![]()

The stock and commodity markets tumbled last week as investors worried about the impact of a slowing Chinese economy and as growing expectations over a potential rate increase in the US kept the dollar elevated. The terrorist attacks in Paris on Friday evening increased risk aversion further, leading to a sharply lower open in Asia Pacific overnight, with the major index futures all gapping lower. European indices have now more than filled those gaps and turned green: a usual response post a terror attack. On this occasion, investors had the whole of the weekend to digest the news, so the panic trading only last a few minutes after the Asian open overnight. But now that the European morning session is out of the way, another wave of selling could begin once the kick-back rally loses momentum – perhaps when US investors return to their desks later on. Indeed, equities remain on shaky footing as sentiment is still downbeat about the global economy, with Japan sliding back into recession with a slightly more than expected 0.2% contraction in the third quarter. Tourism, travel and insurance stocks could get hit hard globally – and stocks in these sectors are sharply lower already today – if we see evidence of more terror attacks or threats thereof, although this could be offset slightly as geopolitical risks tend to boost oil and gold prices and therefore stocks in those sectors.

There are not much data scheduled for today, but things should pick up from tomorrow when we have among other things the UK and US Consumer Price Indices and the latest German ZEW economic sentiment survey. Minutes from the FOMC’s last meeting, due out on Wednesday, could provide valuable information regarding the potential time of a lift off in US interest rates. Then it’s the Bank of Japan’s policy meeting on Thursday and with the local economy thinking 0.2% in the third quarter to slide back into another recession, there is an increased possibility that the central bank may expand the size of its asset purchases programme. Indeed, it is the promise of more QE from the likes of the BoJ and ECB and record low interest rates that is helping to keep stocks still elevated. Without such support and in times like now, one would expect stock prices to be a lot lower than they are.

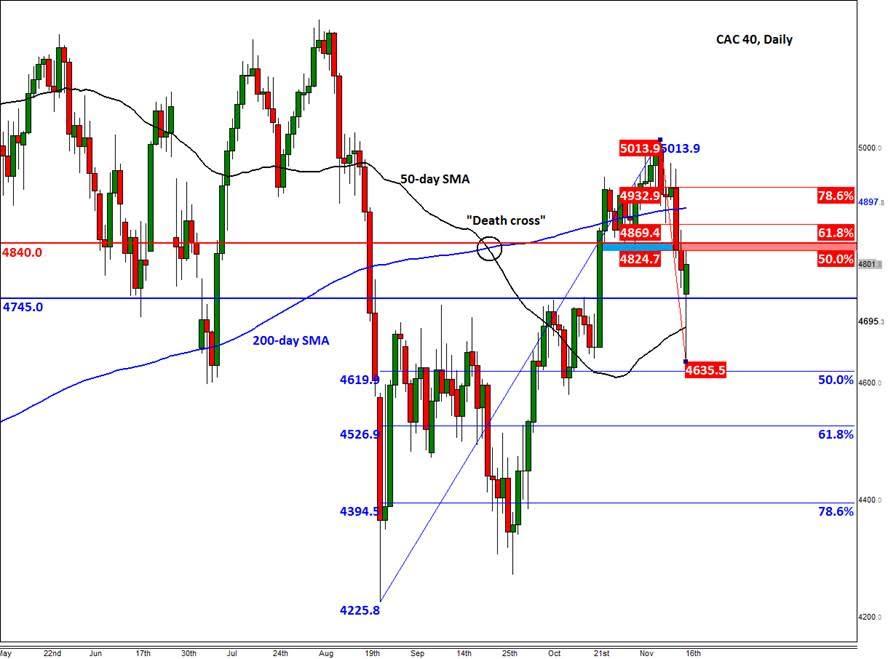

As a result of this morning’s kick-back rally, the French CAC index has recovered sharply and at the time of this writing it was holding its own comfortably above the resistance-turned-support level of 4745. The near-term bias remains neutral while it holds above here on a closing basis. However, a decisive break below 4545 could pave the way for significant losses. In this scenario, the index could initially drop back to the 50-day moving average, around 4695, before potentially extending its decline towards the 161.8% Fibonacci retracement of the most recent upswing at just over 4525. On the upside, there is an area of resistance around 4825-4840 which needs to be cleared if we are to see a move towards the 200-day moving average, at just under 4900, and beyond.

Trading leveraged products such as FX, CFDs and Spread Bets carry a high level of risk which means you could lose your capital and is therefore not suitable for all investors. All of this website’s contents and information provided by Fawad Razaqzada elsewhere, such as on telegram and other social channels, including news, opinions, market analyses, trade ideas, trade signals or other information are solely provided as general market commentary and do not constitute a recommendation or investment advice. Please ensure you fully understand the risks involved by reading our disclaimer, terms and policies.

Recommended Content

Editors’ Picks

EUR/USD declines below 1.0700 as USD recovery continues

EUR/USD lost its traction and declined below 1.0700 after spending the first half of the day in a tight channel. The US Dollar extends its recovery following the strong Unit Labor Costs data and weighs on the pair ahead of Friday's jobs report.

GBP/USD struggles to hold above 1.2500

GBP/USD turned south and dropped below 1.2500 in the American session on Thursday. The US Dollar continues to push higher following the Fed-inspired decline on Wednesday and doesn't allow the pair to regain its traction.

Gold slumps below $2,300 as US yields rebound

Gold extended its daily slide and dropped below $2,290 in the second half of the day on Thursday. The benchmark 10-year US Treasury bond yield erased its daily losses after US data, causing XAU/USD to stretch lower ahead of Friday's US jobs data.

Top 3 Price Prediction BTC, ETH, XRP: Altcoins to pump once BTC bottoms out, slow grind up for now

Bitcoin reclaiming above $59,200 would hint that BTC has already bottomed out, setting the tone for a run north. Ethereum holding above $2,900 keeps a bullish reversal pattern viable despite falling momentum. Ripple coils up for a move north as XRP bulls defend $0.5000.

Happy Apple day

Apple is due to report Q1 results today after the bell. Expectations are soft given that Apple’s Chinese business got a major hit in Q1 as competitors increased their market share against the giant Apple.