![]()

Germany’s DAX index dropped along with other European and US equity indices on Thursday as commodities continued to show persistent weakness and the specter of a more hawkish Fed weighed on global stock markets. The DAX closed down nearly 2% on Thursday, exceeding losses suffered by its UK counterpart, the FTSE index.

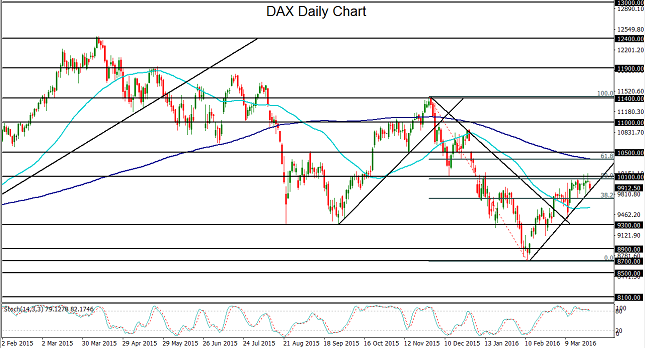

For the past month-and-a-half, the DAX has been well-entrenched in a strong bullish rebound and recovery from February’s long-term lows around 8700. During the course of this rebound, the index has broken out above some major resistance factors, including the important 9300 level and the 50-day moving average. The most recent culmination of this short uptrend occurred earlier this week, when the DAX reached and then retreated from major resistance roughly around the 10100 level. That key level has been a relatively frequent pivoting point for the German index in the past. The 10100 level is also approximately in the vicinity of the 50% Fibonacci retracement of the last major bearish run from the 11400-area highs late last year down to the noted February lows around 8700.

After Thursday’s extended retreat from this resistance, the index has fallen back down to an uptrend support line that has defined the rebound and recovery for the past month-and-a-half. Currently sandwiched between this uptrend line to the downside and the noted 10100-area resistance to the upside, the DAX has arrived at a critical technical juncture. In the event of a breakdown below the uptrend line, price could once again revert back to the longer-term downtrend that has been in place for nearly a year. In this event, the key short-term target to the downside remains at the important 9300 support level. In the opposite event of a sustained breakout above 10100-area resistance, a clear further resistance level to the upside resides at the key 10500 level.

Recommended Content

Editors’ Picks

EUR/USD rises toward 1.0800 on USD weakness

EUR/USD trades in positive territory above 1.0750 in the second half of the day on Monday. The US Dollar struggles to find demand as investors reassess the Fed's rate outlook following Friday's disappointing labor market data.

GBP/USD closes in on 1.2600 as risk mood improves

Following Friday's volatile action, GBP/USD pushes higher toward 1.2600 on Monday. Soft April jobs report from the US and the improvement seen in risk mood make it difficult for the US Dollar to gather strength.

Gold gathers bullish momentum, climbs above $2,320

Gold trades decisively higher on the day above $2,320 in the American session. Retreating US Treasury bond yields after weaker-than-expected US employment data and escalating geopolitical tensions help XAU/USD stretch higher.

Addressing the crypto investor dilemma: To invest or not? Premium

Bitcoin price trades around $63,000 with no directional bias. The consolidation has pushed crypto investors into a state of uncertainty. Investors can expect a bullish directional bias above $70,000 and a bearish one below $50,000.

Three fundamentals for the week: Two central bank decisions and one sensitive US Premium

The Reserve Bank of Australia is set to strike a more hawkish tone, reversing its dovish shift. Policymakers at the Bank of England may open the door to a rate cut in June.