to progressively and persistently weaker oil prices over the past several months, there has been a marked attrition in US oil output, providing some measure of respite to other major oil producers as well as to oil prices.

Aside from lower US output, the most pressing and concrete factor that could potentially either further the recovery in oil or stop it dead in its tracks is the highly-anticipated output deal negotiations, set for this Sunday, April 17. Much back-and-forth speculation has occurred in the months running up to this meeting, with often-conflicting reports on the shifting stances of various participants. As it currently stands, prevailing expectations are that Saudi Arabia and Russia will probably agree, perhaps loosely, to an output cap, even without Iran’s participation. Although this was reported within the past few days, it seems an unlikely outcome. If it does turn out to be accurate, however, such a deal will likely lead to a further boost for crude oil, at least in the very short-term.

So what happens after Sunday’s meeting? Clearly, a failure to reach such a deal would most likely lead to a significant drop in prices that could be sustained for quite some time, given all of the continuing supply pressures that have weighed on crude oil for so long. Even if a deal is successfully reached, however, the question remains as to whether a coordinated production cap at the recent near-record output levels would do much to alleviate the oversupply situation, especially without Iran’s participation. There is much doubt surrounding the expected effect of such an output cap which, it should be noted, would not be an actual output cut. Therefore, even if a deal is reached and it results in a short-term boost for oil, the longer-term picture still remains murky to significantly bearish. This is especially the case in light of recent reports out of the US that have detailed a much higher-than-expected build in crude oil inventories. Given the ongoing oversupply issue that continues to pressure prices, the potential effectiveness of a coordinated output deal is highly questionable.

From a technical perspective, the Brent Crude benchmark continues, for the time being, to trade in a sharply rising short-term trend channel. Within the course of this rising trend channel, Brent broke out above a much larger descending trend channel in March, followed by breakouts above successively higher resistance factors. These factors include the key 40.00 psychological level, the 200-day moving average, and most recently, major prior resistance around 42.00. With any further short-term surge, the next major upside resistance resides at the 46.00 level. From a longer-term perspective, or if a convincing output deal is not reached, however, a failure to curtail oversupply could result in a return below 40.00. In this event, a retreat in oil prices could quickly lead to Brent trading in the mid-30’s once again.

Investopedia does not provide individual or customized legal, tax, or investment services. Since each individual’s situation is unique, a qualified professional should be consulted before making financial decisions. Investopedia makes no guarantees as to the accuracy, thoroughness or quality of the information, which is provided on an “AS-IS” and “AS AVAILABLE” basis at User’s sole risk. The information and investment strategies provided by Investopedia are neither comprehensive nor appropriate for every individual. Some of the information is relevant only in Canada or the U.S., and may not be relevant to or compliant with the laws, regulations or other legal requirements of other countries. It is your responsibility to determine whether, how and to what extent your intended use of the information and services will be technically and legally possible in the areas of the world where you intend to use them. You are advised to verify any information before using it for any personal, financial or business purpose. In addition, the opinions and views expressed in any article on Investopedia are solely those of the author(s) of the article and do not reflect the opinions of Investopedia or its management. The website content and services may be modified at any time by us, without advance notice or reason, and Investopedia shall have no obligation to notify you of any corrections or changes to any website content. All content provided by Investopedia, including articles, charts, data, artwork, logos, graphics, photographs, animation, videos, website design and architecture, audio clips and environments (collectively the "Content"), is the property of Investopedia and is protected by national and international copyright laws. Apart from the licensed rights, website users may not reproduce, publish, translate, merge, sell, distribute, modify or create a derivative work of, the Content, or incorporate the Content in any database or other website, in whole or in part. Copyright © 2010 Investopedia US, a division of ValueClick, Inc. All Rights Reserved

Recommended Content

Editors’ Picks

AUD/USD holds steadily as traders anticipate Australian Retail Sales, Fed’s decision

The Aussie Dollar registered solid gains against the US Dollar on Monday, edged up by 0.55% on an improvement in risk appetite, while the Greenback was crushed by Japanese authorities' intervention. As Tuesday’s Asian session begins, the AUD/USD trades at 0.6564.

EUR/USD finds support near 1.0720 after slow grind on Monday

EUR/USD jostled on Monday, settling near 1.0720 after churning in a tight but lopsided range as markets settled in for the wait US Fed outing. Investors broadly expect US rates to hold steady this week, but traders will look for an uptick in Fed guidance for when rate cuts could be coming.

Gold prices soften as traders gear up for Fed monetary policy decision

Gold price snaps two days of gains, yet it remains within familiar levels, with traders bracing for the US Fed's monetary policy decision on May 1. The XAU/USD retreats below the daily open and trades at $2,334, down 0.11%, courtesy of an improvement in risk appetite.

Will Bitcoin ignore major macro market developments this week?

Bitcoin price will be an interesting watch this week, with increased volatility expected amid crucial events lined up in the macro market. On Tuesday, Hong Kong will be debuting its BTC and ETH ETFs while the next day will see FOMC minutes make headlines.

Gearing up for a busy week: It typically doesn’t get any bigger than this

Attention this week is fixated on the Federal Reserve's policy announcement scheduled for Wednesday. While the US central bank is widely expected to remain on hold, traders will be eager to discern any signals from the Fed regarding the possibility of future interest-rate cuts.